In Dubai’s fast-paced economy, securing financial stability is a priority for many working professionals and residents. The city offers a wealth of opportunities, but with the rising cost of living, is simply saving money enough to build a secure future? According to a Business Insider report, rental prices in Dubai have surged by 16% over the past year, yet average salaries have remained largely unchanged. Meanwhile, Trading Economics data shows that inflation in the UAE currently stands at 2.89%, reducing purchasing power and making it harder for residents to stretch their earnings. With these challenges in mind, how can one make their money work for them instead of watching it lose value over time?

Relying solely on a savings account may not be the smartest move anymore. While saving is important, real financial growth comes from investing wisely—choosing options that are stable, accessible, and practical without requiring massive capital or high-risk speculation. The good news? Dubai offers plenty of investment opportunities suited for working professionals who want to grow their wealth without taking reckless risks. Whether it's real estate without buying a villa, silver over gold, or dividend-paying stocks, there are ways to invest smartly, even on a moderate budget.

This article will explore practical, low-to-moderate-risk investment opportunities in Dubai, helping residents find safe and effective ways to grow their savings.

Small, Smart Real Estate Moves

For Dubai's working professionals and residents seeking to invest in real estate without the hefty commitment of purchasing a villa, several innovative and accessible options are available:

1. Rent-to-Own Apartments: Transitioning from Tenant to Owner

The rent-to-own model offers a pathway to homeownership by allowing tenants to apply a portion of their rent towards the property's purchase price. This approach is particularly advantageous for those who may not have substantial upfront capital. In Dubai, areas like Al Furjan and Jumeirah Village Circle (JVC) have embraced this scheme, providing flexible payment plans that make property ownership more attainable.

2. Danube Properties' 1% Investment Plan: Affordable Luxury

Danube Properties has introduced an innovative payment plan that enables investors to acquire property by paying just 1% of the total price each month, following an initial down payment of approximately 20%. This structure allows for manageable monthly payments, making it easier for individuals to invest in Dubai's real estate market without significant financial strain.

3. Short-Term Rental Units: Capitalizing on Tourism

Investing in properties designed for short-term rentals, such as those catering to platforms like Airbnb, has become increasingly popular in Dubai's bustling tourist districts. This strategy allows investors to generate higher rental yields by accommodating short-term visitors. However, it's essential to navigate local regulations and secure the necessary permits to operate legally in this space.

By exploring these tailored real estate investment strategies, Dubai's working professionals and residents can effectively enter the property market, aligning with their financial capabilities and investment aspirations.

Investing in Silver: The Smart Alternative to Gold

Investing in silver presents a compelling alternative to gold, offering unique advantages for Dubai's working professionals and residents seeking to diversify their portfolios.

Understanding Silver's Volatility Compared to Gold

While silver is often perceived as more volatile than gold, this characteristic can lead to higher returns for investors willing to embrace the associated risks. According to StoneX Bullion, "Silver is more volatile than gold but can offer higher returns, albeit with greater risk." This volatility is influenced by silver's dual role as both an industrial metal and a store of value, making its price sensitive to economic cycles.

Dubai's DMCC: Facilitating Secure Silver Trading

Dubai's Dubai Multi Commodities Centre (DMCC) plays a pivotal role in making silver trading secure and accessible. Established in 2002, DMCC is a free-trade zone and commodities exchange located in the Jumeirah Lake Towers district. It deals in various sectors, including precious commodities like gold and silver. As of 2022, DMCC is the largest free-trade zone in the UAE, with over 21,000 registered members. This infrastructure provides investors with a regulated environment to trade silver confidently.

Ways to Invest in Silver in Dubai

- Physical Silver Bars and Coins: Investors can purchase silver bullion directly from reputable dealers. For instance, Emirates Gold, established in 1992, is one of the largest refineries in the Middle East, producing recognized bullion products. Additionally, retailers like Mint Jewels offer a range of silver products, providing free consultations and buy-back options.

- Silver ETFs (Exchange-Traded Funds): These funds track the price of silver and can be traded on stock exchanges, offering a liquid and convenient investment option without the need to handle physical metal. Investors should consult with financial advisors or use trading platforms authorized in the UAE to access these ETFs.

- DMCC-Approved Silver Accounts: Financial institutions in Dubai, such as Mashreq Bank, offer specialized accounts that allow clients to invest in silver electronically. The Gold/Silver Edge Investment Account enables customers to buy and sell silver online without worrying about storage or security, with no minimum balance requirements.

By exploring these avenues, investors in Dubai can effectively incorporate silver into their investment strategies, potentially benefiting from its unique market dynamics and the robust infrastructure provided by institutions like the DMCC.

Stock Market & Dividend Stocks

Investing in dividend-paying stocks offers a pathway to passive income, allowing investors to benefit from regular payouts without the turbulence often associated with frequent trading. In Dubai, prominent companies such as Emaar Properties and the Dubai Electricity and Water Authority (DEWA) present attractive opportunities for those seeking steady returns.

Emaar Properties: Consistent Dividend Payouts

Emaar Properties, a leading real estate developer in Dubai, has a history of rewarding its shareholders with substantial dividends. According to TradingView, the company is expected to distribute a dividend of 1.00 AED per share, with a dividend yield (TTM) of 3.65%. Notably, in December 2024, Emaar's stock surged by 14.7% following the announcement of plans to declare dividends at 100% of share capital for the upcoming years, amounting to 8.80 billion dirhams (approximately $2.40 billion).

DEWA: Reliable Dividend Yields

DEWA, Dubai's primary electricity and water provider, also offers appealing dividend prospects. As per Investing.com, DEWA's dividend yield stands at 4.90%, reflecting its commitment to providing consistent returns to its shareholders.

Accessing the Market: DFM and Nasdaq Dubai

Both Emaar and DEWA are listed on the Dubai Financial Market (DFM), which, alongside Nasdaq Dubai, provides platforms for investors to engage in low-risk, long-term growth investments. These exchanges offer a range of securities, facilitating diversified investment portfolios.

Starting Your Investment Journey

For those new to investing, initiating participation in Dubai's stock market is both accessible and straightforward. Prospective investors must first obtain an Investor Number (NIN) from the DFM, achievable through the DFM mobile app or via licensed brokerage firms. Once the NIN is secured, individuals can commence trading, with some platforms allowing investments starting from as little as AED 500.

For example, brokers like XM require a minimum deposit of $5, making it accessible for traders of all levels. Additionally, platforms such as Sarwa Trade offer zero-commission trading with no minimum balance requirements, enabling investors to start with amounts as modest as $100.

By focusing on dividend-paying stocks within established companies like Emaar and DEWA, investors can cultivate a source of passive income, leveraging Dubai's robust financial infrastructure to achieve steady financial growth.

Small Business & Side Hustle Investments (Without Quitting Your Job!)

For Dubai's working professionals and residents seeking additional income streams without leaving their primary employment, venturing into small businesses or side hustles presents viable opportunities. Dubai's business-friendly environment, particularly its free zones, offers a conducive platform for such endeavors.

Leveraging Meydan Free Zone for Business Setup

Meydan Free Zone (MFZ) is an attractive option for entrepreneurs aiming for a cost-effective business setup. MFZ provides a streamlined process with competitive pricing:

- License Packages: A standard package, inclusive of three business activities, starts at AED 12,500. For those requiring visa allocations, packages are available at AED 14,350 for one visa and AED 18,050 for up to three visas.

- Additional Costs: Establishment card issuance is AED 2,000 for the first year, with renewal at AED 2,200 annually. Residence visas cost AED 3,520 per applicant, plus medical examination fees ranging from AED 450 to AED 850, depending on the service level.

Potential Business Ventures

- Drop Shipping: This e-commerce model allows entrepreneurs to sell products online without holding inventory. Instead, orders are fulfilled directly by suppliers, minimizing overhead costs. The UAE's burgeoning e-commerce market, projected to reach USD 8 billion by 2025, makes drop shipping a promising venture.

- Freelance Digital Services: Offering skills such as writing, graphic design, or digital marketing on a freelance basis can be both flexible and lucrative. The demand for digital content and online presence management continues to grow, providing ample opportunities for skilled professionals.

- Small-Scale Import/Export Ventures: Dubai's strategic location as a global trade hub facilitates import and export businesses. Entrepreneurs can capitalize on niche markets by sourcing unique products and distributing them locally or internationally.

Financial Considerations

- Licensing Fees: As noted, MFZ offers packages starting at AED 12,500, with additional costs for visas and establishment cards.

- Startup Capital: The initial investment varies by business type. For instance, drop shipping requires minimal capital, primarily for setting up an online platform and marketing. Freelancing may necessitate investment in equipment or software, while import/export businesses might require funds for inventory and logistics.

- Expected Returns: Profit margins differ across industries. Drop shipping typically yields margins between 15% and 20%, though Dubai's strategic position could potentially enhance these figures. Freelancers' earnings depend on skill level and demand, while import/export profits are influenced by market conditions and product selection.

Peer-to-Peer Lending & Crowdfunding

Investing in peer-to-peer (P2P) lending and crowdfunding platforms offers Dubai's working professionals and residents a unique opportunity to support small businesses and individuals while earning a passive income. These platforms facilitate direct lending or investment, allowing investors to diversify their portfolios without the complexities of running a business.

Understanding P2P Lending and Crowdfunding

P2P lending involves individuals lending money to borrowers—often small businesses or individuals—through online platforms, earning interest over time. Crowdfunding, on the other hand, allows investors to fund projects or businesses in exchange for equity or other rewards. Both models democratize finance by connecting investors directly with opportunities, often through secure, government-approved platforms.

Top Platforms in the UAE

- Beehive: As the UAE's first regulated P2P lending platform, Beehive connects investors with creditworthy small and medium-sized enterprises (SMEs). Investors can start with as little as AED 100, earning monthly returns typically ranging from 8% to 12% per annum. The platform's regulatory oversight ensures a secure investment environment.

- SmartCrowd: This real estate crowdfunding platform enables investors to co-own rental properties in Dubai. With a minimum investment of AED 500, individuals can earn rental income and potential capital appreciation. SmartCrowd is regulated by the Dubai Financial Services Authority (DFSA), ensuring compliance and investor protection.

- Eureeca: An equity crowdfunding platform, Eureeca allows investors to acquire shares in growth-oriented businesses. Founded in 2013, it has expanded globally, offering opportunities across various sectors. Eureeca operates on an "all or nothing" funding model, where investments are only processed if the funding target is met, mitigating risk for investors.

- FundedByMe: Originally from Sweden, FundedByMe has established a presence in the UAE, offering equity crowdfunding opportunities. The platform connects investors with startups and SMEs seeking capital, providing a diverse range of investment options. FundedByMe operates on an "all or nothing" funding principle, ensuring that funds are only released if the project meets or exceeds its funding target.

Benefits of Investing Through These Platforms

- Diversification: Investors can spread their capital across multiple projects or businesses, reducing risk.

- Accessibility: Low minimum investment thresholds make it easier for individuals to participate.

- Passive Income: Regular returns, such as interest payments or rental income, provide a steady income stream without active management.

Considerations

- Risk Assessment: While these platforms conduct due diligence, it's essential for investors to assess the risks associated with each opportunity.

- Liquidity: Investments may have lock-in periods or limited secondary markets, affecting liquidity.

By leveraging P2P lending and crowdfunding platforms like Beehive, SmartCrowd, Eureeca, and FundedByMe, Dubai's working professionals and residents can diversify their investment portfolios, support entrepreneurial ventures, and potentially achieve attractive returns.

Government Bonds & Islamic Sukuk

For Dubai's working professionals and residents seeking low-risk, stable investment opportunities, UAE government bonds and Islamic Sukuk present attractive options. These instruments offer predictable returns and align with Sharia-compliant investment principles.

Understanding UAE Government Bonds and T-Bonds

The UAE government issues Federal Treasury Bonds (T-Bonds) denominated in Emirati Dirhams (AED). These bonds aim to develop the UAE's local currency bond market and provide investors with secure investment avenues. Investors lend money to the government for a specified period, receiving regular interest payments (coupons) until maturity, at which point the principal amount is repaid.

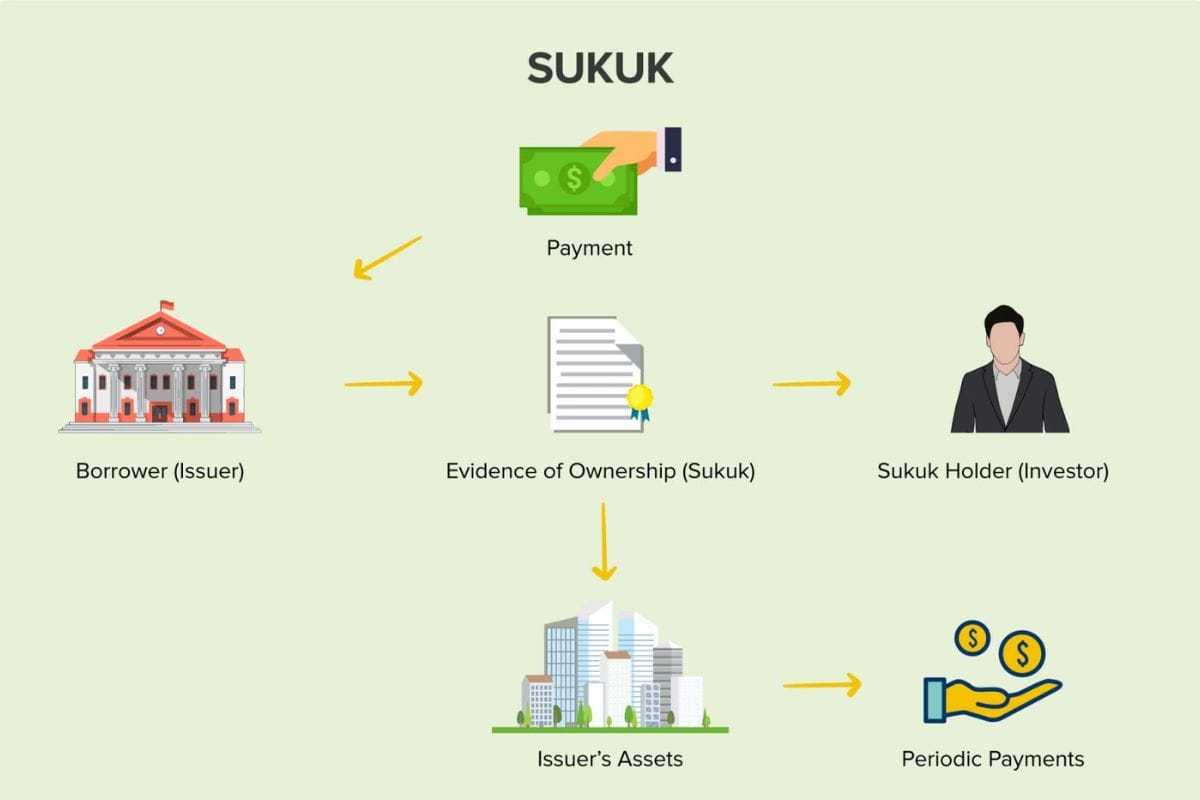

Exploring Islamic Sukuk

Islamic Sukuk are Sharia-compliant financial instruments similar to bonds but structured to comply with Islamic law, which prohibits interest-bearing investments. Instead, Sukuk represents ownership in tangible assets or projects, and investors earn returns derived from the performance of these assets. The UAE government issues T-Sukuk, denominated in AED, to support the establishment of a Sukuk capital market and offer diversified funding sources.

Investment Amounts and Accessibility

Traditionally, investing in bonds or Sukuk required substantial capital, often with minimum investments of USD 200,000 or equivalent. However, financial institutions like Emirates NBD have introduced Fractional Bonds & Sukuk, allowing investors to participate with as little as USD 25,000. This innovation enables diversification across multiple bonds or Sukuk, enhancing portfolio stability.

Expected Returns

The returns on government bonds and Sukuk are generally stable, reflecting their low-risk nature. For instance, National Bonds, a Sharia-compliant savings and investment scheme in the UAE, offers Term Sukuk with flexible tenures of 3, 6, 9 months, or 1 year and a minimum investment of AED 10,000. Investors enjoy regular profit distributions on a monthly or quarterly basis, with capital protection as per the National Bonds Mudaraba Structure.

Additionally, National Bonds introduced The Payout, a short-term offering spanning 2 years, with an expected profit of up to 11% per annum for the first 6 months, distributed monthly. This product provides capital protection and flexibility for investors seeking higher returns without compromising safety.

Considerations

- Liquidity: While government bonds and Sukuk are considered low-risk, they may have longer lock-in periods. It's essential to assess your liquidity needs before investing.

- Currency Risk: Investments denominated in foreign currencies may expose investors to exchange rate fluctuations. However, UAE government bonds and Sukuk issued in AED mitigate this risk for local investors.

- Credit Risk: Although government-issued instruments carry minimal default risk, it's prudent to evaluate the creditworthiness of the issuer.

By investing in UAE government bonds and Islamic Sukuk, individuals can achieve stable growth while aligning with their risk tolerance and investment principles. These instruments provide a secure foundation for a diversified investment portfolio, offering peace of mind and predictable returns.

Mutual Funds & ETFs: Easy Investments for Beginners

For working professionals and residents in Dubai seeking straightforward investment avenues, Mutual Funds and Exchange-Traded Funds (ETFs) offer accessible and diversified options. These instruments are particularly suitable for individuals who prefer a hands-off approach, as they are managed by financial experts and provide exposure to a broad range of assets, thereby mitigating risk.

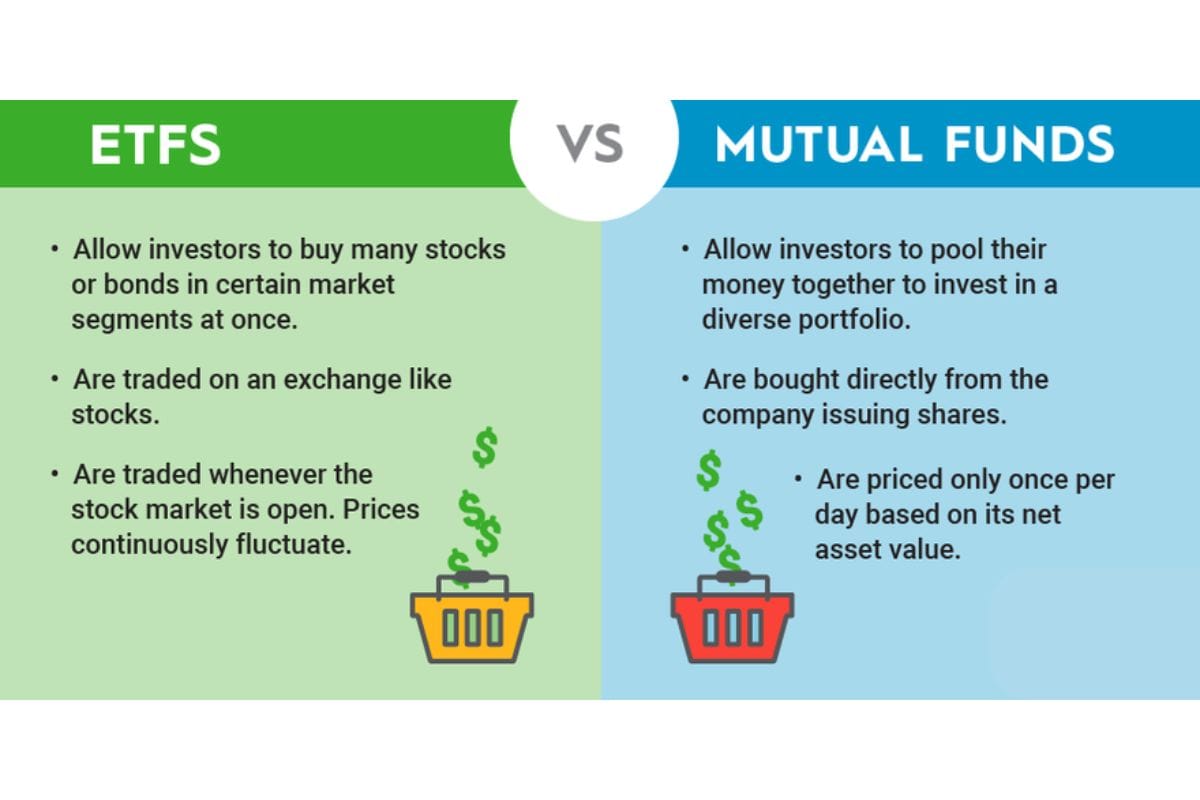

Understanding Mutual Funds and ETFs

- Mutual Funds: These are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

- ETFs: Similar to mutual funds, ETFs hold a collection of assets but are traded on stock exchanges like individual stocks. This trading flexibility allows investors to buy and sell ETF shares throughout the trading day.

Advantages of Mutual Funds and ETFs

- Diversification: Both mutual funds and ETFs provide exposure to a wide array of assets, reducing the impact of any single investment's performance on the overall portfolio.

- Professional Management: Investors benefit from the expertise of fund managers who actively monitor and adjust the fund's holdings to align with investment objectives.

- Accessibility: ETFs, in particular, are accessible to small investors since they can be purchased in individual units, whereas mutual funds may require higher minimum investments.

Top Mutual Funds and ETFs in the UAE

- iShares MSCI UAE ETF (UAE): This ETF seeks to track the investment results of an index composed of UAE equities, offering targeted access to UAE stocks. It provides investors with exposure to a broad range of companies in the United Arab Emirates.

- Shelton NASDAQ-100 Index Direct (NASDX): This mutual fund aims to replicate the performance of the largest non-financial companies listed on the NASDAQ stock exchange. It offers a convenient way to invest in a broad section of the tech-heavy NASDAQ-100 index.

- Fidelity Global Dividend Fund: This fund focuses on identifying and investing in dividend-paying companies worldwide, aiming for income and long-term capital growth.

Getting Started with Mutual Funds and ETFs in the UAE

- Through Local Banks: Banks such as Abu Dhabi Commercial Bank (ADCB) offer access to a selection of international mutual funds covering various asset classes, sectors, and regions.

- Online Investment Platforms: Platforms like Sarwa provide user-friendly interfaces for investing in diversified portfolios, including ETFs, with low minimum investment requirements.

- Dubai Financial Market (DFM): The DFM offers ETFs that are traded like stocks, providing liquidity and the ability to buy or sell at any time during trading hours. They also have low management fees, making them more accessible to small investors.

Considerations

- Risk Tolerance: Assess your risk appetite to choose funds that align with your financial goals and comfort level.

- Fees and Expenses: Be mindful of management fees and other associated costs, as they can impact overall returns.

- Performance History: Review the historical performance of funds, keeping in mind that past performance does not guarantee future results.

By leveraging mutual funds and ETFs, investors in Dubai can achieve diversified exposure to various markets and asset classes, facilitating steady financial growth with minimal active management.

Investment Risks: What to Avoid

Investing in Dubai offers numerous opportunities, but it's essential to remain vigilant against potential scams and high-risk traps. Here's how to navigate the investment landscape safely:

Common Scams and High-Risk Traps in Dubai

- Ponzi and Pyramid Schemes: These fraudulent investment operations promise high returns with little risk by paying earlier investors with capital from newer ones. For instance, USI Tech, a Dubai-based company, was exposed as a Ponzi scheme, defrauding investors worldwide before its collapse.

- Advance Fee Scams: Scammers request upfront payments for services or investments that never materialize. They often lure victims with promises of significant returns, only to disappear once the fee is paid.

- Unregulated Cryptocurrency Platforms: The rapid growth of cryptocurrencies has attracted fraudsters. Unregulated platforms may offer enticing returns but lack oversight, increasing the risk of fraud.

How to Verify Legitimate Investments

- Check Regulatory Approval: Ensure the investment platform or company is registered with Dubai's financial regulatory authorities. The Dubai Financial Services Authority (DFSA) oversees financial services within the Dubai International Financial Centre (DIFC) and maintains a public register of authorized firms.

- Consult Official Sources: For real estate investments, verify the legitimacy of developers and projects through the Dubai Real Estate Regulatory Agency (RERA), which regulates the real estate sector in Dubai.

- Be Skeptical of Unrealistic Returns: Exercise caution with investments promising unusually high returns with minimal risk. Such offers often indicate fraudulent schemes.

- Seek Professional Advice: Consult licensed financial advisors or legal professionals before committing to any investment. They can provide insights into the legitimacy and risks associated with the opportunity.

- Conduct Thorough Research: Investigate the company's history, management team, and business model. Look for reviews, news articles, or any regulatory actions against them.

By staying informed and exercising due diligence, you can protect yourself from scams and make sound investment decisions in Dubai's dynamic market.

The best investment decisions aren’t about chasing risky opportunities or waiting for the “perfect” moment—they’re about making steady, informed choices that align with your financial goals. Whether it’s real estate, stocks, or alternative investments, the key is to start now with what you can afford and let your money work for you.

Dubai offers countless opportunities for those who take the time to invest wisely, but the real difference comes from action. The longer your money sits idle, the more potential growth you miss. Smart investing isn’t about how much you start with—it’s about starting at all.

Also read: