While the revenue from a UAE government contract is significant, the real value for an SME lies in the professional prestige it confers.

In 2026, the government’s "Digital-First" procurement initiative has become the standard, making it easier, in theory, for small businesses to compete. In practice, however, registration is only the first step. To secure a place on the approved vendor list, businesses must now demonstrate a clear commitment to the UAE’s national vision, from sustainability metrics to ICV compliance.

This guide outlines the essential steps to meeting these modern requirements and securing your status as a government partner.

Understanding the Two-Tiered Gateway System

Before beginning your registration journey, you must understand a critical structural reality: there isn't just one "government vendor list" in the UAE. Depending on which government entities you want to serve, you must register on different platforms at different levels.

Federal Level Registration (Ministry of Finance)

If your goal is to provide services to federal entities—such as the Ministry of Education, Ministry of Health, Federal Authority for Identity and Citizenship, or any other federal ministry or independent authority—you must register on the Federal Supplier Register via the Ministry of Finance (MoF) portal.

The Platform: The Ministry of Finance operates the "Digital Procurement" platform, often referred to as the "Haji" portal in its evolved 2026 version. This system has undergone significant digital transformation in recent years, streamlining what was once a fragmented process.

The Goal: Registration here makes your company visible to all UAE federal ministries and independent federal authorities when they issue tenders, request quotations, or conduct supplier evaluations.

Strategic Consideration: Federal contracts often involve larger budgets and longer-term engagements, but they also typically require more extensive compliance documentation and longer approval cycles.

Local Level Registration (Dubai Government)

If your target market is Dubai-specific government entities—such as Dubai Electricity and Water Authority (DEWA), Roads and Transport Authority (RTA), Dubai Municipality, or any of the dozens of Dubai government departments—the gatekeeper is Dubai Government's e-Supply portal, managed in collaboration with Tejari.

The Platform: esupply.dubai.gov.ae serves as the unified gateway for over 40 Dubai government entities.

The Goal: This single registration provides access to procurement opportunities across the entire Dubai government ecosystem, from infrastructure projects to IT services to catering contracts.

Strategic Consideration: Dubai government entities are often more digitally advanced and procurement-savvy than other emirates, meaning the competition is typically more sophisticated but the processes are more transparent and efficient.

Other Emirates and Semi-Government Entities

Abu Dhabi: Entities in Abu Dhabi operate primarily through TAMM and ADERP systems, with In-Country Value (ICV) certification being particularly crucial for approval.

Semi-Government Organizations: Entities like Emaar, Dubai Holding subsidiaries, and similar organizations often use enterprise procurement platforms like SAP Ariba or maintain their own internal vendor portals. These require separate registration processes and typically demand proven track records in similar projects.

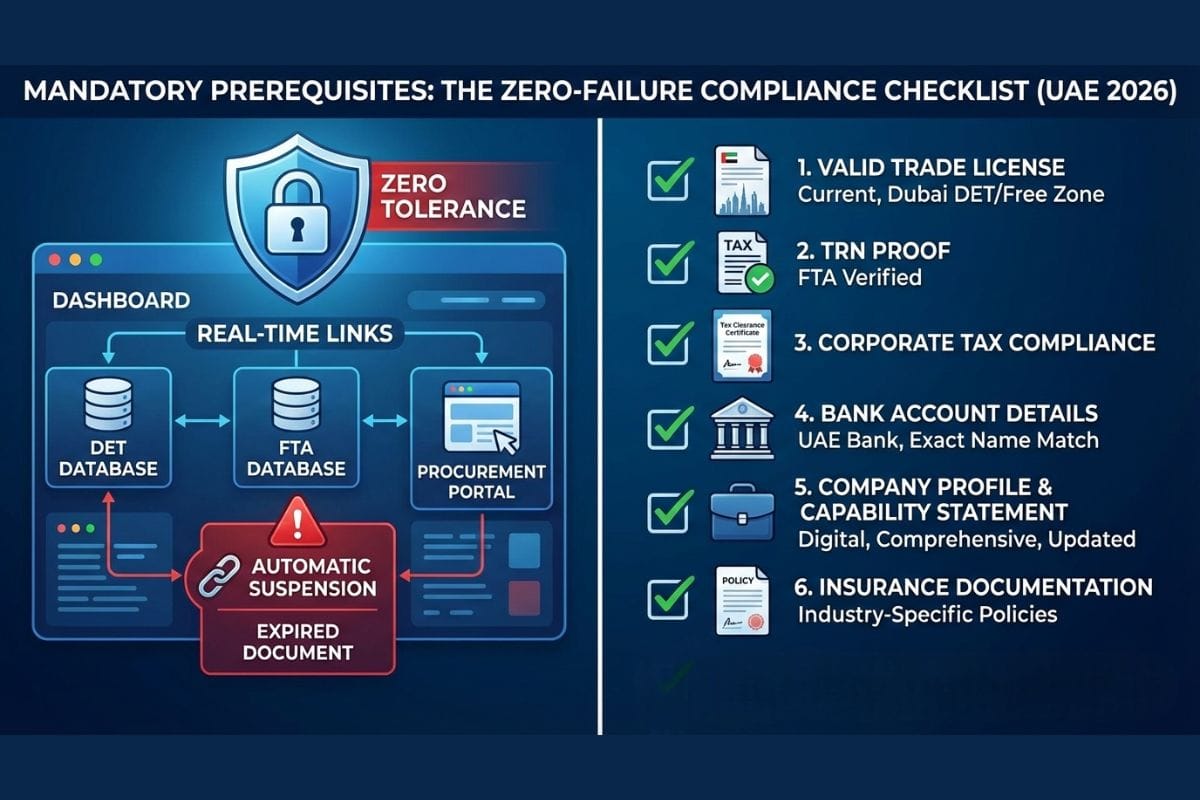

Mandatory Prerequisites: The Zero-Failure Compliance Checklist

In 2026, government procurement systems across the UAE are linked in real-time with regulatory databases. This means if one document is expired in the Department of Economy and Tourism (DET) system, your vendor application will be automatically suspended or rejected without manual review. There is zero tolerance for incomplete or outdated documentation.

Essential Documentation Requirements

- Valid Trade License: Your trade license must be issued by Dubai DET or a relevant free zone authority and must be current. The system detects license expiry 30 days before the actual expiration date and may preemptively block your access to tender views.

- Tax Registration Number (TRN): You must provide verified proof of VAT registration with the Federal Tax Authority (FTA). This demonstrates tax compliance and is automatically cross-checked against FTA databases.

- Corporate Tax Compliance: By 2026, evidence of Corporate Tax registration and your latest "Tax Clearance Certificate" from the FTA is mandatory for all vendor applications. This requirement was introduced as corporate tax implementation matured across the UAE.

- Bank Account Details: A formal letter from a UAE-based bank confirming your IBAN and account details is required. Critically, the account name must exactly match your trade license name—any discrepancy will trigger automatic rejection.

- Company Profile and Capability Statement: A comprehensive digital capability statement highlighting your past performance, specialized certifications (ISO, industry-specific accreditations), key personnel qualifications, and reference projects. This document should be professionally formatted and regularly updated.

- Insurance Documentation: Depending on your industry, you may need to provide evidence of professional indemnity insurance, general liability coverage, or other sector-specific insurance policies.

The key to success is treating this as a "zero-failure" checklist. Missing even one document or having one expired certificate will halt your entire application.

The ICV Score: Your 2026 Competitive Edge

In 2026, you can technically be "registered" as a vendor without an In-Country Value (ICV) certificate, but you will rarely be "approved" for significant tenders, and almost never win competitive bids. The National ICV Program, led by the Ministry of Industry and Advanced Technology (MoIAT), has become the cornerstone of government procurement evaluation.

Understanding ICV Calculation

The ICV certificate is a scorecard measuring how much of your business spend stays within the UAE economy. The formula is complex, but it essentially rewards SMEs that hire Emirati and resident workers, manufacture or source locally, subcontract to UAE-based firms, and invest in UAE operations.

Simplified evaluation logic:

ICV% = (Local Manufacturing Cost + Local Subcontracting + Local Investment + Emiratization + Expat Workforce) / Total Cost × 100

Why ICV Matters in Practice

During the tender evaluation process, your final "Weighted Score" is adjusted based on your ICV percentage. This means an SME with a high ICV score (say, 45-60%) can win a contract even if their financial bid is 5-10% higher than a competitor with a low ICV score (under 20%).

Real-world impact: For a hypothetical AED 500,000 contract, a company with 50% ICV scoring 85/100 on technical merit might win against a company scoring 90/100 on technical merit but only having 15% ICV, because the weighted scoring formula favors local economic contribution.

Obtaining Your ICV Certificate

ICV certificates are issued by approved certification bodies after auditing your financial statements, payroll records, supplier invoices, and investment documentation. The certificate is valid for one year and must be renewed annually.

Timeline: Plan for 2-4 weeks to obtain your first ICV certificate, assuming your financial records are well-organized and your auditors are responsive.

The Dubai SME Advantage: Law No. 16

If you are a 100% Emirati-owned SME, you possess a distinct legal advantage that can dramatically improve your success rate in Dubai government procurement.

Legislative Benefits

Under Dubai Law No. 16 of 2016, Dubai government entities are legally mandated to:

Budget allocation: Reserve 10% of their total annual procurement budget specifically for certified Dubai SME members.

Price preference: Offer a 10% price preference in tender evaluations. This means if your bid is within 10% of the lowest bid, you can still win based on your Dubai SME status.

Financial guarantees: Exempt members from certain bid bonds and performance guarantees for smaller contracts (typically under AED 500,000), reducing the capital requirements for participation.

Actionable Strategy

Before registering as a vendor on the e-Supply portal, ensure you are first a certified member of Dubai SME by registering at sme.ae. This certification is automatically recognized by the e-Supply system, triggering your preferential status in evaluations without requiring any additional documentation.

Step-by-Step Registration Workflow (Tejari/e-Supply)

The 2026 digital workflow for Dubai government vendor registration is designed to be completed within 72 hours, provided your documentation is prepared and accurate.

Step 1: Initial Profile Creation

Visit the e-Supply portal (esupply.dubai.gov.ae) and create a basic profile using your trade license number. The system will automatically pull some basic information from the DET database.

Step 2: Category Selection (UNSPSC Codes)

This step is where most SMEs fail. You must select the correct UNSPSC (United Nations Standard Products and Services Code) that accurately describes your offerings.

Critical importance: If you select "General Trading" as your category but the government entity is searching for "IT Consultancy Services," your company will never appear in their supplier search results, regardless of your actual capabilities.

Best practice: Select all relevant UNSPSC codes that match activities listed on your trade license. Be specific rather than generic—"Cybersecurity Consulting" is better than "Computer Services."

Step 3: Document Upload

Upload all the prerequisite documents outlined earlier. Ensure PDFs are clear, recent (within 3 months for most documents), and properly labeled.

Step 4: Verification Phase

The Dubai Government procurement team or the specific department's vendor management office will review your file. This typically takes 5-10 business days for complete applications.

Common delay: Incomplete applications can sit in review for weeks. Ensure every field is completed and every requested document is uploaded before submitting.

Step 5: Activation and Vendor Code

Once approved, you will receive a Vendor Code—your "golden ticket" to view and bid on relevant government tenders. This code is unique to your organization and remains valid as long as you maintain compliance with renewal requirements.

From "Approved" to "Winning": Active Tender Strategy

Being on the vendor list is passive; winning contracts requires active engagement and strategic positioning.

Leverage Vendor Open Days

Government entities like DEWA, RTA, and Dubai Police regularly host "Vendor Open Days"—often conducted virtually. These are not networking events; they are technical briefings on upcoming procurement needs for the next 6-12 months.

Strategic value: Attending these sessions allows you to tailor your capabilities, prepare proposals in advance, and even pre-qualify for upcoming major projects before formal tenders are published.

The Sustainability Mandate

Following COP28 and the UAE's "Year of Sustainability" legacy, 2026 government tenders now include "Green Procurement" criteria as a weighted evaluation factor.

Competitive advantage: Vendors who can prove carbon-neutral delivery methods, plastic-free packaging, sustainable sourcing, or environmental certifications (like ISO 14001) receive bonus points in technical evaluations—sometimes as much as 5-10% of total scoring.

Practical application: If your SME delivers products, consider switching to electric vehicles for local delivery or sourcing from certified sustainable suppliers. Document these practices thoroughly.

Build Relationships Before Tenders

Government procurement is increasingly transparent, but relationships still matter. Attend industry forums, participate in government-organized SME workshops, and engage with procurement officers during open consultation periods.

Ethical boundary: Never attempt to influence specific tender outcomes, but do ensure procurement teams are aware of your capabilities and past successes.

Common Rejection Pitfalls (Based on Official Data)

Based on 2025 Ministry of Finance data, approximately 40% of vendor applications were rejected. Understanding these common failures helps you avoid them:

- Expired license: The system automatically detects license expiry 30 days before the actual expiration date and may block tender views or suspend active vendor status.

- Mismatched activities: Your trade license activities do not align with the UNSPSC codes you selected during registration.

- Lack of localization: Failing to provide an ICV certificate for contracts over threshold amounts (typically AED 5 million+).

- Incomplete tax records: Not possessing a current "Tax Clearance Certificate" from the Federal Tax Authority.

- Inconsistent information: Discrepancies between your trade license name, bank account name, and uploaded documentation.

Registration Summary by Entity Type

- Federal Ministries: Register on MoF Digital Procurement platform; requires MoF Supplier Registration and full federal compliance documentation.

- Dubai Government: Register on e-Supply/Tejari portal; Dubai SME membership provides significant advantages if eligible.

- Abu Dhabi Entiies: Register through TAMM and ADERP systems; ICV certification is crucial and often weighted more heavily than in other emirates.

- Semi-Government Organizations: Register on SAP Ariba or entity-specific internal portals; proven track record in similar projects is typically required.

Ultimately, securing a position on the 2026 Approved Vendor list should be viewed less as a routine filing and more as a foundational investment in your company’s future.

By maintaining rigorous tax compliance, optimizing your ICV score, and fully utilizing the resources available through Dubai SME, you are doing more than just meeting a requirement.

You are aligning your business with the UAE’s broader economic objectives, transitioning from a service provider to a strategic partner in the nation’s continued growth.

Also Read: