It’s a common scenario that can surprise even the most passionate entrepreneurs: a business is booming with sales, the order books are full, and revenue figures look impressive. Yet, behind the scenes, there’s a quiet panic – bills are piling up, suppliers are waiting, and the bank account looks alarmingly low. This unsettling reality stems from a fundamental truth that many new businesses often overlook: sales don't equal solvency. In Dubai’s fast-paced market, understanding and proactively managing your cash flow isn't just good practice; it’s the absolute lifeblood of your venture.

This article will pull back the curtain on the critical distinction between revenue and cash flow, explore why cash flow is paramount, and equip you with essential strategies to manage it effectively, ensuring your new business not only survives but thrives.

Understanding the Fundamentals: Revenue vs. Cash Flow

Before diving into management, let's clarify these often-confused terms:

- Revenue: Simply put, revenue is the total money your business earns from selling its products or services over a period. If you sell an AED 1,000 service, that's AED 1,000 in revenue, regardless of whether the client has paid you yet. It's often called the "top line" because it sits at the very top of your income statement.

- Profit: This is what's left after you subtract all your expenses (costs of goods sold, operating expenses, etc.) from your revenue. You can have high revenue and still be unprofitable if your costs are too high. Profit is a measure of financial performance over time.

- Cash Flow: This is the actual movement of money in and out of your business's bank account. It tracks the liquidity – the real cash you have on hand to pay bills, invest, and operate. You can have high revenue and even be profitable on paper, but if customers haven't paid you (accounts receivable) or you’ve made large capital expenditures, your cash flow might be negative.

The crucial distinction lies in timing. Revenue is recognised when a sale occurs, but the cash might not hit your bank account for weeks or months. This gap can lead to a healthy profit-and-loss statement masking a severe cash shortage.

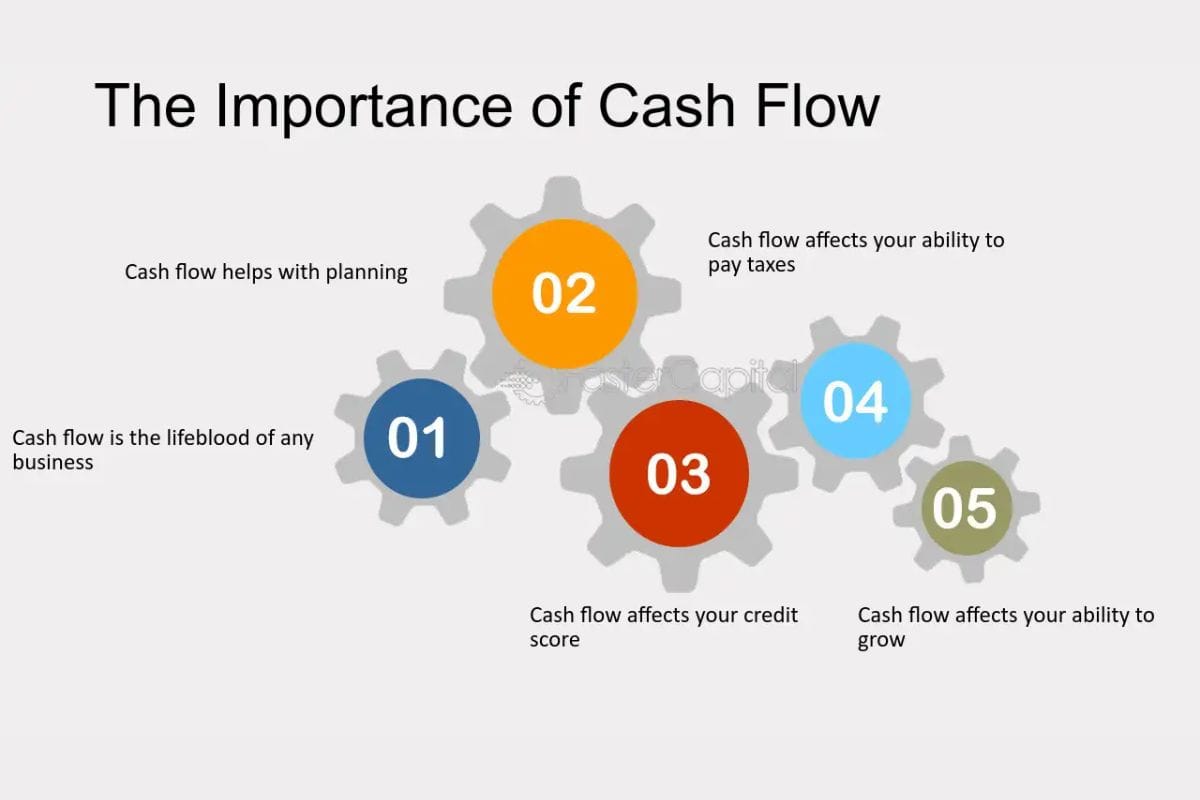

Why Cash Flow Reigns Supreme: The Lifeblood of Your Business

Cash flow isn't just another financial metric; it's the air your business breathes.

- Ensuring Solvency & Operations: Positive cash flow means you have enough actual money to meet your immediate financial obligations – paying salaries, covering rent, settling supplier invoices, and fulfilling daily operational needs. Without it, your business, regardless of its sales figures, faces the risk of insolvency.

- Fuelling Growth & Investment: Healthy cash flow provides the capital for reinvestment. Whether it's purchasing new equipment, expanding your team, launching a new product, or seizing market opportunities, robust cash reserves enable growth without relying solely on external financing.

- Building Resilience: Unexpected challenges are inevitable. A strong cash buffer acts as a vital safety net during economic downturns, unforeseen expenses, or periods of lower sales, allowing your business to weather storms without immediate panic or drastic measures.

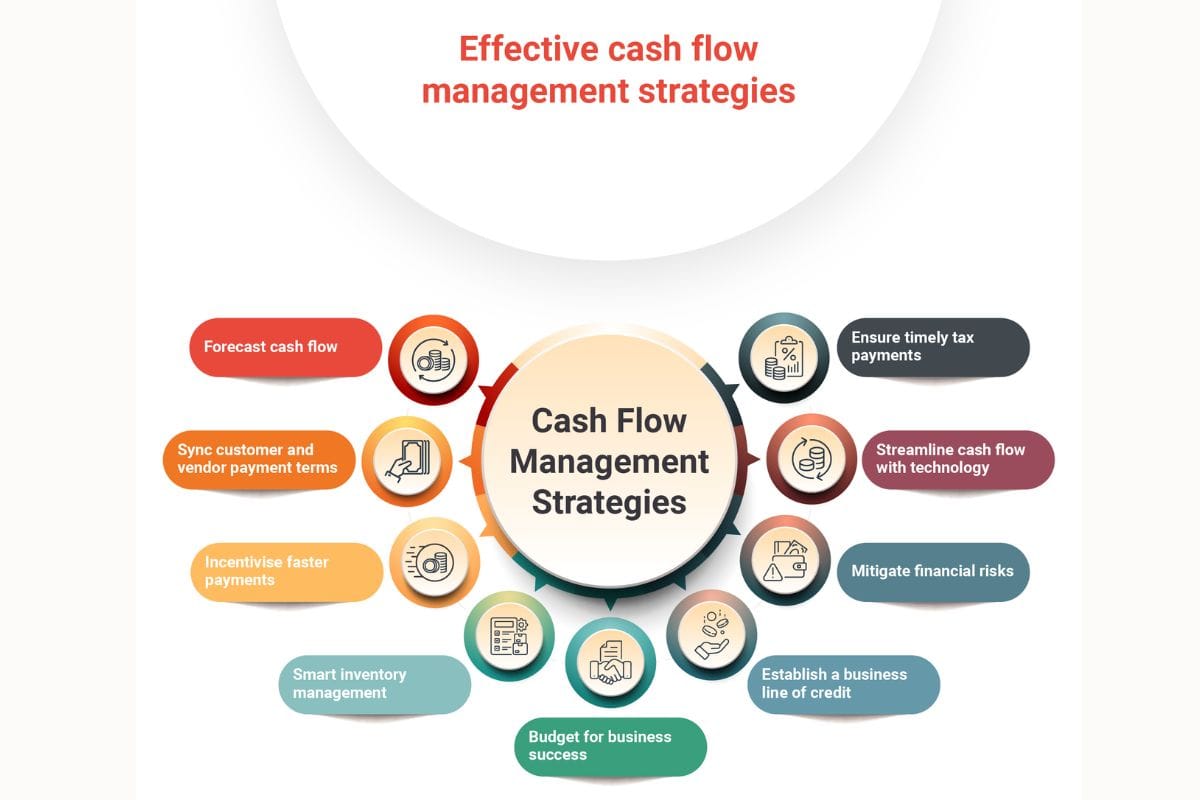

Mastering Cash Flow Management: Essential Strategies

Effective cash flow management is proactive, not reactive. Here are key strategies for new businesses in Dubai:

A. The "Provision Pocket" for Surprises

Think of this as your business's emergency fund. Just as individuals need savings for a rainy day, your business needs a dedicated reserve for unexpected events.

- How to Build It: Regularly set aside a percentage of your incoming cash, even during profitable periods, into a separate savings account. Aim for enough to cover 3-6 months of essential operating expenses.

- What It Covers: This fund protects you from unforeseen equipment breakdowns, sudden drops in client demand, delayed large payments, or urgent maintenance needs, preventing these surprises from crippling your daily operations.

B. Segregating Government Funds: VAT and Corporate Tax

This is a critical point, especially for businesses operating in Dubai with VAT and the upcoming Corporate Tax. The money you collect as VAT (Value Added Tax) or set aside for Corporate Tax (CT) provision is not your working capital. It belongs to the government.

- Best Practice: Open a separate bank account specifically for VAT collected from customers. Transfer the VAT portion of every payment received into this account immediately. Similarly, start provisioning for Corporate Tax from day one, setting aside a percentage of your taxable profit in a distinct fund.

- Consequences of Mixing: Treating these funds as disposable working capital is a common, dangerous mistake. When payment deadlines approach (quarterly for VAT, annually for CT), you'll face a sudden and significant cash shortage, potentially leading to penalties and severe liquidity issues.

C. Strategic Approach to Business Financing

While loans can fuel growth, using high-interest business loans to cover operational shortfalls is a slippery slope that can quickly escalate debt.

- Warning: Avoid high-interest loans, particularly short-term ones or those from less reputable lenders, to bridge temporary cash gaps. These can quickly eat into your profits and create a vicious cycle of debt.

- Alternatives: If you need financing, explore lower-interest options like traditional bank loans, lines of credit (when in good financial standing), or invoice factoring for immediate liquidity against outstanding invoices.

- Golden Rule: Debt should primarily be used for strategic investments that generate returns (e.g., expanding capacity, acquiring assets, funding R&D), not for paying everyday bills.

D. Optimize Accounts Receivable: Get Paid Faster

The faster you collect money owed to you, the healthier your cash flow.

- Clear Invoicing: Send professional, detailed invoices promptly with clear payment terms and due dates.

- Proactive Follow-ups: Don't wait until payment is overdue. Send polite reminders a few days before the due date.

- Early Payment Discounts: Consider offering a small discount for payments made within a very short timeframe (e.g., 2% discount for payment within 5 days).

- Digital Payment Options: Make it easy for clients to pay you through various digital channels.

E. Manage Accounts Payable: Pay Smarter

Just as you want to get paid faster, you should strategically manage your outgoing payments.

- Negotiate Terms: Try to negotiate longer payment terms with your suppliers (e.g., Net 30 or Net 60 days) without damaging relationships.

- Batch Payments: If possible, group smaller payments to reduce transaction fees or administrative time.

- Avoid Early Payments (Unless Discounted): Don't pay bills earlier than necessary unless there's a significant early payment discount. Keep your cash working for you longer.

F. Inventory & Expense Control

Every dirham tied up unnecessarily is a dirham not contributing to your cash flow.

- Lean Inventory: Avoid overstocking. Implement efficient inventory management to minimize holding costs and tie-up of capital.

- Expense Review: Regularly review all your expenses. Can you negotiate better deals with vendors? Are there subscriptions or services you no longer use? Cut unnecessary spending.

G. Forecasting and Budgeting

Forecasting is your crystal ball for cash flow.

- Create Cash Flow Projections: Develop a realistic projection of your expected cash inflows and outflows for the next 3, 6, and 12 months.

- Regularly Update: Review and update these forecasts frequently (weekly or monthly) based on actual performance and upcoming commitments. This helps identify potential shortfalls before they become crises.

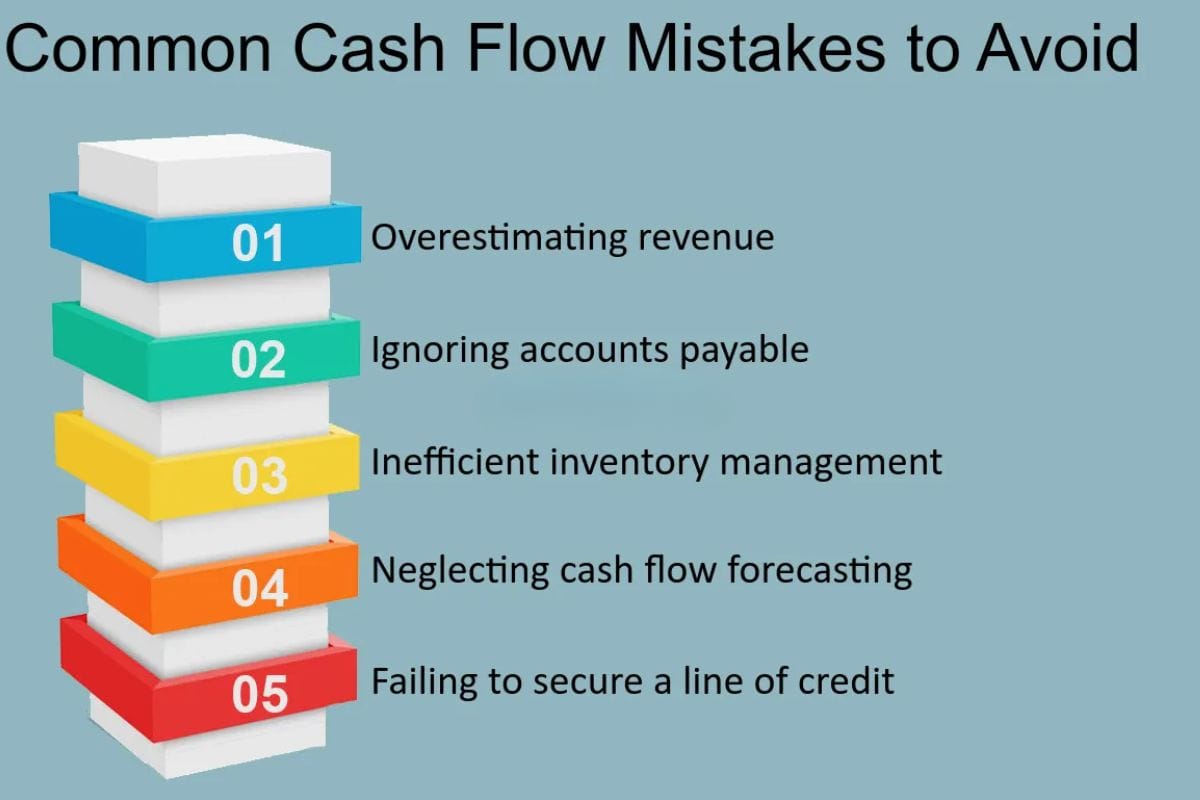

Common Cash Flow Pitfalls to Avoid

Even with the best intentions, new businesses can stumble. Watch out for these common missteps:

- Over-reliance on a Few Clients: Losing one major client can devastate your cash flow if you don't have diversified income streams.

- Ignoring the Cash Flow Statement: This often-overlooked financial statement provides the truest picture of your liquidity. Don't just focus on profit and loss.

- Uncontrolled Growth: Rapid growth can be a cash flow killer if not managed. You might need to pay for more inventory, staff, or equipment before the new revenue comes in.

- Underpricing Products/Services: If your prices don't adequately cover your costs and provide a healthy margin, your cash flow will suffer.

- Poor Credit Control: Extending credit without proper checks or lax collection policies can lead to significant amounts of cash being tied up in unpaid invoices.

Tools and Practices for Effective Management

You don't need a finance degree to manage cash flow effectively.

- Simple Spreadsheets: Start with basic spreadsheets to track all money in and out.

- Accounting Software: Invest in user-friendly accounting software (like Zoho Books, QuickBooks, or local options) that offers cash flow reports and forecasting features.

- Dedicated Cash Flow Apps: Explore specialized apps designed specifically for cash flow monitoring and forecasting.

- Regular Reviews: Make cash flow review a routine, perhaps a weekly 30-minute check-in, to stay on top of your financial health.

In Dubai's dynamic business environment, sales numbers might grab headlines, but it's robust cash flow that ensures your business's heartbeat. Understanding the crucial distinction between revenue and liquidity, and implementing smart management strategies, is non-negotiable for any new venture.

By diligently monitoring your inflows and outflows, creating provisions, responsibly handling government funds, and making informed financial decisions, you're not just making money – you're building a resilient, sustainable, and truly prosperous business in the heart of the UAE.

Also Read: