For decades, Dubai's identity as a tax-free paradise has been one of its most powerful attractions. Entrepreneurs, multinational corporations, and investors flocked to the emirate, drawn by the promise of zero income tax and business-friendly free zones that seemed almost too good to be true. That narrative, while not entirely gone, is evolving into something more nuanced and, arguably, more sustainable.

As of 2025, the UAE's corporate tax landscape has matured significantly. The introduction of a 9% corporate tax rate – effective since June 2023 with key updates rolling out throughout 2025 – marks a deliberate shift toward global standards. Influenced by OECD frameworks like Pillar Two, this change signals Dubai's transition from a purely tax-advantaged jurisdiction to a sophisticated, transparent business hub that can compete on fundamentals beyond just tax benefits.

This evolution shouldn't be viewed as a deterrent. Rather, it's a sign of economic maturity that ensures Dubai remains attractive for genuine foreign direct investment while promoting fair taxation practices. For small businesses and startups, success in this new landscape depends on understanding the framework, leveraging available exemptions, and implementing strategic structures that minimize liabilities without compromising growth potential.

Understanding Dubai's 2025 Corporate Tax Framework

The UAE's corporate tax system applies a 9% rate to businesses with taxable income exceeding AED 375,000, while maintaining a 0% rate for income below that threshold. This small business relief mechanism is specifically designed to ease the burden on SMEs, recognizing that Dubai's entrepreneurial ecosystem thrives on startup innovation. Source: UAE Federal Tax Authority

Key 2025 Updates Shaping the Landscape

Domestic Minimum Top-Up Tax (DMTT):

Large multinational enterprises (MNEs) with global revenues exceeding EUR 750 million now face a 15% minimum tax rate. This aligns the UAE with the OECD's global minimum tax initiative designed to prevent base erosion and profit shifting. While this primarily affects major corporations, it signals the UAE's commitment to international tax standards. Source: OECD Pillar Two Framework

Free Zone Clarifications:

Dubai's celebrated free zones – including DIFC, DMCC, and Jebel Ali – retain their 0% corporate tax rate for "qualifying income." However, 2025 has brought stricter clarifications around what qualifies. Activities must genuinely occur within the zone or involve non-resident entities. More importantly, businesses must demonstrate real economic substance through adequate employees, physical premises, and genuine operations. The days of mailbox companies are definitely over.

Real Estate Investment Trust (REIT) Exemptions:

Ministerial Decision No. 96 of 2025 provides exemptions for certain REITs, provided they meet specific distribution and ownership criteria. This maintains Dubai's attractiveness for real estate investors while ensuring compliance with broader tax principles.

Critical Filing Deadlines:

The first corporate tax returns are due by September 17, 2025, for financial years ending in 2024. Audits and transfer pricing documentation must be completed by September 30, 2025. These deadlines are non-negotiable, and businesses should be preparing now rather than scrambling at the last minute.

Personal Income Remains Tax-Free:

Individual salaries and personal income continue to enjoy 0% taxation. However, business owners must carefully distinguish between personal and corporate income to avoid reclassification issues that could trigger unexpected tax liabilities.

These reforms aim to boost transparency and attract sustainable, quality investment rather than purely tax-driven capital. While they introduce compliance complexities for Dubai's diverse business ecosystem, they also position the UAE as a credible, long-term business destination.

