Saudi Arabia has become the biggest insurance market in the GCC, surpassing the UAE.

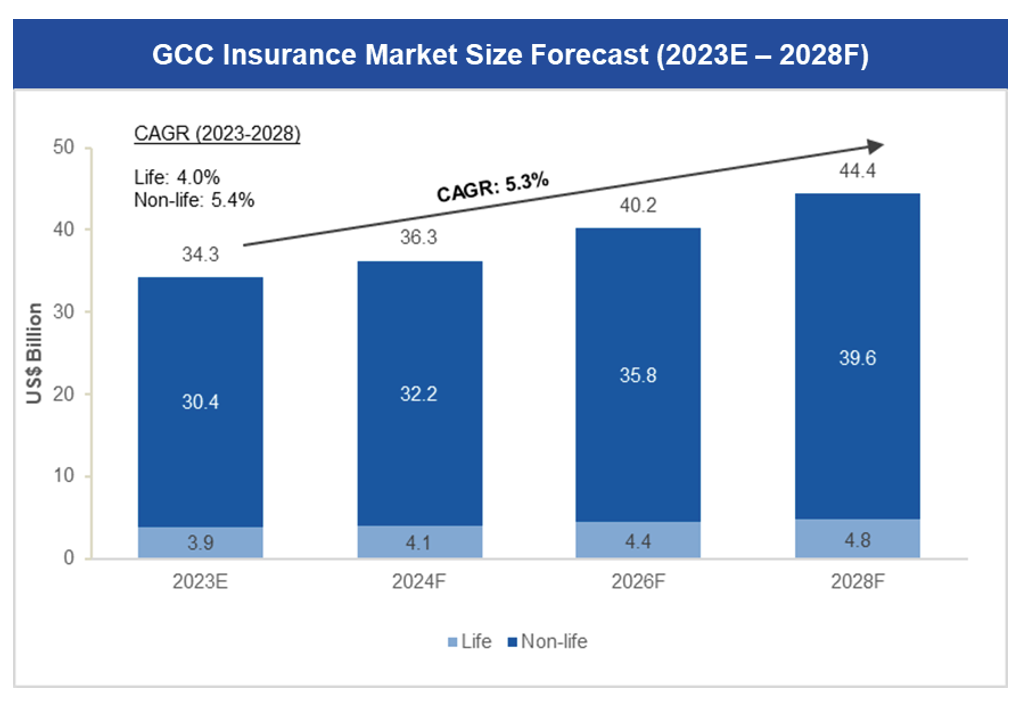

A recent report from Alpen Capital, a UAE-based investment banking advisory firm, predicts significant growth in the GCC insurance sector. By 2028, the Gross Written Premium (GWP) is expected to reach around $44.4 billion. The report forecasts a steady rise, with the GWP increasing at a Compound Annual Growth Rate (CAGR) of 5.3%.

Notably, the non-life insurance segment is anticipated to drive much of this growth, with a projected CAGR of 5.4% between 2023 and 2028. This segment is expected to reach $39.6 billion by 2028, constituting approximately 89.2% of the region's GWP.

Sameena Ahmad, the managing director at Alpen Capital, commented on the findings, stating,

"The GCC insurance industry has seen steady growth in recent times, thanks to the economic recovery following the COVID-19 slowdown and the successful adoption of mandatory health insurance across GCC nations."

Ahmad emphasized that sustained economic diversification, population expansion, and significant infrastructure development are driving factors contributing to the sector's optimistic outlook.

Saudi Arabia the largest insurance market

According to Alpen Capital's projections, the GCC insurance market is set for strong growth, driven by factors like resilient economic expansion, population growth, and growing demand for health and life insurance, along with ongoing infrastructure projects.

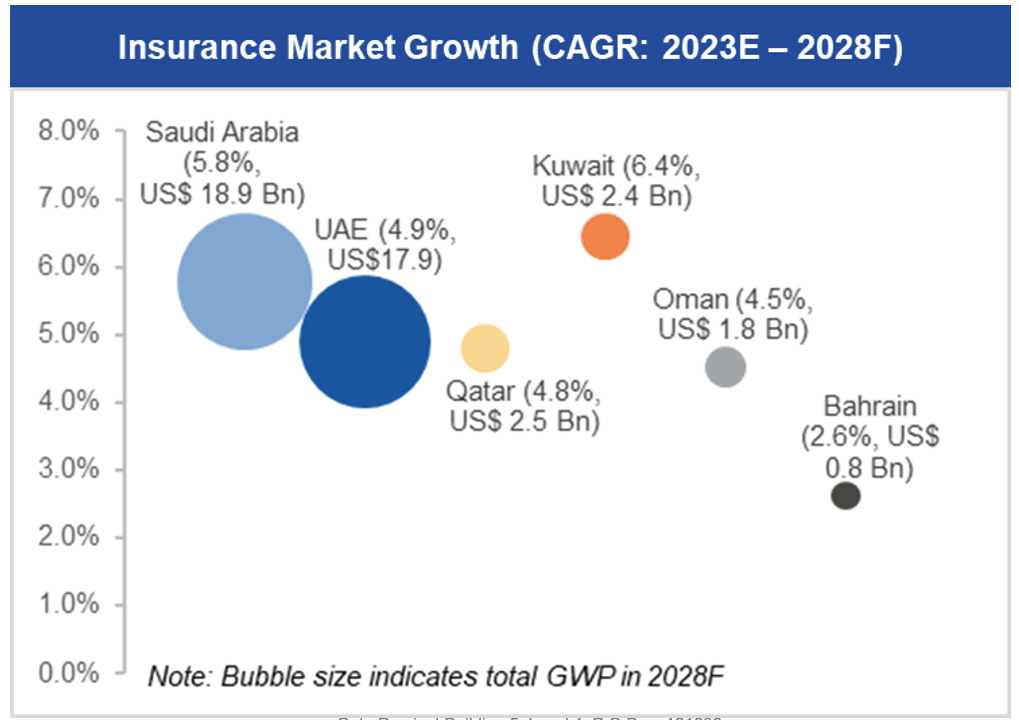

Significantly, Saudi Arabia has taken the lead as the largest insurance market in the GCC, surpassing the UAE, with expectations for sustained growth. The kingdom's insurance sector is being propelled by extensive infrastructure development and a rising demand for motor and medical insurance, as highlighted in the report.

The firm has projected a Compound Annual Growth Rate (CAGR) of 5.8 per cent for Saudi Arabia between 2023 and 2038.

For the UAE, the insurance market is expected to grow at a CAGR of 4.9 per cent. Meanwhile, Kuwait is forecasted to experience the highest growth rate in the GCC, with a CAGR of 6.4 per cent. This growth is attributed to steady population expansion between 2023 and 2028 and increased government investments in infrastructure.

Krishna Dhanak, also from Alpen Capital, highlighted the surge in M&A (Mergers and Acquisitions) activities within the GCC insurance industry. These activities are driven by strategic expansion plans, regulatory changes, and rising operating expenses.

Dhanak further noted a growing interest in investing in technologies such as Artificial Intelligence, Internet of Things, and blockchain. These investments aim to improve customer support and prevent fraudulent claims within the industry.

Challenges

However, the industry faces challenges, including fragmented and highly competitive markets, complex accounting frameworks, and disruptions in the reinsurance market.

- Fragmented and highly competitive market fosters price competition, posing profit margin threats for insurers.

- Implementation of IFRS 17 standard introduces complex accounting frameworks, challenging medium-sized providers to adapt existing processes.

- Rising cession rates and hardening of reinsurance market disrupt business models, impacting reinsurance revenues and underwriting margins.

- Claims inflation and increasing tax rates potentially impact core business lines, notably motor and medical insurance segments crucial for GCC insurers’ GWP.

Despite these challenges, the GCC region’s early adoption of digital transformation presents opportunities for insurers to enhance customer experience and develop innovative products.

The GCC insurance industry stands at an important juncture, driven by demographic shifts, economic factors, and technological advancements. With supportive government regulations and a focus on operational efficiency, the region should see a sustainable business model amidst ongoing evolution.

News Source: Gulf Business