Dead inventory is the kind of problem that sneaks up quietly. These are the products that once held promise—fresh stock brought in with confident forecasts—but now sit unmoved for months on end, gathering dust on your shelves or warehouse racks. Typically, any item that remains unsold for over 6 to 12 months is considered dead stock. While every retailer expects a few slow movers, the real issue begins when this unsold inventory starts piling up unnoticed.

In a competitive and cost-sensitive market like the UAE, the consequences of ignoring dead inventory are sharper than in most regions. Why? Because retail and storage space here comes at a premium. A 2024 report by Savills noted that prime warehouse rents in Dubai are among the highest globally, averaging around US$20.48 per square foot—a hefty cost to pay for housing stock that doesn’t move. So, ask yourself: how much of your storage space is currently occupied by products that haven’t sold in a year?

So, what makes dead inventory so dangerous? It quietly drains capital, occupies expensive space, and limits your ability to bring in new, fast-selling stock. More importantly, it signals a deeper issue—something may be off with your forecasting, promotions, or procurement strategy. But clearing dead stock doesn’t mean scrambling for discounts or dumping items into bargain bins. Instead, it’s about making smart, calculated moves that recover costs, protect your brand, and improve future inventory decisions.

What’s your approach when faced with stock that refuses to sell? Do you slash prices? Bundle it away? Or let it sit, hoping for a surprise sale? The truth is, most retailers have no clear plan. This guide will help change that by showing how UAE businesses can spot dead inventory early, understand why it happens, and take smart steps to turn it into an opportunity, rather than a lingering loss.

How to Identify Dead Inventory Before It Drains You

Dead inventory rarely appears overnight—it builds up quietly, often escaping notice until it becomes a financial and storage burden. In the UAE, where space is costly and seasons drive rapid demand shifts, spotting slow-moving stock early is critical.

Inventory aging reports are a simple but powerful tool, helping retailers flag products unsold for 180 days or more. Combine this with turnover ratios—ideally above 4–10 times a year—to pinpoint which items are at risk. Modern POS and ERP systems also offer zero-movement alerts, which can automatically highlight idle stock after 60, 90, or 180 days.

Seasonal misfires, like unsold Ramadan collections or over-ordered winterwear, are common in the UAE’s event-driven retail cycle. That’s why proactive tools like Vin eRetail, Zoho Inventory, and Omniful.ai are gaining popularity—they provide real-time visibility, SKU-level tracking, and AI-powered forecasting.

By using these systems to monitor patterns, retailers can identify underperformers before they become losses, clearing space, saving costs, and keeping inventory efficient and relevant.

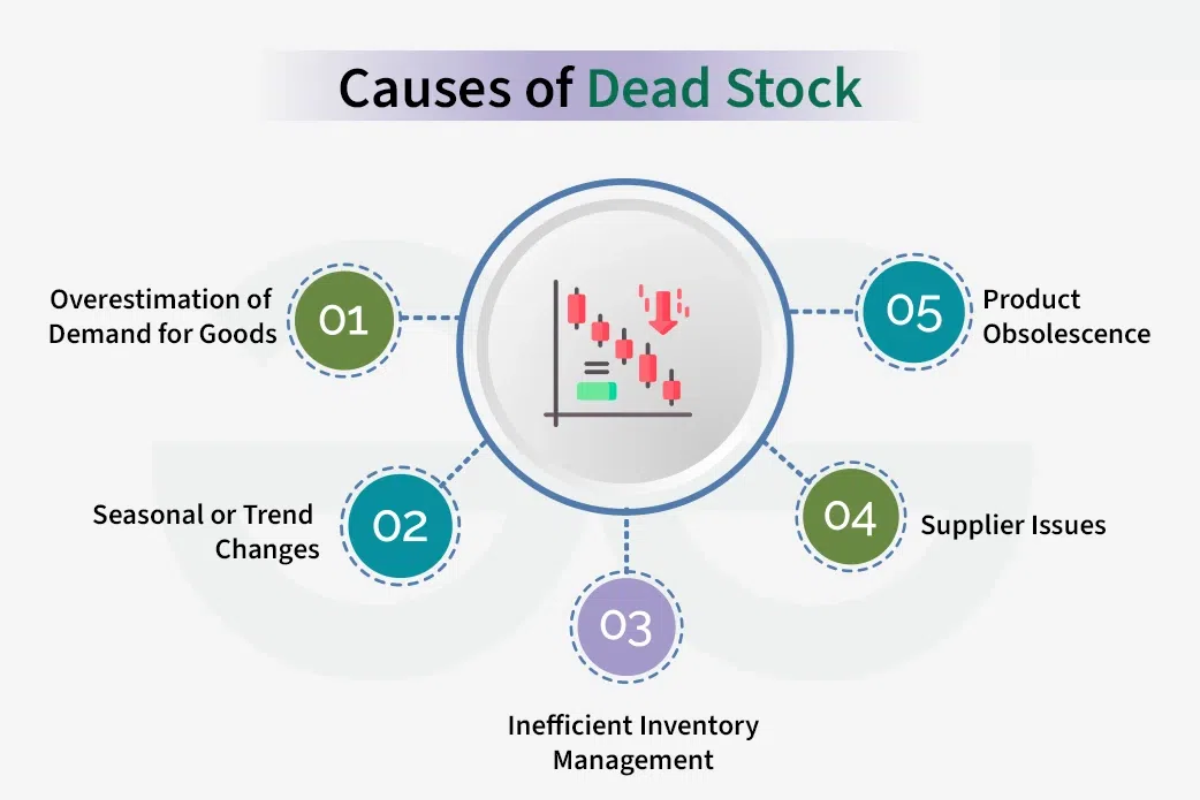

Understand the Why: Root Causes of Dead Stock in UAE Retail

Dead stock rarely happens overnight. Often, it stems from a chain of small missteps—each one seemingly minor until they accumulate into a financial burden. In the UAE, these issues hit harder due to fast-moving markets, cultural diversity, and high storage costs.

1. Poor Demand Forecasting in a Diverse, Expat‑Heavy Market

Relying on historical sales or gut instinct alone is risky. The UAE’s customer base is uniquely diverse, with expats from dozens of countries, each with distinct shopping behaviors and seasonal preferences. What sold well during last year’s Ramadan or National Day may not perform the same again.

Without predictive models that factor in shifting demographics and holiday cycles, misaligned forecasting becomes inevitable. Modern analytics systems—especially those using AI—have been shown to improve forecast accuracy by up to 40–50%, helping reduce obsolescence.

2. Overordering Due to Supplier Minimum Order Quantities (MOQs)

Suppliers often set MOQs to encourage high-volume buying, and retailers pursuing volume discounts can end up stocking more than actual demand warrants. While bulk deals might seem cost-efficient initially, unsold stock ties up capital and occupies warehouse space, in a market where rent can run to $20+ per square foot annually. Excess units that don’t sell become dead inventory faster than expected.

3. Ineffective Product Launches or Weak Marketing Support

A strong product needs visibility to sell. Without effective promotion—through seasonal campaigns, social media, or local influencers—even well-targeted products can stagnate. In the UAE’s visually driven retail landscape, a lack of hype or strategic rollout often leads to quiet failure. If launch timing, visual merchandising, or digital promotion don’t align, customers simply don't notice.

4. Failure to Adapt Fast Enough to Trends or Cultural Buying Shifts

When trend cycles accelerate—especially in categories like fashion, electronics, or décor—what’s hot today may be outdated tomorrow. In the UAE, where cultural festivals, expatriate preferences, and rapid trend adoption converge, being slow to pivot can make products obsolete almost overnight. Whether it's unexpected preference shifts in Ramadan gifting or trending colors in DSF displays, retailers must stay agile.

These root causes are rarely isolated—they often overlap. Poor demand forecasting leads to overordering, which is worsened when marketing support falls short, and trends change mid-cycle. Over time, these factors turn formerly promising stock into dead inventory that drains both capital and space.

Clear It Without Panic: Smart Moves to Eliminate Dead Inventory

Once you’ve identified the slow movers in your stockroom, the next step is to clear them out—but without harming your brand or resorting to desperate discounts. In the UAE’s retail environment, smart clearance is all about timing, positioning, and knowing where else your products can go. Here are practical strategies that actually work:

Targeted Flash Sales Aligned with UAE Holidays

- Leverage key seasons like Ramadan, Eid, back-to-school, and National Day, when customer spending is naturally higher.

- Run time-sensitive flash sales online or in-store with limited quantities to create urgency.

- Focus on clearance campaigns that align with how shoppers buy during local holidays, especially in the evening or post-iftar hours.

Bundles & Cross-Sells with Fast-Moving Products

- Pair slow-moving stock with bestsellers to create attractive value packs.

- Use combo deals or gift bundles that tie older items into currently trending ones.

- This helps reduce old stock without deep markdowns, while increasing the average basket size.

Offer B2B Bulk Discounts to Service Businesses

- Sell excess stock in bulk to local hotels, cafés, salons, or event companies who can use the products for giveaways, internal use, or seasonal demand.

- Offer volume-based discounts or discreet direct-to-business deals that help you offload units quickly without hurting your retail price structure.

Move to Other Channels

- List old stock on marketplaces like Amazon.ae or Noon to reach a wider audience beyond your main customer base.

- Create a clearance section on your own website to attract deal-seekers and clear aging items more discreetly.

- Consider pop-ups or weekend stalls at community events where dead stock can find new buyers.

Use WhatsApp or Instagram Stories to Create Urgency

- Promote limited-time deals through WhatsApp broadcasts or Instagram Stories to get direct attention.

- Use countdowns, polls, or "only 10 left" messaging to encourage quick buying decisions.

- These platforms are highly responsive in the UAE and work especially well for exclusive or last-call items.

Partner with Liquidation Firms in the UAE

- If stock remains unsold after multiple strategies, work with local liquidation or clearance companies who purchase dead stock in bulk.

- This allows you to recover part of the cost, free up warehouse space, and move on from stagnant inventory without affecting brand perception.

Smart clearance is not about giving up—it’s about choosing your exit paths wisely. In the UAE, where seasonal spending surges, diverse customer behavior, and mobile-first marketing are the norm, these strategies give your old inventory a second life while keeping your business moving forward.

Don’t Let It Pile Again: Long-Term Prevention Tactics

To shift from reaction to resilience, following a clearance phase, UAE retailers must build systems that stop dead stock before it forms. Here are proactive strategies grounded in proven best practices:

Align Procurement with Seasonal Trends and Sales Forecasts

- Use historical data, holiday calendars (Ramadan, Eid, DSF, back-to-school), and seasonal indices to predict inventory needs accurately.

- Employ predictive demand forecasting (often AI-powered) to anticipate SKU-level peaks and troughs.

- Adjust purchase volumes based on expected local events and avoid over-ordering for low-demand periods.

Switch to Just-in-Time (JIT) Ordering When Storage Is Limited

- Adopt JIT as a lean strategy: order only what’s needed, just before demand materializes.

- This reduces holding costs significantly and avoids tying up capital in slow-moving goods.

- Requires reliable supplier relationships and accurate lead-time tracking.

Adopt a 90/180/360-Day Review System

- Institute a cadence: review stock that hasn’t sold in 90, 180, or 360 days.

- At each threshold, decide: keep, markdown, bundle, transfer, or liquidate.

- Cycle this review monthly or quarterly to ensure no SKU lingers past its usefulness.

Set Auto-Discount Triggers in Your POS or ERP

- Create rules: if a SKU hasn’t sold in 90 days, auto-apply small discounts or highlight it for promotional bundles.

- Automating markdowns prevents slow stock from accumulating unnoticed.

- Tie thresholds to your review system so alerts and actions happen in sync.

Run Monthly “Stock Clean-Up Day” for Physical Verification and Markdown Planning

- Dedicate time each month for physical audits, matching system data to actual shelf and warehouse stock.

- Use the audit to flag discrepancies and plan markdowns or reassignments on the spot.

- Involve merchandising, inventory, and marketing teams to align clearance efforts with promotional campaigns.

Why These Tactics Work—Especially in the UAE Context

- UAE retailers face tight margins due to high warehousing costs (often over USD 20 per square foot) and limited buffer space, all making lean inventory vital.

- Seasonal demand in the UAE is intense yet short-lived; goods must arrive before key shopping events or risk becoming obsolete post-season.

- Using time-based reviews and tiered automatic actions ensures your inventory stays dynamic, freeing space and preserving capital before slow stock becomes dead stock.

By embedding these systems into your routine, you transform inventory from reactive backlog into controlled, actionable assets, keeping your shelves fresh and profits protected.

Smart Tactics That Actually Work

- Set automated “aging alerts” in your inventory system to flag items after 60, 90, or 180 days of no movement.

- Offer old stock as loyalty rewards or free gifts with minimum purchase thresholds.

- Partner with subscription box companies in the UAE to include slow-moving stock as added value.

- Create exclusive “staff-only flash sales” to move stock internally or through employee networks.

- Use geotargeted Instagram or Snapchat ads to push clearance items to users within 5 km of your store.

- Rent micro-shelves in shared concept stores or weekend flea markets to showcase older items.

- Bundle old inventory as part of Ramadan or Eid gifting hampers with curated packaging.

- Set up a “secret sale” WhatsApp group where regular customers get early access to marked-down stock.

- Offer bundle deals with a QR code at checkout that applies a hidden discount on older SKUs.

- Exchange slow stock with non-competing retailers in similar categories to refresh shelf presence.

Build Internal Systems to Manage Inventory Better

Managing inventory effectively starts with building internal habits and systems that spot problems early, long before stock becomes dead weight.

Begin by training your staff to recognize aging stock. Equip teams on the ground with simple criteria—like SKUs that haven’t sold in 90 days—and make it part of regular stock checks to flag items at risk. This encourages faster internal decisions and prevents stagnation from going unnoticed.

Invest in dashboards that visualize problem areas. Platforms like Zoho Inventory or Oracle NetSuite provide real-time insights into aging SKUs, stock velocity, and low-turn items. These visuals make it easier to act quickly without digging through complex reports.

Move away from gut-based reordering and automate based on actual performance. Use your system’s data to trigger replenishment only when needed, and scale down orders for products with slowing movement. This protects cash flow and keeps shelf space efficient.

In Dubai’s high-cost retail environment, where warehousing can exceed USD 20 per square foot, it makes sense to relocate slow stock to off-site or third-party storage, especially in lower-cost emirates like Sharjah. This keeps your primary space clear for faster-selling, high-margin products.

With the right mix of trained staff, smart tools, and automated rules, you create an ecosystem where inventory is monitored, managed, and optimized, reducing the risk of dead stock piling up unnoticed.

Dead stock isn’t a sign of failure—it’s a chance to make smarter decisions moving forward. For UAE retailers, where space, timing, and margins matter more than ever, tackling dead inventory strategically can lead to better forecasting, leaner operations, and more agile supply chains. Instead of treating it as leftover stock to offload, see it as insight into what your business truly needs—and what it doesn’t.

Also read: