City is now fourth busiest market for luxury homes in the world.

The prime residential neighbourhoods of the Palm Jumeirah, Emirates Hills and Jumeirah Bay Island continue to dominate luxury home sales.

Dubai recorded 88 home sales above $10m hit Dh6 billion during the first quarter, according to the latest analysis carried out by global property consultant Knight Frank.

Knight Frank’s analysis also shows that the city’s prime residential neighbourhoods of the Palm Jumeirah, Emirates Hills and Jumeirah Bay Island continue to dominate luxury home sales, with average transacted prices in these highly sought-after locations for US10 million homes reaching Dh8,800 per square foot during the first quarter. Other locations in the city are however also fast rising prime status too.

Faisal Durrani, Partner – Head of Middle East Research said:

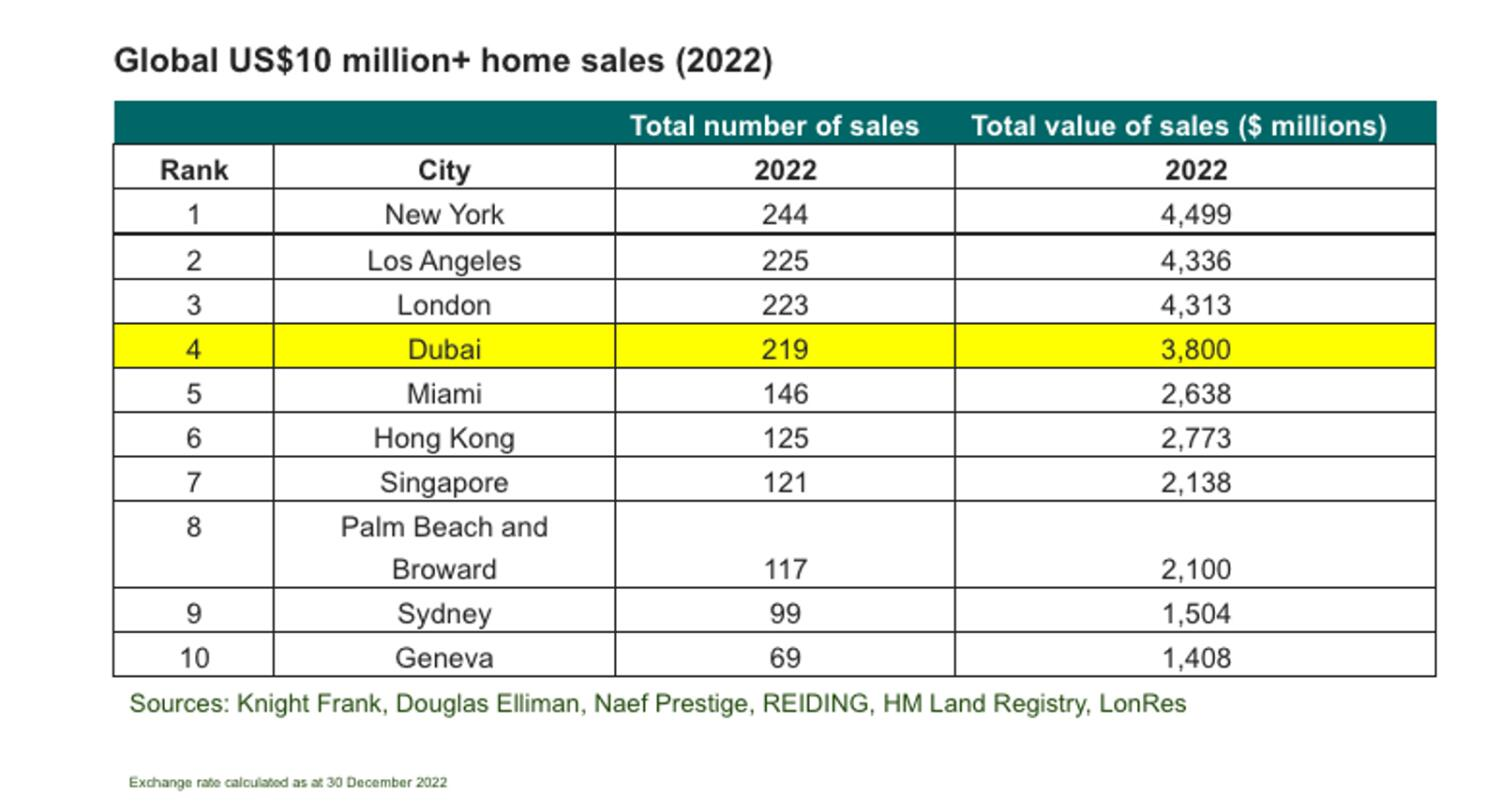

“The $10 million plus homes market in Dubai continues to strengthen, with 88 sales being registered in Q1 alone. 2022 saw Dubai record 219 deals above this price point, positioning the city as the fourth busiest luxury homes market in the world. 2023 is shaping up to be another record year for this segment of the market.

“The depth of demand for homes at this price point from local and international UHNWI [ultra high networth individuals] is helping to drive up prices in this exclusive segment of the market. Indeed, Q1 has seen average transacted prices for $10 million plus homes reach Dh7,235 per square foot, which represents a 16 per cent increase on 2022’s Dh6,250 per square foot.”

While Dubai’s prime neighbourhoods of the Palm Jumeirah, Jumeirah Bay Island and Emirates Hills accounted for 64 per cent of $10 million home sales during Q1, other areas are also growing in prominence and are likely to be classed as ‘prime’ if they continue to entrench themselves as high-end neighbourhoods, the Knight Frank study shows. The Al Wasl-Dubai Canal corridor is one such area, with branded residential sales contributing to its emergence as a hotspot for UHNWI who are focused on securing the most expensive homes in the emirate’s most desirable neighbourhoods.

Andrew Cummings, Partner – Head of Prime Residential Sales, added:

“Tilal Al Ghaf is the other location that has quickly joined the growing list of ultra-lux neighbourhoods in Dubai. Last year, three homes here sold for over Dh90 million and during Q1, seven villas transacted for over $ 10 million, strongly suggesting that Tilal Al Ghaf will soon meet our definition for a prime neighbourhood.

“While the bulk of international UHNWI looking at Dubai are drawn to acquiring second homes on the coast, Tilal Al Ghaf has set a new benchmark for luxury living as an inland community that delivers on quality and amenities. The shortage of completed waterfront communities and the lack of developments sites that can be easily activated suggests that such inland communities will continue to grow in prominence.”

Outlook for Dubai’s prime market

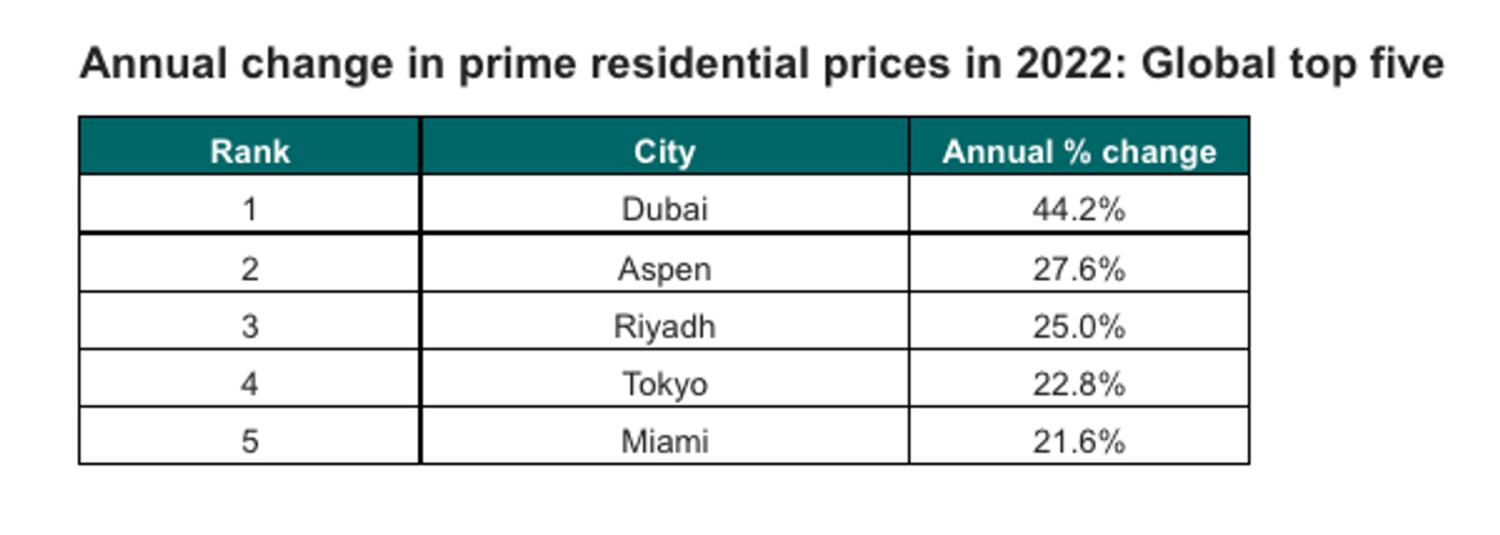

Dubai’s prime residential market registered a price growth of 44 per cent during 2022, emerging as the world’s fastest growing luxury market. Knight Frank forecasts that prime residential values in Dubai will rise by 13.5 per cent, positioning the city as the fastest growing residential market for the second year running.

However, with $1 million securing 1,130 square feet in any of Dubai’s three prime neighbourhoods, the city is the 16th most “affordable luxury” market in the world. Effectively, this means $1 million buys three-times more prime residential space than cities like London, New York, or Singapore.

“With a shortage of prime developments under construction and no slowdown in the relentless UHNWI demand for luxury second homes in Dubai, the upward trajectory for prime prices is likely to be sustained,”

Durrani said.

News Source: Khaleej Times