The United Arab Emirates is known for its tax-friendly policies, making it attractive for professionals and businesses worldwide.

Here, individuals usually don’t pay taxes on what they earn. This means people can keep more of their salaries, which is a big draw for those considering moving there. On the business side, many companies, particularly in areas called 'free zones', don't face the usual corporate taxes. This welcoming tax environment is a magnet for global companies looking for a business-friendly location.

However, things changed slightly in 2018. The UAE added a tax known as VAT, or Value Added Tax. It's a 5% charge on many goods and services. But why this change? The UAE has long enjoyed significant revenue from oil and hydrocarbons. But to ensure a sustainable future and continued enhancement of public facilities, the government saw the need to diversify its revenue streams.

The taxes collected help fund major infrastructure projects, public parks, markets, and healthcare facilities, enriching the lives of residents. Moreover, some taxes, like those on harmful products, serve the dual purpose of revenue generation and promoting healthier societal choices.

What's also appealing is the UAE's approach to international dealings. They have set up agreements with many countries to prevent 'double taxation'. This ensures people and businesses aren’t taxed twice on the same income – once in the UAE and once back home.

But, like everywhere, there are exceptions. Certain sectors, like major oil producers and some foreign banks, do have specific tax rules.

In this article, we will look deeper into the various taxes present in the UAE and explore how they work.

VALUE ADDED TAX (VAT)

What is VAT?

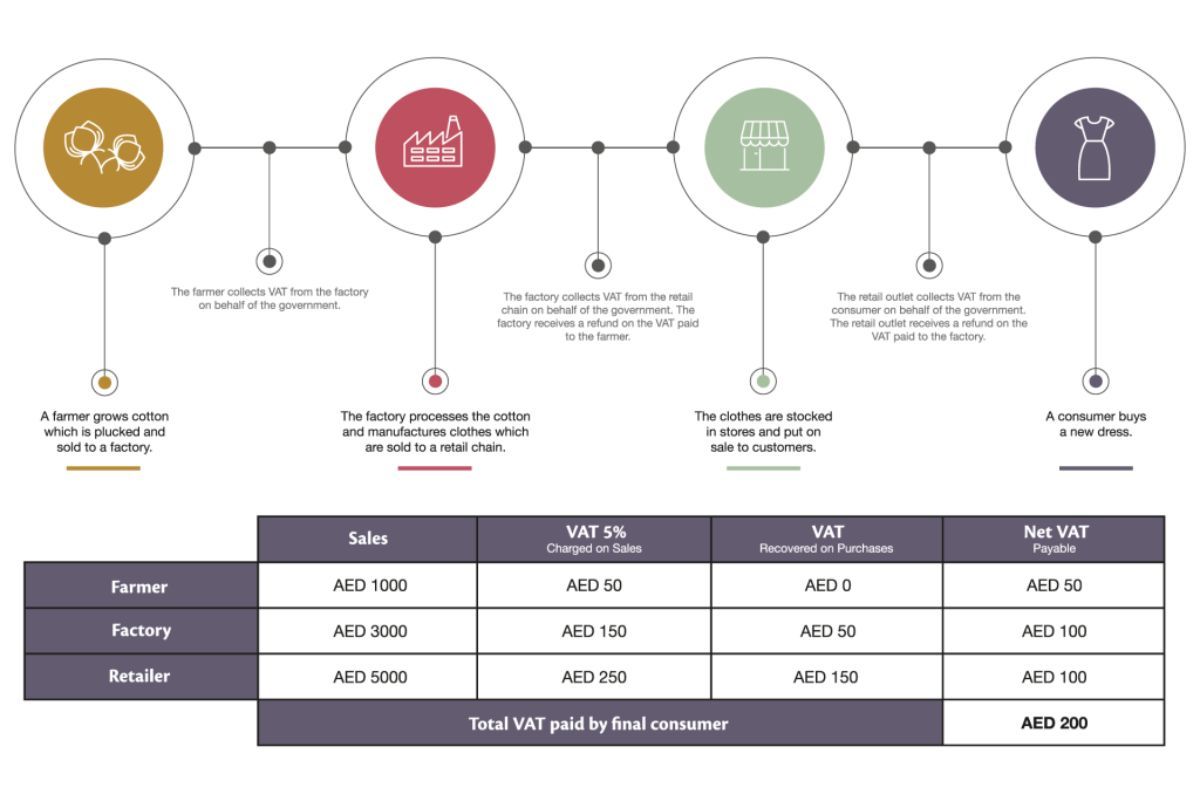

Value Added Tax (VAT) is a consumption tax placed on goods and services. In the UAE, a standard rate of 5% is applied at the point of sale. Businesses collect this tax and then pay it to the government.

When was VAT introduced in the UAE and Why?

VAT was introduced in the UAE on 1 January 2018. The aim was to provide a new income source for the country, helping fund high-quality public services and reduce reliance on oil and hydrocarbons for revenue.

Who should register for VAT?

Registration is mandatory for:

- UAE-based businesses with taxable supplies and imports exceeding AED 375,000 annually.

- Non UAE-based businesses making taxable supplies in the UAE, regardless of the value, provided no one else is responsible for the due tax.

However, registration is optional for businesses with supplies and imports exceeding AED 187,500 annually.

Who collects VAT and how?

VAT-registered businesses collect the tax. Consumers bear the VAT as a 5% increase in the cost of taxable goods/services. The UAE applies VAT at each step of the supply chain, and tourists also pay VAT (which can be reclaimed) at the point of sale.

What are the VAT-related responsibilities for businesses?

- Record all financial transactions accurately.

- Register for VAT if they meet the minimum annual turnover requirement.

- Charge VAT on taxable goods/services supplied.

- Reclaim VAT paid on business-related goods/services.

- Maintain records for government checks.

- Regularly report the amount of VAT charged and paid. If they've charged more than paid, they owe the government; if they've paid more than charged, they can reclaim the difference.

Are there any special zones for VAT purposes?

Yes, certain free zones are designated as special VAT zones, and unique rules apply to them. However, businesses in these zones might still need to register for VAT if they meet the criteria.

How to file a VAT return?

VAT returns must be filed electronically through the FTA portal: eservices.tax.gov.ae. Make sure all requirements are met before filing.

Failure to file a tax return within the specified time can result in fines as per Cabinet Resolution No. 40 of 2017 on Administrative Penalties for Violations of Tax Laws in the UAE.

When and How often should businesses file VAT returns?

- For businesses with an annual turnover below AED150 million, VAT returns are filed quarterly.

- For businesses with an annual turnover of AED150 million or more, returns are filed monthly.

To get more detailed information on Value Added Tax, click here.

CORPORATE TAX

What is the significance of the Corporate Tax Law in the UAE?

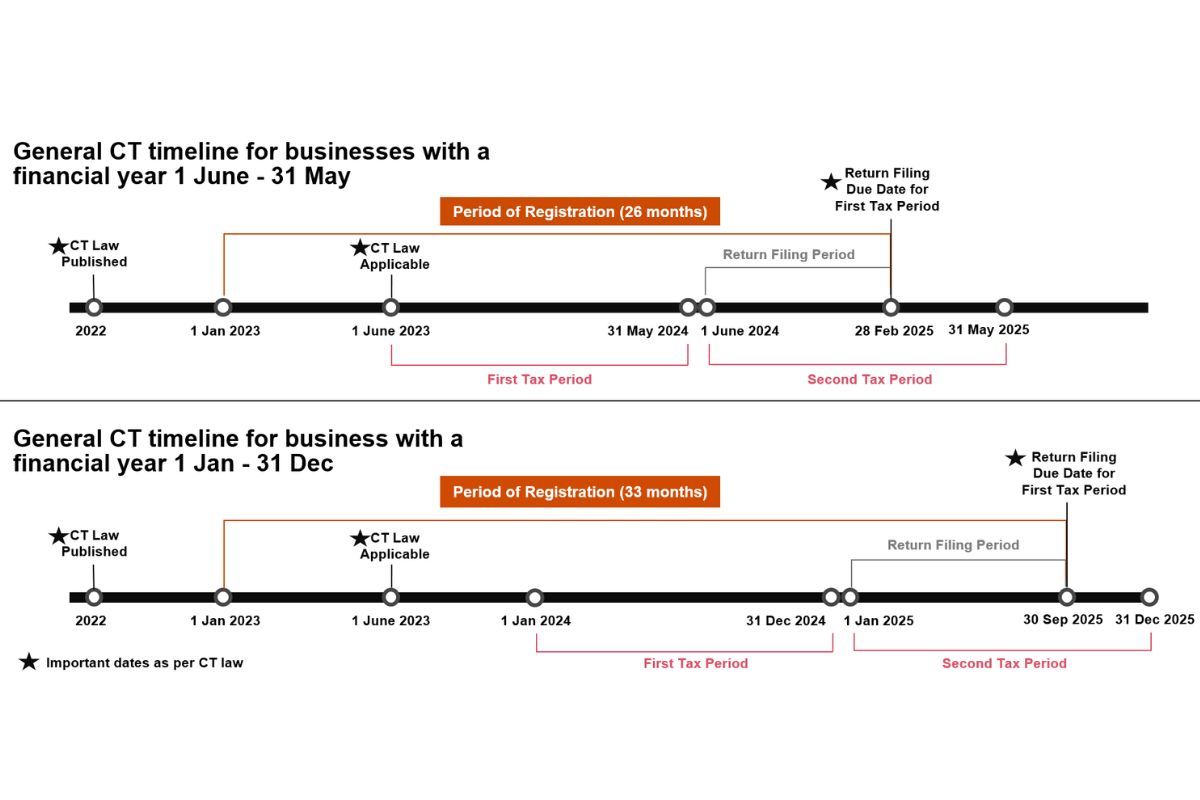

The "Corporate Tax Law", formalized as the Federal Decree-Law No. (47) of 2022, heralds a significant fiscal reform in the UAE. Introduced on 09 December 2022, it paves the way for a structured Federal Corporate Tax regime, applicable from financial years commencing on or after 1 June 2023.

Why was the Corporate Tax introduced in the UAE?

Beyond generating revenue, the tax aims to fortify the UAE's global economic stature. By implementing a tax regime that aligns with international standards, and with the reinforcement of double tax treaties, the UAE bolsters its dedication to financial transparency, global business compatibility, and sustainable development.

What is Corporate Tax (CT)?

Corporate Tax is a direct tax levied on the net income or profit of corporations and business entities.

Who is liable to pay this tax?

Those operating under a commercial license in the UAE, entities within free zones, foreign entities having regular transactions in the UAE, banks, and those involved in real estate ventures.

Are there entities exempt from this tax?

Entities involved in extracting natural resources, for instance, remain exempt. Moreover, Dividends and capital gains earned by UAE businesses, certain intra-group transactions, and reorganizations can also be exempt if conditions are met.

How is the tax amount determined?

The rate applied depends on the taxable income.

- There's a 0% rate for taxable income up to AED 375,000.

- Income above this threshold is taxed at 9%.

- A different rate, yet to be specified, will be applied to certain large multinationals based on international guidelines.

How do businesses know if they're subject to Corporate Tax?

A company is taxed based on residency and source of income. Resident businesses are taxed on both local and foreign income, while non-residents are taxed only on income from UAE sources. Residency is determined by specific factors outlined in the Corporate Tax Law.

What does Corporate Tax apply to?

The tax applies to the net income of a business. This is calculated annually, where businesses determine their taxable income and then file a return with the FTA to declare it.

Are there provisions to reduce taxable income through deductions?

Genuine business expenses, which are necessary for earning taxable income, are deductible. However, some expenses, like fines, certain entertainment expenses, and others, are either non-deductible or partially deductible.

How can a Free Zone entity benefit from a 0% Corporate Tax rate?

If a Free Zone entity maintains sufficient substance in the UAE, derives 'Qualifying Income', and meets other specified conditions, it can be considered a Qualifying Free Zone Person, benefitting from a 0% tax rate on that income.

How should businesses equip themselves for Corporate Tax

Acquaintance with the Corporate Tax Law is the first step. Companies should discern their specific tax obligations, maintain accurate financial records, and proactively seek updates and guidance, primarily from the Ministry of Finance and the FTA.

To get more detailed information on Corporate Tax, click here.

EXCISE TAX

What is Excise Tax?

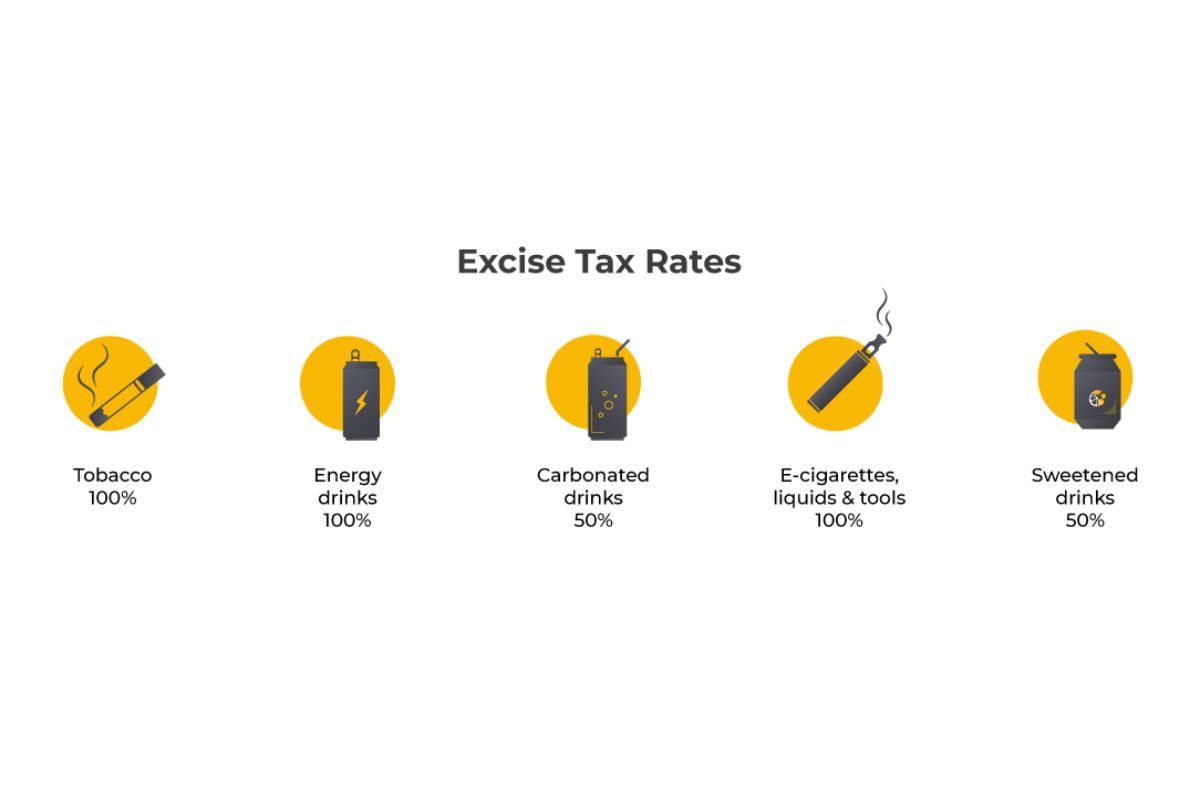

Introduced in 2017, the excise tax in the UAE is an indirect tax applied to specific goods, termed “excise goods.” These are generally items believed to be harmful to human health or the environment.

Which products fall under the “excise goods” category?

- Carbonated drinks, which exclude unflavoured aerated water.

- Energy drinks encompassing beverages promoted as energy boosters, containing stimulants like caffeine, taurine, ginseng, and guarana.

- Tobacco and tobacco products.

- As of 1 December 2019, electronic smoking devices, the liquids used in them, and sweetened drinks were added to this list.

Why has the UAE introduced the excise tax?

The dual objective behind this tax is to deter the consumption of goods detrimental to health and the environment and simultaneously augment government revenues. These funds are further invested in public services that benefit the community.

How does the excise tax impact consumers?

For the end consumer, the direct implication is a price increase on the goods falling under the “excise goods” bracket. Essentially, items that have negative health or environmental implications will become pricier.

What are the rates set for the excise tax?

- 50% on carbonated drinks

- 100% on tobacco products

- 100% on energy drinks

- 100% on electronic smoking devices and the liquids used in them

- 50% on products containing added sugar or sweeteners.

Which businesses need to register for excise tax?

If a business is involved in the import, production, or stockpiling of excise goods in the UAE, it's mandatory to register for the excise tax. This also extends to individuals overseeing an excise warehouse or designated zone.

How can a business register for the excise tax?

Companies can register via the e-services section on the Federal Tax Authority (FTA) website. Initially, they need to sign up and create an account. Detailed guides on the excise tax registration are also available on the FTA site.

What happens if businesses don’t comply?

The FTA has the authority to audit companies. In cases of non-compliance, businesses might face penalties.

OTHER TAXES

Income Tax

Individuals residing in the UAE do not pay personal income tax on their earnings, whether they are salaried or self-employed.

The absence of personal income tax makes the UAE an attractive destination for many professionals and entrepreneurs. They can earn and accumulate wealth without any deductions on their income, which often results in higher disposable income.

Taxes in Tourist Facilities

Restaurants, hotels, hotel apartments, resorts, etc. in the UAE might charge one or more of the following taxes:

- A 10% tax based on the room rate.

- A service charge of 10%.

- Municipality fees are also set at 10%.

- A city tax, which can vary between 6% to 10%.

- A tourism fee of 6%

Specifically, in Dubai, establishments levy a 'Tourism Dirham Fee' for each room on every night of stay. This fee can range from AED 7 to 20, depending on the hotel's classification, and is applicable for up to 30 consecutive nights.

Abu Dhabi introduced an additional charge in May 2016. Hotels in the emirate now impose a 4% fee on the total hotel stay bill, along with an additional AED 15 per room for each night.

In Ras Al Khaimah, a flat tourism fee of AED 15 is charged for every room per night.

Visitors should be aware of these charges when budgeting for their stay in the UAE. Tourists who qualify can apply for a refund on the VAT they've paid for their purchases. To do so, they must validate their purchases when leaving the country. Once validated, they have one year from the validation date to claim their refund. To know more on how to shop tax-free as a tourist, read more here.

It's essential for individuals and businesses to stay updated on any tax changes, especially given global shifts towards tax transparency and anti-avoidance measures. While the UAE offers numerous tax advantages, always consult with tax professionals for comprehensive details and potential implications in your home country.

Also Read: