Buy-now-pay-later (BNPL) apps provide options for shoppers to purchase items and pay in installments over short periods. In the UAE, these apps gain traction among consumers who seek flexible payment methods. Retailers integrate BNPL to meet this demand, which alters how sales occur.

The market for BNPL in the UAE stands at about $1.17 billion in 2025 and reaches $1.47 billion in 2026, with annual growth of 25.4 percent. This expansion reflects broader shifts in retail, where digital tools influence buying habits. Founders observe these changes to refine their approaches in fintech and retail spaces.

This article explores the mechanics of BNPL in UAE retail, its effects on business operations, and practical insights for those starting or scaling similar ventures.

The Rise of BNPL in the UAE

BNPL services allow payments in installments, often without interest for short terms like four parts over six weeks. Users apply through apps at checkout, online, or in-store, and receive quick approvals based on basic checks. In the UAE, high smartphone penetration of over 99 percent, and e-commerce valued at $9.2 billion in 2026, support this model. Consumers, especially millennials and Gen Z, who make up over 45 percent of users, prefer these options for managing cash flow.

The Central Bank of the UAE (CBUAE) oversees BNPL as short-term credit under its Finance Companies Regulation. Providers must hold licenses, follow know your customer rules, and report data to credit bureaus like the Al Etihad Credit Bureau. This setup builds trust and encourages wider adoption. BNPL transactions now occur in diverse sectors, from fashion to healthcare, as apps partner with merchants.

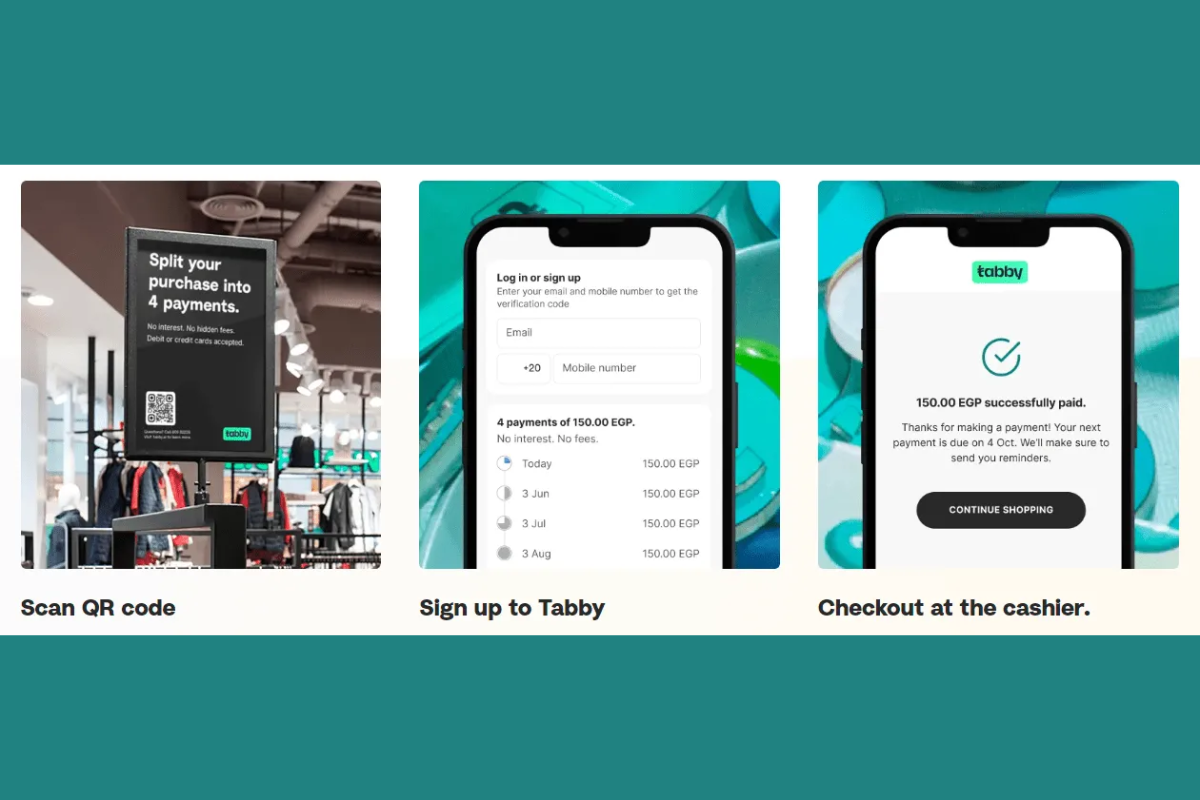

E-commerce drives much of the activity, with online channels holding about 70.85 percent market share in 2025. Platforms like Noon and Amazon.ae embed BNPL at checkout, using one-click integrations. In-store use grows through QR codes and point-of-sale terminals, especially in malls where luxury retail thrives. Tourist inflows, reaching 17.15 million in 2024, boost this trend as visitors opt for installments on high-value items.

Key BNPL Providers Operating in the UAE

Several apps lead the BNPL space in the UAE. Tabby offers interest-free plans in four installments, partnering with retailers like Noon and mall operators. It focuses on seamless integrations and has expanded through alliances with payment gateways like Checkout.com. Tamara provides Sharia-compliant options, securing $2.4 billion in funding in 2025 to grow its fintech offerings. It collaborates with Mastercard for virtual cards that split payments.

Spotii enables payments in four parts over two months, targeting fashion and lifestyle sectors. Cashew emphasizes secure, interest-free installments with merchant analytics to improve sales. Postpay partners with banks like the Commercial Bank of Dubai to broaden its reach. These providers hold significant shares, with fintechs accounting for 67.7 percent of transaction volume in 2024.

Banks enter the fray by offering BNPL through existing credit limits or APIs. This mix creates a competitive environment where apps differentiate via features like quick approvals and data-driven risk assessments. Providers also adapt to local preferences, such as Sharia compliance, to attract expatriates and residents.

Shifts in Consumer Behavior Due to BNPL

Shoppers in the UAE often use BNPL to handle both daily needs and bigger buys. A resident in Dubai might split the cost of groceries or school supplies when cash is tight mid-month, making it easier to cover rent and utilities without stress. This helps many keep their household spending on track, especially with salaries paid at month-end.

This flexibility leads shoppers to add more items to their carts. Families in Abu Dhabi frequently include extra home essentials or small appliances during online browsing, as installments spread the total amount comfortably. Merchants see basket sizes grow by 30 to 50 percent when BNPL shows up at checkout, turning hesitant browsers into completed buyers.

Fashion stands out as a key area, particularly among women updating wardrobes for occasions like family gatherings or work events. A professional in Sharjah could pick outfits from local labels on apps like Noon, paying over weeks to match her income flow. The affordable luxury segment in fashion has seen strong uptake, with many viewing installments as a practical way to access better quality pieces.

Electronics follow a similar path, where people upgrade phones or laptops without saving up the full price first. In malls or online, a buyer in Dubai might choose a new device during sales, knowing the payments align with their budget. This category captures high volumes, as BNPL opens access to premium models for everyday users.

Apps succeed when they keep things clear and simple. Users like seeing exact due dates in notifications and having all payments listed in one dashboard, which builds trust and encourages ongoing use.

Retailers observe that customers come back more often to places offering BNPL. Someone who bought shoes with installments might return for matching accessories, linking the store to a smooth experience. This habit grows as people check for the option before heading to spots like Dubai Mall.

Data from past buys lets stores send targeted suggestions. A customer who purchased a gadget could get offers for related items like cases or chargers, making promotions feel relevant and timely. This approach helps strengthen ongoing relationships with shoppers.

Impact on Retail Operations

Retailers in the UAE make targeted adjustments to bring BNPL into their daily operations. Online stores add simple widgets or one-click buttons at checkout for instant approvals, which helps turn more visitors into buyers. Many platforms report that this setup lifts completion rates noticeably, often in the range of 15 to 30 percent, as shoppers face less hesitation over the full price upfront.

In physical locations, retailers install updated point-of-sale terminals or use QR codes that link directly to BNPL apps. This setup works well for both residents and the large number of tourists who visit malls in Dubai and Abu Dhabi. Visitors can complete high-value buys without immediate full payment, aligning with their travel budgets and currency preferences.

Furniture outlets see clear shifts from this approach. Pan Home, a prominent retailer, notes that around 30 percent of its orders now come through BNPL. Customers feel comfortable selecting larger pieces or full room sets, leading to sales that might otherwise stay smaller or get delayed.

Luxury brands apply similar tactics in their boutiques. Cartier and comparable names integrate BNPL at in-store counters, drawing in tourist traffic. Average transaction amounts in these settings often climb by up to 40 percent, as flexible options ease concerns over exchange rates or card limits for international shoppers.

Merchants collect direct transaction details through these integrations. This first-party information supports sharper decisions on stock levels, helping avoid overstocking slow items or shortages during peak seasons like shopping festivals. Teams use the data to forecast demand more accurately across categories.

Marketing efforts gain from the same insights. Retailers craft personalized messages or promotions based on what BNPL users have bought before, such as suggesting matching accessories after a main purchase. Co-branded campaigns with providers like Tabby or Tamara split promotion costs while exposing the store to broader audiences through app notifications or partner channels.

Steady purchasing patterns from BNPL users create more predictable flows for supply chains. Retailers adjust ordering and warehousing to match consistent demand rather than sharp spikes, reducing waste and improving turnaround times with suppliers.

Overall, BNPL becomes embedded as a core part of how stores operate, shifting payment from a backend process to an active driver of sales and customer connections.

Challenges in the BNPL Landscape

Missed payments remain a key issue. Late installments trigger fees that accumulate, and prolonged non-payment can lead to court action. In the UAE, unresolved debts sometimes result in travel bans under civil procedures until settlement. Providers counter this by improving credit checks—many now use AI models that pull from transaction history, repayment behavior, and Al Etihad Credit Bureau data to approve users more precisely and keep defaults controlled.

Merchant fees add pressure. Rates usually range from 2.5 percent to 7 percent per transaction (Tabby often 2.79–5.99 percent, Tamara around 2.5–6 percent), higher than typical card fees. Retailers in thin-margin sectors like fashion or electronics negotiate hard or set minimum order values (e.g., AED 300 on some platforms) to offset costs. Smaller BNPL apps struggle most here, as they cannot match the pricing power of larger players.

Banks intensify competition. They integrate installment options into credit cards, apps, or existing limits, often at lower merchant costs. Forecasts show banks capturing BNPL share faster than pure fintechs in some segments, supported by customer trust, capital strength, and regulatory alignment. Fintechs respond with deeper ties to gateways (e.g., Tabby with Checkout.com, Tamara with Mastercard) to expand reach, though this squeezes margins further in a volume-driven business.

Data privacy demands careful handling. UAE laws—Federal Decree-Law No. (45) of 2021 and CBUAE rules—require strong encryption, clear consent, and secure sharing with credit bureaus. Any lapse risks fines or reputational damage, so providers invest in audits and compliance systems.

Tourism fluctuations affect volumes. High-value luxury and travel spending in Dubai and Abu Dhabi relies heavily on visitors, and any drop (seasonal or external) reduces in-store BNPL use. Providers diversify into steadier areas like healthcare, education, and local services, while analytics help predict shifts and adjust risk settings.

These challenges require balanced management. Providers focus on risk tools, cost control, partnerships, and compliance to sustain growth in a maturing market.

What Founders Can Learn from BNPL Successes

Founders building BNPL or related fintech in the UAE can apply these practical lessons from Tabby and Tamara:

- Prioritize merchant partnerships early

Tabby integrated directly with Noon, SHEIN, Adidas, IKEA, and thousands of others from day one → easier checkout → higher order values & conversions → more users → more merchants (network flywheel). - Treat BNPL as commerce infrastructure, not just lending

Focus on merchant value (increased sales, lower cart abandonment) to drive rapid ecosystem growth—online first, then in-store via POS and QR. - Embed cultural & regulatory fit from the start

Tamara secured a CBUAE full restricted license (Oct 2025) and built Sharia-compliant models (no interest, asset-linked, independent board review) to appeal to ethical preferences and gain trust. - Navigate regulation proactively

Secure licenses/partnerships early, integrate with Al Etihad Credit Bureau, respect debt/fee caps, and implement strong KYC → avoids delays and builds credibility with regulators, merchants, and users. - Leverage strategic partnerships for fast scale

Tabby → Checkout.com, MoneyHash; Tamara → Mastercard virtual cards → expand reach and use cases without building everything alone. Target gateways, banks, and platforms like Amazon.ae or Noon. - Invest in tech & data from the beginning

Use AI credit scoring (transaction patterns + bureau data) for fast, accurate approvals. Build mobile-first apps with clear dashboards, due-date alerts, and budgeting tools to promote responsible use and retention. - Start small, test, and iterate

Pilot in free zones or one city/sector (e.g., fashion), then expand country-by-country or into healthcare/automotive based on real feedback. - Secure appropriate funding for infrastructure

Use equity for tech, AI, compliance, and acquisitions (e.g., Tabby’s Tweeq deal); use debt for lending pools and product expansion (e.g., Tamara’s $2.4B Sharia facilities in 2025). - Listen to users continuously

Add bilingual support, event promotions, and UX improvements based on feedback to maintain strong adoption in a competitive landscape (including bank card-linked installments).

Providers are expanding beyond consumer retail into B2B financing for bulk purchases and subscription models for recurring services such as software, fitness, or education. AI continues to improve credit scoring by analyzing transaction patterns and alternative data, enabling faster approvals while keeping defaults in check. Omnichannel setups—linking online widgets, in-store terminals, and mobile apps—are becoming standard, allowing seamless use across Dubai’s mixed online-offline retail environment.

Regulations are likely to evolve with possible refinements to debt caps, fee limits, and responsible lending rules as the CBUAE maintains close oversight. Banks will capture more share by embedding installments in existing cards and apps, increasing competition but also raising industry standards. Cross-border usage with GCC neighbors should rise through shared payment systems, boosting volumes for regional players like Tabby and Tamara.

Retailers are investing in deeper BNPL integrations, custom analytics, and co-branded promotions to maintain a competitive edge, especially during high-traffic events like shopping festivals.

In summary, BNPL has become a core part of UAE retail, enabling flexible payments that lift sales, increase basket sizes, and strengthen customer loyalty. Providers and merchants adapt by navigating regulations, managing risks, and expanding into new sectors. Founders entering this space succeed by prioritizing early compliance, strong merchant partnerships, robust data and AI tools, and user-focused design.

As the market matures toward a multi-billion-dollar scale in the early 2030s, consistent execution—balancing innovation with responsibility—will support steady, sustainable progress for businesses and consumers alike.

Also read: