McKinsey & Company's report says MENAP fintech ecosystem is becoming geographically more diverse.

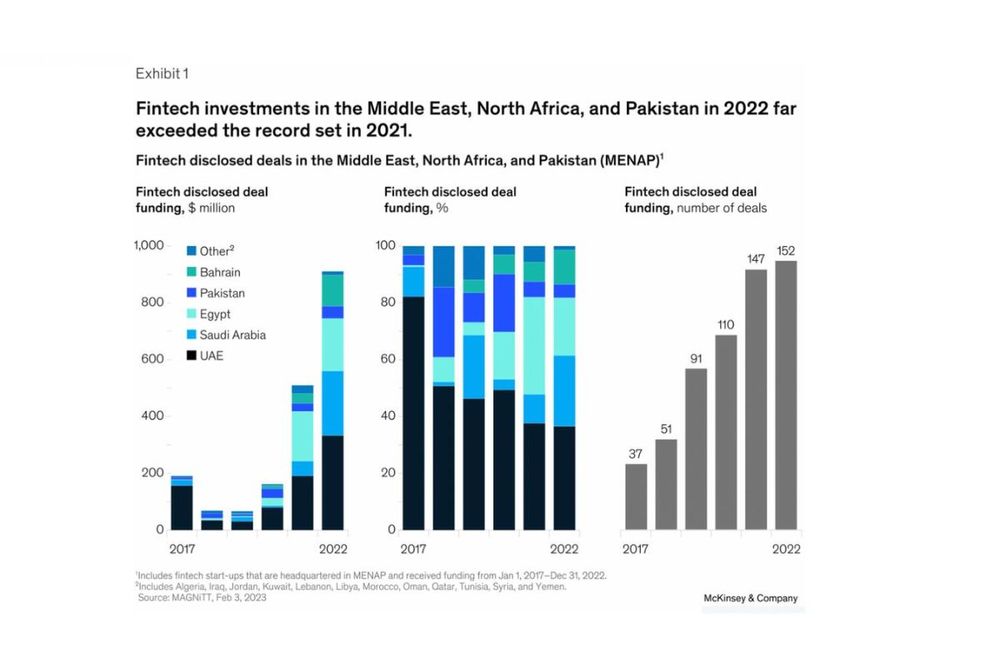

The Fintech sector in the Middle East, North Africa, and Pakistan (MENAP) is experiencing robust growth, driven by evolving licensing regimes and increased investor funding, which increased by approximately 36 percent annually from 2017 to 2022, according to a report by McKinsey & Company.

Based on the data from our recent report — Fintech in MENAP: A solid foundation for growth, investor funding for MENAP fintech start-ups quadrupled from approximately $200 million in 2020 to $885 million in 2022.

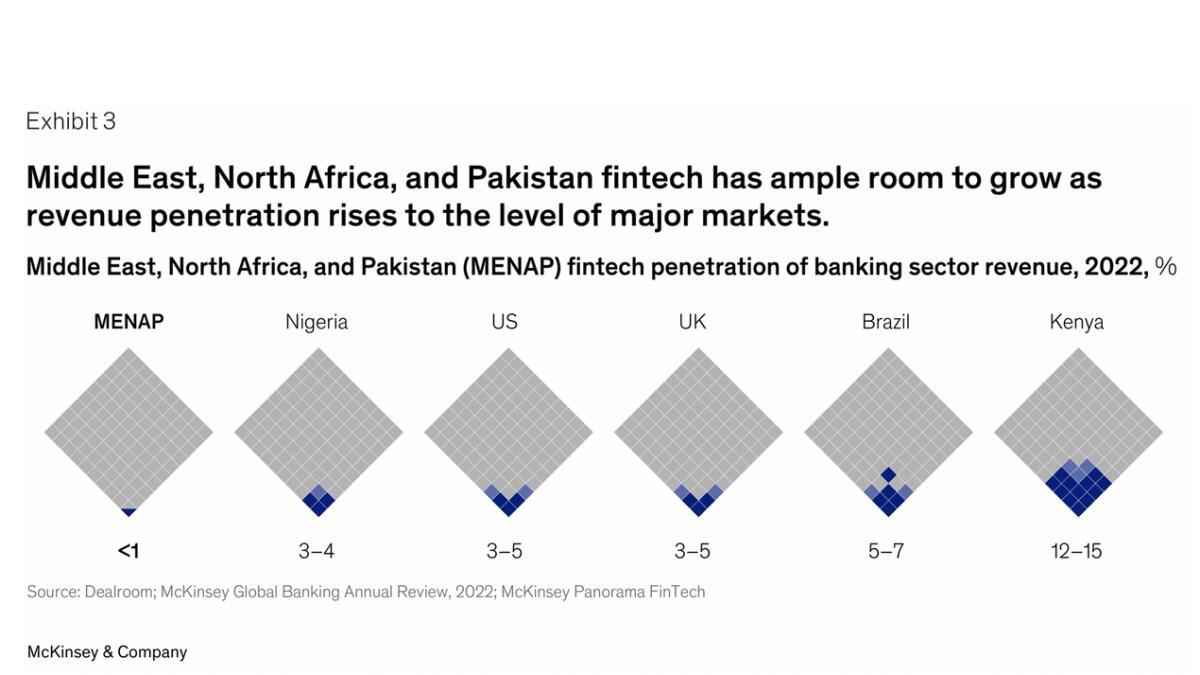

Despite global market fluctuations in 2022, MENAP fintechs continue to expand, emphasizing profitability. MENAP fintech revenue is projected to almost triple from $1.5 billion in 2022 to between $3.5 billion to $4.5 billion by 2025, according to the report.

The MENAP fintech ecosystem is becoming geographically more diverse with the UAE attracting 37 percent of funding in 2022 followed by Saudi Arabia (25 percent), Egypt (20 percent), Bahrain (12 percent), and Pakistan (5 percent).

Many founders operate in multiple markets, emphasizing the importance of a multicountry strategy for growth and resilience.

Moreover, MENAP fintechs offer a broad range of fintech services and have expanded beyond basic offerings like mobile wallets, with a focus on both B2C and B2B use cases. Examples include buy-now, pay-later (BNPL) services, working capital finance, insurtech, digital investment platforms, and open-banking solutions.

The diversity of actors including homegrown fintech start-ups, established international fintech firms, banks, nonbank financial institutions, and cross-sector fintech firms in the MENAP fintech ecosystem increase the sector's resilience and innovation opportunities.

While incumbents and start-ups compete to win market share, in recent years they have also collaborated through licencing agreements, equity stakes, and acquisitions to address customer pain points and strengthen customer loyalty.

While global fintech valuations declined in 2022, losing more than 55 percent off their peak in 2021, MENAP's strong economic fundamentals and banking sector growth support a positive outlook. Economic growth in the region is expected to outperform other global regions, with strong investor confidence in the banking sector.

MENAP fintech revenue is projected to reach two percent to 2.5 percent of total financial services revenue by 2025, with the potential for further growth. Considering the number of fast-growing MENAP start-ups with valuations approaching $150 million, as well as several already exceeding $250 million in market value, the emergence of four to six new fintech unicorns is anticipated by 2025 in the region.

Four building blocks are essential for the growth and value creation of the MENAP fintech sector: capital injections, regulatory and market harmonization, technical and leadership talent, and strategic partnerships.

First, an estimated $5 billion to $7 billion in funding is needed over the next three years to support the sector as start-ups mature and scale across the region. Second, regulatory, and legal harmonization and uniform standards for APIs are crucial for scalability according to founders operating in multiple markets across the region. Third, the region must address talent shortages, develop localized skills, and promote gender diversity in leadership positions.

Finally, new approaches to collaboration and co-creation beyond traditional joint ventures and mergers/acquisitions between incumbents and start-ups can enhance value propositions and meet customer expectations.

Just as fintech companies have spurred growth in the UAE and the United Kingdom, the MENAP fintech sector is beginning to make its mark on the region’s financial services landscape, seeking to broaden financial inclusion, increase customer choice, lower costs, strengthen resilience and security, and more.

News Source: Khaleej Times