Source: UAE Federal Tax Authority

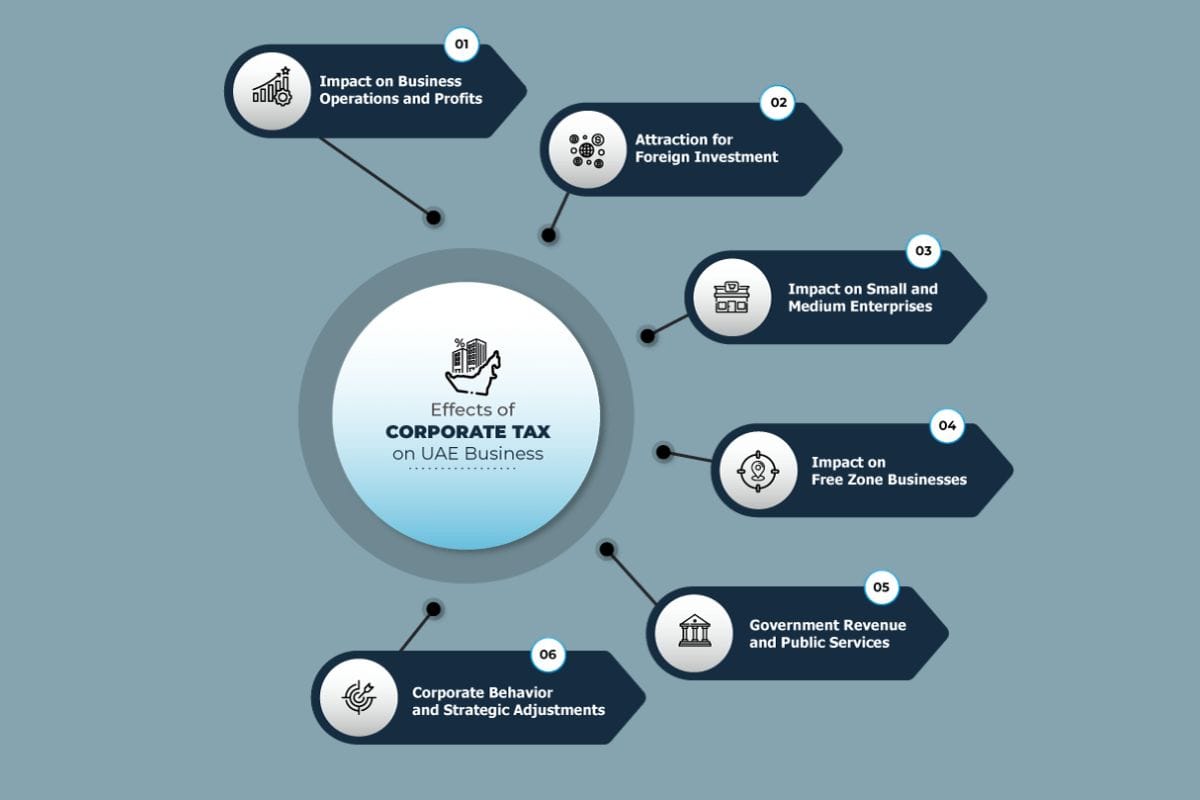

The Challenges Businesses Face in Dubai's New Reality

While the 9% corporate tax rate remains exceptionally competitive compared to global averages – the US charges 21%, most European nations exceed 20%, and regional competitors like Saudi Arabia impose 20% – adaptation presents real challenges for businesses accustomed to zero taxation.

Compliance Burden for SMEs

Small and medium enterprises now face increased administrative costs. Proper audits, transfer pricing documentation (ensuring arm's-length pricing for related-party transactions), and meticulous record-keeping require resources that many startups haven't budgeted for. The cost of compliance – both in terms of money and management time – can be particularly challenging for businesses in their growth phases.

Free Zone Complexity and Substance Requirements

The promise of 0% taxation in free zones comes with strings attached. Income derived from mainland UAE operations or transactions with UAE-resident entities may trigger the 9% tax rate. If a business cannot prove adequate economic substance – real employees, genuine premises, meaningful operations – it risks disqualification from free zone benefits entirely. This requires careful structuring and honest assessment of whether a free zone model truly serves your business needs.

Multinational Considerations

For multinational groups with UAE operations, the DMTT adds complexity. Global tax calculations must account for UAE entities, potentially requiring restructuring to optimize effective tax rates across jurisdictions. This affects not just compliance but strategic decisions about where to locate functions, how to price inter-company transactions, and how to structure regional operations.

Economic Context and Competitive Pressures

Dubai's broader economic environment includes rising operational costs in some sectors. Amid fuel price fluctuations and the natural maturation of the market, corporate tax could squeeze margins for startups in particularly competitive sectors like e-commerce, PropTech, or consumer services. Every percentage point of margin matters when you're competing for market share.

That said, Dubai's ecosystem offers significant offsetting advantages: 100% foreign ownership across most sectors, remarkably quick business setup processes (3-5 days in many cases), and double taxation treaties (DTTs) with over 115 countries that prevent income from being taxed twice. These structural advantages help mitigate the impact of corporate taxation.

Strategic Approaches to Minimize and Adapt to Corporate Tax

Success in Dubai's evolving tax landscape requires proactive planning rather than reactive scrambling. Here are actionable strategies tailored to Dubai's specific business environment:

- Leverage Free Zones Strategically for 0% Taxation

The Approach:

Operating in free zones like Jebel Ali, DIFC, or DMCC can secure 0% corporate tax on qualifying activities. The key is ensuring your operations genuinely qualify by maintaining real economic substance.

Dubai-Specific Implementation:

- Focus operations on "qualifying income" streams – exports, services to non-residents, or approved activities

- Hire actual employees based in the free zone, not just remote contractors

- Maintain genuine physical premises appropriate to your business scale

- Document that decision-making and core activities occur within the free zone

- Carefully audit operations against Decision No. 229 clarifications to avoid the 9% fallback rate

Recent clarifications have tightened substance requirements, so what worked in 2022 may not suffice in 2025. Regular compliance reviews are essential.

- Maximize Small Business Relief Benefits

The Approach:

Keep taxable income under the AED 375,000 threshold to maintain the 0% corporate tax rate. This requires strategic expense management and smart deductions.

Dubai-Specific Implementation:

- Claim legitimate business expenses aggressively – from office costs to professional development

- Consider R&D tax credits for innovation-focused businesses

- Utilize accelerated depreciation on assets like technology equipment

- Time major investments strategically to manage taxable income across fiscal years

- If approaching the threshold, consider whether splitting operations makes sense

For startups in Dubai's innovation hubs, this relief can provide crucial breathing room during growth phases. The difference between 0% and 9% on early profits can fund additional hiring or marketing that accelerates growth. Source: UAE Federal Tax Authority

- Optimize Business Structure Thoughtfully

The Approach:

Use holding companies, offshore entities, or group relief mechanisms to manage tax exposure across related businesses. Separate high-margin from low-margin activities where appropriate.

Dubai-Specific Implementation:

- Benefit from UAE-KSA double taxation treaty for cross-border operations

- Structure mainland LLCs for local market access while ring-fencing free zone entities for international operations

- Consider holding company structures for multiple business lines

- Use group relief provisions to offset losses in one entity against profits in another

- Evaluate whether offshore entities in jurisdictions like RAK or ADGM serve specific purposes

The UAE's expanding network of double taxation treaties creates opportunities for efficient regional structuring, particularly for businesses operating across GCC markets. Source: UAE Ministry of Finance – Double Taxation Treaties

- Master Transfer Pricing Documentation

The Approach:

Document that transactions between related entities follow arm's-length principles – meaning they're priced as if the parties were unrelated and negotiating fairly.

Dubai-Specific Implementation:

- This is mandatory for MNEs and increasingly important for growing businesses with related entities

- Hire Dubai-based tax consultants who understand local benchmarks and OECD methods

- Document pricing methodologies for inter-company services, goods, and intellectual property

- Maintain contemporaneous documentation rather than scrambling during audits

- Understand that non-compliance risks penalties up to 200% of unpaid tax

Transfer pricing has historically been overlooked in the tax-free era, but it's now a critical compliance area that can trigger severe penalties if handled improperly. Source: OECD Transfer Pricing Guidelines

- Claim All Available Exemptions and Incentives

The Approach:

Understand which income streams and entity types qualify for exemptions, then structure accordingly.

Dubai-Specific Implementation:

- REITs and qualifying investment funds can access full exemptions under specific conditions

- Natural persons engaged in non-business activities remain exempt

- Use double taxation treaties for withholding tax relief on cross-border payments

- Expats can secure UAE tax residency certificates for global tax benefits

- Dividend income from qualifying shareholdings may be exempt

Dubai offers numerous carve-outs designed to maintain competitiveness for specific sectors. Understanding these nuances can dramatically affect your effective tax rate. Source: UAE Ministerial Decision No. 96 of 2025

- Invest in Compliance Technology

The Approach:

Adopt software solutions that automate reporting, track expenses, and manage compliance deadlines.

Dubai-Specific Implementation:

- Tools like Avalara or region-specific ERP integrations reduce filing errors

- Cloud-based accounting systems provide real-time visibility into tax positions

- Automated expense tracking ensures all legitimate deductions are captured

- Compliance calendars prevent missing critical deadlines like September 30, 2025

- Digital documentation systems facilitate audit readiness

The cost of compliance software is minimal compared to penalties for late filing or errors. For businesses managing complex structures, technology isn't optional – it's essential. Source: Technology vendors and compliance platforms

- Plan for DMTT (If Applicable to Large Groups)

The Approach:

Multinational groups must calculate potential top-up taxes and explore safe harbor provisions.

Dubai-Specific Implementation:

- Review global structures if your group's UAE operations are part of an MNE exceeding EUR 750 million in revenue

- Use the UAE's relatively low effective rate to minimize additional DMTT liabilities

- Consider whether consolidation or separation of UAE entities optimizes outcomes

- Engage specialized advisors who understand both UAE and global minimum tax rules

While DMTT primarily affects large corporations, mid-sized businesses with growth ambitions should understand these rules to avoid surprises as they scale.

- Engage Professional Advisors Early

The Approach:

Work with tax advisors who understand UAE-specific regulations and can tailor strategies to your situation.

Dubai-Specific Implementation:

- Firms like KPMG, Deloitte, PwC, and EY maintain UAE practices with deep local expertise

- Boutique Dubai-based tax consultancies often provide more personalized service for SMEs

- Early planning can reduce effective tax rates by 20-30% through legitimate optimization

- Annual reviews ensure structures remain optimal as business circumstances and regulations evolve

- Advisors help navigate the gray areas where rules are still being interpreted

The cost of professional advice is an investment that typically pays for itself many times over through legitimate tax savings and avoided penalties.

A Perspective: This Evolution Enhances Dubai's Appeal

Rather than viewing corporate tax as eroding Dubai's attractiveness, consider it an evolution that enhances credibility and sustainability. The combination of a competitive 9% rate, zero VAT on exports, robust double taxation treaties, and continued free zone benefits positions the UAE strategically amid global tax pressures and increased scrutiny of tax havens.

For entrepreneurs, this evolution encourages building businesses on genuine value rather than pure tax arbitrage. It attracts more serious, long-term investors who prioritize business fundamentals over short-term tax advantages. It positions Dubai as a credible partner in international business, not a tax dodge. With Dubai targeting 4.8% GDP growth, businesses that adapt thoughtfully will find that compliance becomes a competitive advantage rather than merely a cost. Source: Dubai Economic Projections

The transparency and structure that corporate tax brings also facilitates access to international capital markets, improves corporate governance, and makes UAE businesses more attractive to sophisticated investors and partners worldwide.

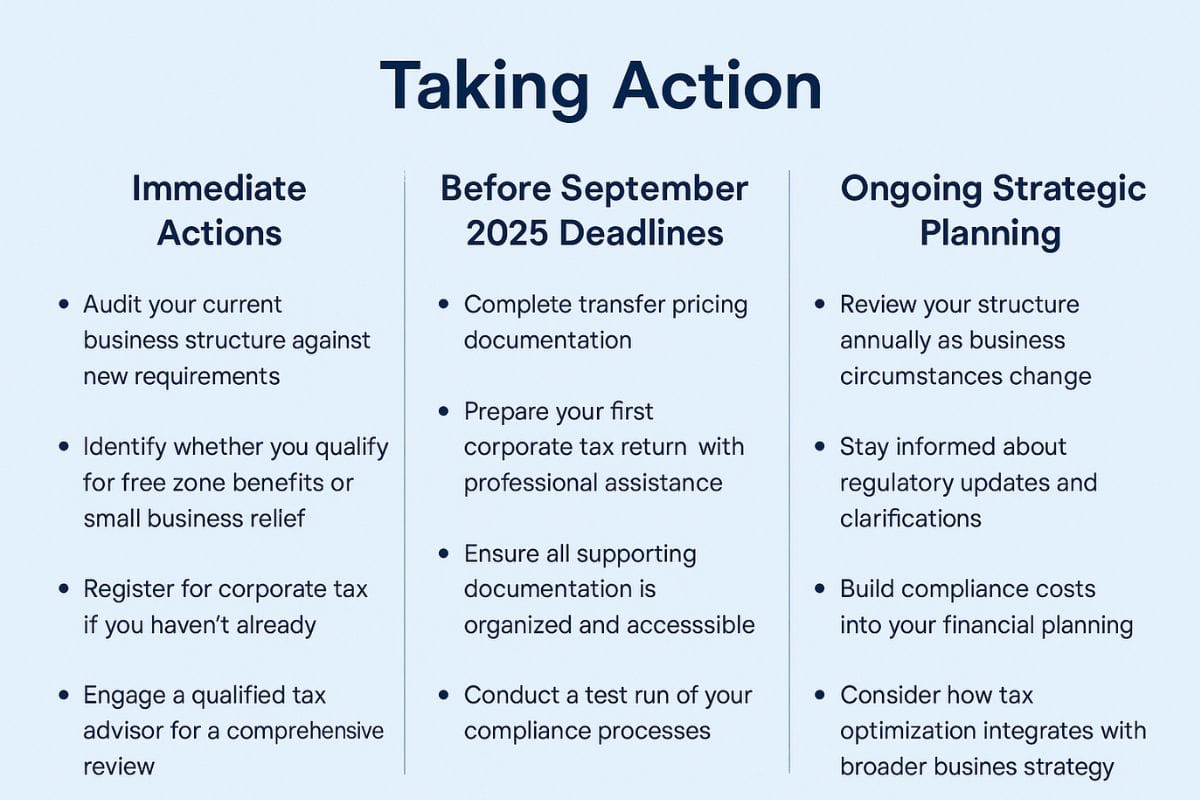

Taking Action

Understanding the framework is just the beginning. Effective adaptation requires concrete action:

Immediate Actions:

- Audit your current business structure against new requirements

- Identify whether you qualify for free zone benefits or small business relief

- Register for corporate tax if you haven't already

- Engage a qualified tax advisor for a comprehensive review

Before September 2025 Deadlines:

- Complete transfer pricing documentation

- Prepare your first corporate tax return with professional assistance

- Ensure all supporting documentation is organized and accessible

- Conduct a test run of your compliance processes

Ongoing Strategic Planning:

- Review your structure annually as business circumstances change

- Stay informed about regulatory updates and clarifications

- Build compliance costs into your financial planning

- Consider how tax optimization integrates with broader business strategy

The Federal Tax Authority portal provides official guidance, but professional interpretation of how rules apply to your specific circumstances is invaluable. In this new era of Dubai business, foresight and proactive planning trump the old tax-free myth.

Dubai's evolution from tax-free paradise to sophisticated tax-efficient jurisdiction represents maturity, not decline. The corporate tax framework introduced in 2023 and refined through 2025 aligns the UAE with global standards while maintaining genuine competitive advantages.

For businesses willing to adapt – leveraging free zones strategically, optimizing structures thoughtfully, claiming available reliefs, and maintaining rigorous compliance – Dubai remains one of the world's most attractive business locations. The 9% rate beats virtually every developed economy. The small business relief protects startups. The free zones still offer 0% for qualifying operations. And the broader ecosystem of international connectivity, infrastructure, and opportunity continues strengthening.

The businesses that will thrive aren't those clinging to the old tax-free narrative, but those embracing transparency, building genuine substance, and viewing compliance as a foundation for sustainable growth. In Dubai's evolving landscape, the opportunities remain extraordinary for those prepared to navigate them intelligently.

Also Read: