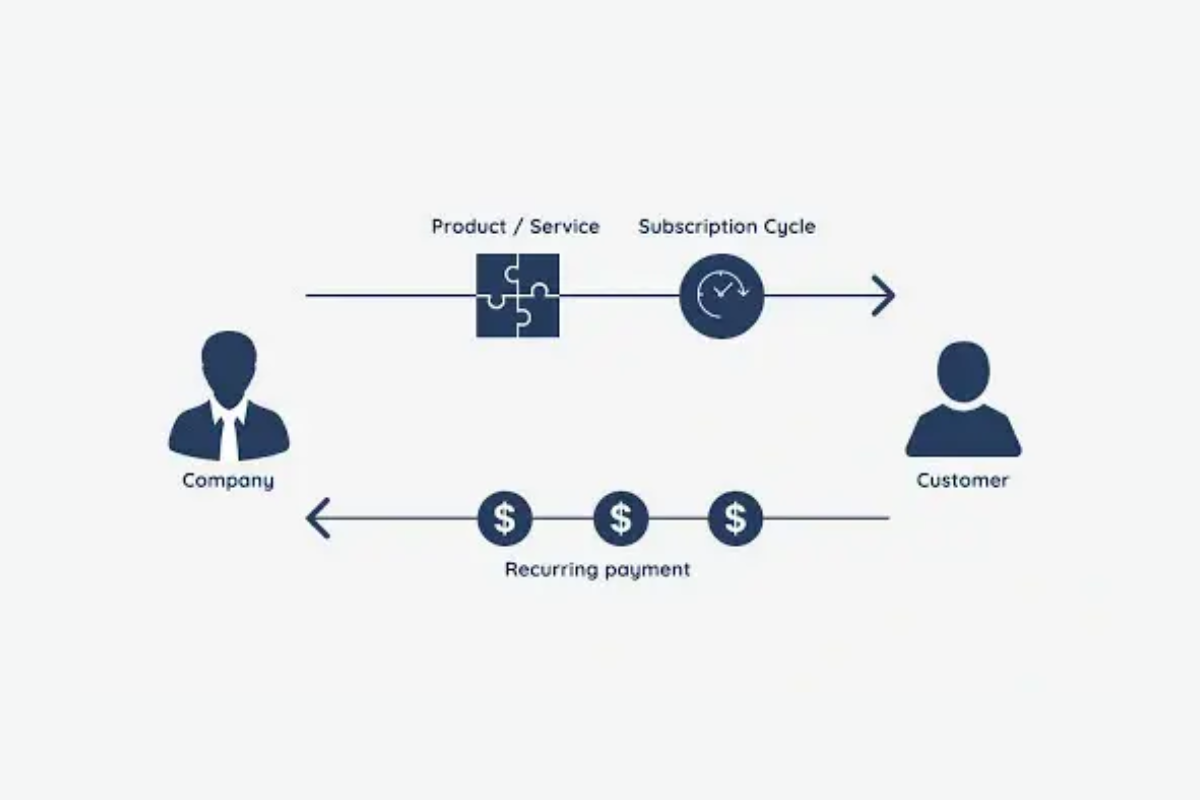

Owning less and accessing more — that’s the quiet shift redefining how people and businesses interact across the world. Instead of buying products outright, more consumers are choosing to subscribe to them, enjoying convenience, personalization, and continuous access without the burden of ownership. This is the essence of the subscription-based business model — where customers pay a recurring fee, monthly or annually, to access goods or services that evolve with their needs.

Globally, the model has moved far beyond magazines and streaming platforms. Today, everything from fashion and fitness to food delivery and software operates on subscription terms. According to a report by Subsbase, the global subscription economy, valued at around USD 650 billion in 2021, is projected to reach USD 1.5 trillion by 2025. The appeal is clear: businesses enjoy predictable revenue and stronger customer retention, while users gain flexibility and convenience in an increasingly digital world.

In the UAE, this model has found a particularly strong footing. With internet penetration exceeding 99%, a thriving e-commerce sector, and widespread digital payment adoption, the country provides the ideal environment for subscription-based ventures to grow. Consumers here are accustomed to efficiency and comfort — values that align closely with recurring service models. Whether it’s meal plans, streaming platforms, car refueling services, or curated product boxes, recurring access fits naturally into the rhythm of daily life.

As more entrepreneurs and established brands adopt this model, a new question takes shape: how can businesses ensure that convenience leads to long-term loyalty?

In this article, we’ll explore the rise of subscription-based businesses in the UAE, the factors driving their success, the industries embracing this shift, and the strategies helping them sustain growth in a competitive market.

What’s Driving the Subscription Boom in the UAE

1. Growing Digital Lifestyles and Payment Convenience

Life in the UAE has become seamlessly digital. From grocery shopping to transportation, almost every daily need is fulfilled online. This shift has made people more comfortable with recurring payments and digital transactions. Mobile wallets, tap-to-pay options, and instant transfer systems have become standard, allowing customers to make payments in seconds without the friction of cash.

Businesses have adapted quickly too. Today, most retailers, startups, and service providers offer secure online billing, while advanced fintech systems handle automated renewals smoothly. This ecosystem makes it easy for brands to build subscription-based offerings — and even easier for customers to commit to them.

Take Amazon UAE, for example. Its “Subscribe & Save” option allows users to set up recurring deliveries for everyday essentials like diapers, detergents, and pantry items, often with discounted prices for long-term commitments. This model appeals to busy parents and professionals who prefer convenience over remembering repeat purchases. Similar trends can be seen in grocery apps, fuel delivery services, and even pharmacies that deliver regular prescriptions on schedule.

The widespread use of smartphones and the UAE’s 99% internet penetration ensure that consumers are well-equipped to manage these subscriptions with a few simple taps — making recurring purchases feel as natural as any one-time transaction.

2. Preference for Convenience, Flexibility, and Experience

In a fast-moving country like the UAE, convenience is currency. Subscriptions simplify life for people who want consistency without the hassle of constant reordering. Many residents now rely on meal plan services that deliver freshly prepared dishes each week, or coffee subscriptions that keep their pantry stocked automatically.

Flexibility also plays a big role. Modern consumers want control over their choices — they prefer subscriptions that can be paused, switched, or canceled at any time. Businesses that provide this freedom tend to see higher trust and longer retention.

Equally important is the desire for discovery. The UAE’s multicultural population enjoys trying new things, and subscriptions make that easy. Brands offering monthly beauty boxes, curated snacks, or streaming bundles satisfy this craving for novelty while maintaining comfort and familiarity. Subscriptions combine predictability with pleasant surprises — something that fits perfectly into the lifestyle of a diverse, experience-driven society.

3. Supportive Business Environment and Tech Infrastructure

The UAE’s infrastructure and business climate have made it one of the most supportive markets in the region for subscription-based ventures. The government’s ongoing digital transformation strategy continues to strengthen the foundations for e-commerce and fintech innovation.

Free zones such as Dubai Internet City and Abu Dhabi Global Market encourage startups with simplified licensing and access to digital tools. Cloud platforms, data centers, and AI-driven analytics make it easier for businesses to handle recurring payments, manage user preferences, and predict customer behavior.

Several homegrown startups have also embraced this model successfully. For instance, Washmen offers laundry subscriptions with pickup and delivery options, while Cafu provides regular on-demand refueling services through its app. These businesses show how recurring access models can work beyond digital goods, offering consistent value and convenience in everyday life.

With such strong infrastructure, smart regulations, and a tech-savvy population, the UAE has become a natural hub for businesses looking to move away from one-time transactions and toward continuous customer engagement.

Benefits for Businesses

1. Enhanced Forecasting & Resource Allocation

Subscription models give firms the visibility to forecast future revenue with much greater confidence. With recurring payments, businesses can project cash flow over months or years rather than guessing based on sporadic sales. That clarity allows better planning for hiring, inventory, marketing, and capital expenditures.

For example, a subscription fitness app in the UAE can estimate the number of active users next quarter (less churn), then decide how many coaches to hire, which new features to build, or where to expand regionally. This reduces over- or under-investment compared to traditional models.

2. Lower Customer Acquisition Cost (Over Time)

While acquiring subscribers may require investment, over time, the effective cost to maintain and “re-activate” customers falls. Once someone is a subscriber, you can retain, re-engage, or upsell them more cheaply than acquiring a brand-new customer.

For instance, a meal-kit provider will spend less on promotions toward existing subscribers than on paid ads for new customers. The amortized acquisition cost becomes more favorable as lifetime value (LTV) rises.

3. Faster Feedback Loop & Iterative Improvement

Subscription businesses interact with customers continuously, not just at the point of sale. Every renewal, cancellation, usage pattern, or feedback message is a signal. That constant loop enables:

- Rapid testing of new features or tiers

- Iteration on pricing, packaging, and service levels

- Early detection of patterns leading to cancellations

As an example, a digital streaming platform in the UAE can monitor usage dips and send re-engagement prompts or test new content bundles mid-subscription, all based on real-time data.

4. Creation of “Switching Cost” and Reduced Churn

Because subscriptions often tie users into a routine — billing cycles, auto-deliveries, saved preferences — there is friction in switching to a competitor. That inertia is a subtle but powerful form of competitive advantage.

For example, if a parent subscribes to a diaper delivery service, their stored order history, delivery schedule, and account details create a mental and operational barrier to trying a competitor. That “stickiness” helps reduce churn even without aggressive retention tactics.

5. Higher Valuation & Investment Appeal

Investors tend to value businesses with predictable, recurring revenue more highly because risk is lower and scalability clearer. Subscription-based companies often command higher multiples at exit or during funding rounds.

In practice, a UAE SaaS firm with a solid subscription base may attract more favorable terms and valuation compared with a comparable business relying on spot contracts or one-time services.

6. Opportunity to Expand Horizontally (Cross-Sell & Ecosystem Building)

Subscriptions open the door to layered offerings and ecosystem growth. Once you have a base of engaged users, you can roll out adjacent products or services — sometimes more easily than starting cold.

Imagine a home maintenance subscription in the UAE: after gaining subscribers for regular cleaning, you could cross-sell HVAC servicing, window cleaning, or smart home monitoring. Because customers already trust the platform, adoption is smoother.

Challenges to Watch Out For

1. Retaining Customers & Preventing Churn (Beyond Simple Loyalty)

Even though subscriptions imply recurring engagement, many businesses underestimate how hard it is to keep customers over time.

- Involuntary churn — failed payments. A large share of cancellations isn’t deliberate: credit card expiry, insufficient funds, or payment system errors lead to involuntary churn. Studies suggest that unpaid subscriptions contribute to more than half of all churn in some industries.

- Content or offering fatigue. Customers may feel the service or product stops feeling fresh over time. If your subscription doesn’t evolve, users may leave—not because they dislike you, but because they get bored.

- Mismatch between expectations and delivered value. If onboarding or early usage fails to prove value, subscribers may cancel before becoming “sticky.” In the UAE, streaming services, for example, research shows that dissatisfaction with content variety or technical issues strongly influences churn.

- High benchmark of alternatives. In markets like the UAE, with many subscription options (entertainment, fitness, food), a subscriber who becomes slightly dissatisfied can instantly switch to a competitor. The friction for switching is low.

Because churn erodes revenue rapidly, any subscription business needs to treat retention as an ongoing investment—not just a one-time acquisition problem.

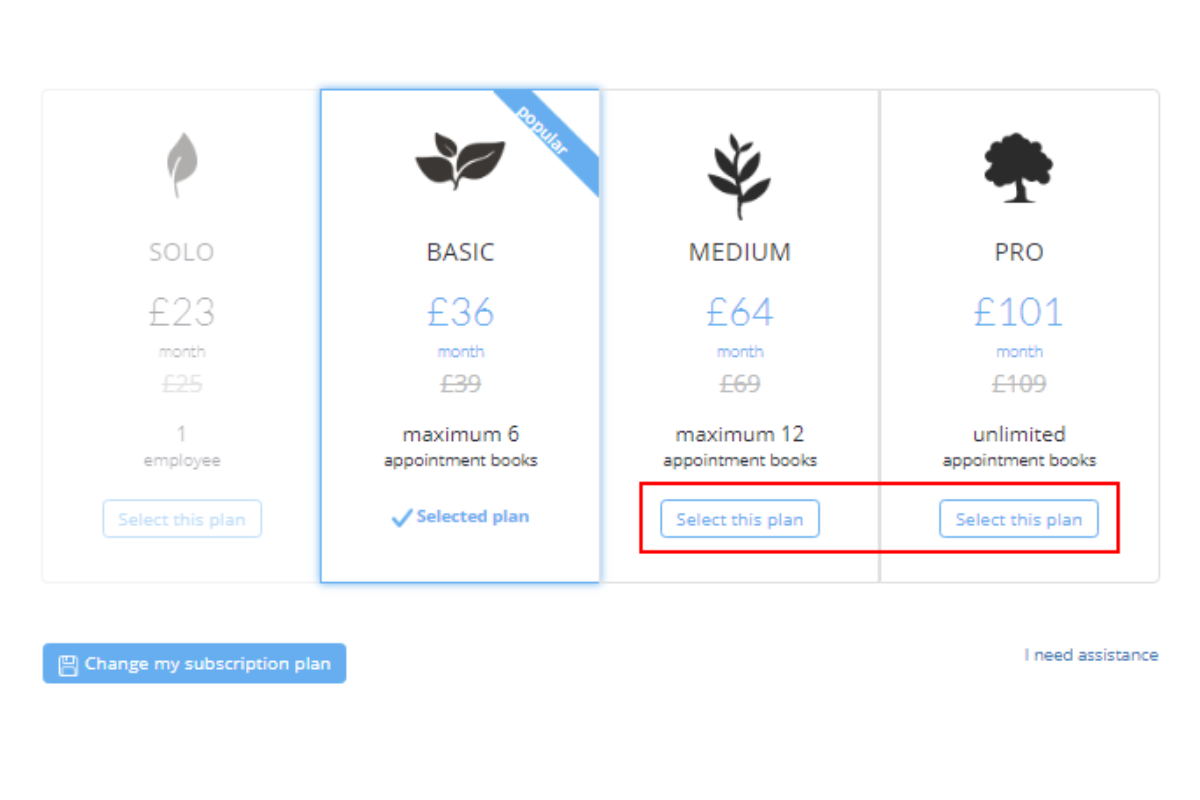

2. Pricing Competition & Differentiation in a Saturated Market

As subscription models become more common, the competitive demands change.

- Commoditization risk. When many players charge for similar offerings, customers tend to shop by price — unless your service is clearly differentiated. This forces margins down.

- Tier confusion and complexity. Offering too many plan options can confuse customers; offering too few may alienate potential segments. Striking the right balance is hard.

- Discount fatigue. Heavy discounting to attract or retain subscribers (e.g. first-month free, steep introductory rates) can erode perceived value long-term and condition customers to expect lower prices.

- Value perception gap. Some services provide physical goods, others deliver content or software. Convincing customers that what they pay monthly is worth it can be more challenging when there’s no physical “thing” to hold.

To survive, subscription businesses must lean heavily into unique value propositions, clarity around benefits, or vertical specialization rather than competing on cost alone.

3. Payment Failures & Operational Logistics

Smooth operations are the backbone of sustaining subscriptions; in the UAE context, these challenges are especially acute.

- High payment failure rates. As mentioned, involuntary churn is often due to payments not going through. Retry logic, payment method diversity, and alerts to customers are essential to minimize this.

- Cross-border and currency complications. Given the UAE’s diverse expatriate base, customers from many countries subscribe. Handling currency exchange, foreign cards, different billing rules, and tax/regulatory compliance is complex.

- Addressing and last-mile delivery issues. The lack of a universal postal address system in many parts of the UAE complicates accurate delivery. Delivery failures due to vague addresses or navigation issues inflate costs and frustrate customers.

- Scalable fulfillment & inventory constraints. Subscription models often demand consistent replenishment. Fluctuations in demand, supply chain hiccups, or warehouse constraints can break consistency.

- Regulation, licensing, and compliance overheads. Some goods, especially regulated products like medicines, require permits, inspections, or logistics compliance. If subscriptions cross emirate or national borders, the regulatory burden multiplies.

- Operational cost and staff management. As subscription volumes scale, logistics, customer support, returns, and quality control teams all need to scale too—often rapidly. If growth outpaces operations, breakdowns occur.

How Businesses Can Succeed

1. Offer Flexibility and Personalization

Subscribers want control. Allowing them to pause, skip, or switch plans freely builds trust and reduces cancellations. Simple options like choosing delivery frequency or adjusting billing cycles make users feel valued rather than locked in.

Personalization also plays a major role. By studying customer preferences and behavior, businesses can tailor suggestions, send relevant offers, and localize language or payment options. In a diverse market like the UAE, that attention to detail can turn a routine subscription into something customers actually enjoy managing.

2. Focus on Experience, Not Pricing

Price attracts customers, but experience keeps them. A good subscription feels smooth, rewarding, and fresh over time. Strong onboarding ensures customers see value early, while updates, new features, and surprise perks help maintain excitement.

Brands that build communities or offer extra guidance — like fitness apps sharing personalized routines or meal plans with lifestyle content — strengthen emotional connection. The goal is to make people stay because they love the experience, not just because it’s affordable.

3. Invest in Tech, Data, and Engagement

Technology is the engine behind every successful subscription model. Using customer data intelligently helps predict churn, automate renewals, and deliver personalized recommendations.

Reliable payment systems, smart retry mechanisms, and unified customer dashboards ensure smooth operations even as the business scales. Tracking key metrics like churn rate, engagement, and lifetime value gives companies the insight they need to grow sustainably.

Investing in these systems early gives businesses the clarity and stability to retain subscribers, improve experiences, and expand confidently in a competitive market.

The subscription economy in the UAE is moving toward a smarter, more personalized future. Beyond entertainment and meal plans, new sectors like mobility, wellness, and home services are adopting flexible, hybrid models — from pay-as-you-go memberships to “subscribe-to-own” options.

Artificial intelligence and data insights will shape the next stage of this growth. By predicting customer needs, businesses can offer more relevant plans and experiences that evolve naturally over time. The focus is shifting from transactions to relationships — building loyalty through consistency and trust.

This transition marks more than a business trend; it signals a long-term mindset where value grows with every renewal. The UAE’s strong digital infrastructure and consumer readiness make it a natural leader in this shift, setting the stage for subscription-based models to become a cornerstone of how business is done in the years ahead.

Also read: