Dubai’s real estate market stands out as a lucrative investment destination, offering a range of benefits for investors.

Its performance and rebound since the pandemic have put it among the top global performers in the real estate prime residential assets class.

Dubai marked its strongest ever performance ever with 1.6 million transactions (from real estate transactions to rental agreements), with 166,000 real estate deals worth Dhs634bn in 2023. This represents a remarkable growth of 16.9 percent compared to 2022, which accounted for approximately 1.368 million transactions. The city also drew in investors from around the globe, with the percentage of non-resident investors constituting 42 percent of the total new investors.

With new developments being developed across the city, here’s a breakdown of the key advantages of investing in Dubai:

Prime residential property market:

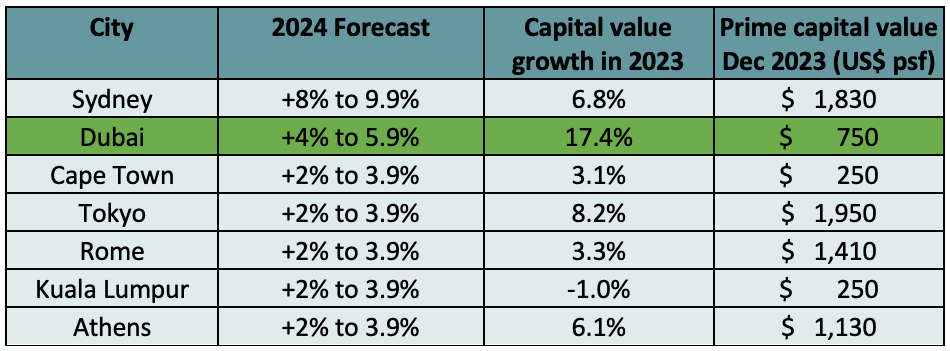

In 2023, Dubai’s prime residential properties witnessed a remarkable surge in capital values, soaring by 17.4 percent. This impressive growth outpaced the global average of just 2.2 percent, as reported by Savills.

Competitive Pricing

At $850 per square foot, Dubai’s real estate market remains relatively competitively priced compared to other global cities. This affordability attracts both international and domestic investors, seeking high returns on investment.

Forecasted growth

Looking ahead to 2024, Savills forecasts continued positive growth for Dubai’s prime residential market. Despite a slight moderation from the previous year, with growth expected to range between 4 percent to 5.9 percent, Dubai maintains its allure as a promising investment destination.

Rental price increase

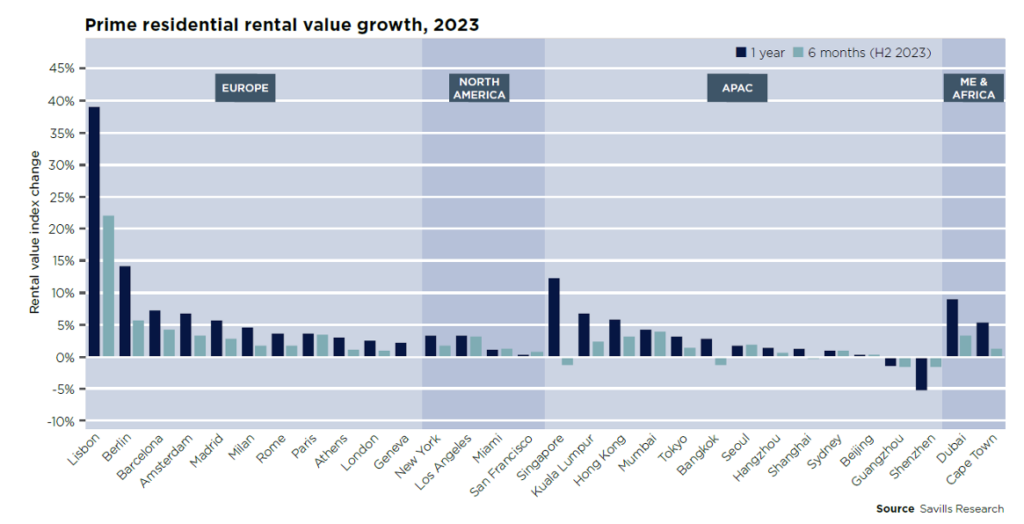

Rental prices in Dubai surged by nearly 10 percent in 2023, outpacing the global average of 5.1% among other major cities monitored by Savills. This robust rental performance ensures steady income streams for property investors.

High rental yields

Dubai boasts high rental yields, standing at an impressive 4.8 percent. This surpasses the global prime gross yield average of 3.1 percent, offering investors attractive returns on their rental properties.

Low transaction costs

The cost associated with buying, holding, and selling property in Dubai is among the lowest globally, amounting to less than 10 percent of the property purchase price. This favorable cost structure enhances the profitability of real estate investments in the emirate.

Stable economic environment:

Dubai’s robust economy, supported by diversified sectors such as tourism, finance, and trade, provides a stable environment for real estate investment. Additionally, fast-tracked urban development projects and investor-friendly policies further bolster confidence in the market.

Strategic location:

The secret to real estate success is “Location, location, location” as any real estate expert would tell you. And the city enjoys the strategic advantage of being situated at the crossroads of East and West. The location combined with its access to regional markets makes it a hub for business and commerce. This geographic advantage enhances the long-term value proposition of real estate investments in the city.

Government reforms:

Ongoing government reforms, including visa reforms aimed at attracting investors and expatriates, contribute to sustained demand in the real estate sector. Initiatives such as long-term residency visas and simplified visa processes further incentivize investment in Dubai’s property market.

Forecasted top performer:

With Sydney, Dubai, and other global cities poised for growth in 2024, Dubai stands out as a top performer. Savills anticipates Dubai to continue its upward trajectory, with prices forecasted to grow by an additional 4 percent to 5.9 percent in the coming year.

The perfect storm of advantages

Investing in Dubai’s real estate offers a compelling opportunity for investors, characterized by robust capital appreciation, high rental yields, and a conducive regulatory environment. As global markets navigate economic uncertainty, Dubai’s growing real estate market is proving to be a safe haven in times of global turbulence.

News Source: Gulf Business