Residents have to pay 5% import customs duty and 5% value-added tax (VAT).

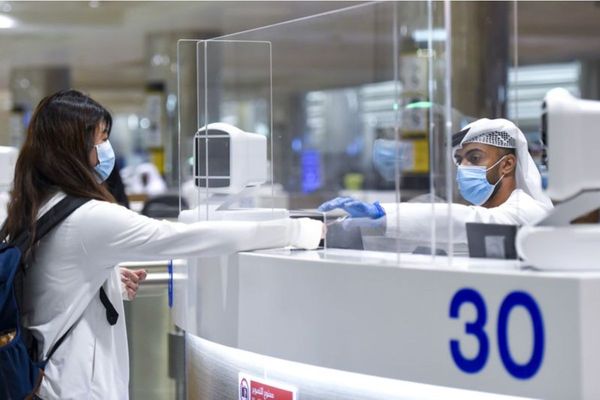

Dubai has introduced new customs duty on goods bought internationally with a value of more than Dh300.

“Customs duty rate has been set at five per cent of the goods if their value exceeds Dh300, except where a rate of zero per cent exemption applies according to the Unified Customs Tariff for the GCC States of 2022,”

said Abdelhak Attalah, partner, maritime and international trade practice, Galadari Advocates and Legal Consultants.

This means residents shopping internationally with a value of over Dh300 will have to pay five per cent import customs duty and five per cent value-added tax (VAT).

Attalah further added that tobacco, tobacco products, e-cigarettes and vaping liquids are subject to a higher customs duty at the rate of 200 per cent in addition to the “sin tax” which is applied also to sugary drinks.

According to a notice from Dubai Customs – Notice No.5 of 2022, this new customs duty and customs clearance law came into effect on January 1, 2023.

However, goods imported with a value of less than Dh300 will be exempted from customs duties. But tobacco, tobacco products, e-cigarettes, nicotine liquid, alcoholic beverages and foods containing alcohol are excluded from the exemption of customs duties.

In 2017, the UAE introduced an excise tax on products that are harmful to human health such as carbonated drinks, energy drinks, tobacco and tobacco products. Later on, the excise tax scope was expanded to e-smoking devices and tools, liquids used in such devices and sweetened drinks.

News Source: Khaleej Times