Starting a business without a plan is like setting out on a road trip without a map. You might eventually reach your destination, but the journey will be much harder, longer, and more expensive than it needs to be. A well-crafted business plan serves as your roadmap, guiding every decision from launch to growth while helping you secure the funding you need to succeed.

The numbers tell a compelling story. According to the U.S. Small Business Administration, businesses with formal plans grow 30% faster than those without them. Research also shows that entrepreneurs with written plans are twice as likely to secure funding and achieve sustainable growth.

With global startup funding reaching record highs in 2025, a winning business plan isn't just a formality you check off a list. It's a strategic tool that demonstrates to investors, lenders, and partners that you understand your market, have realistic projections, and possess a clear path to profitability. Whether you're launching a tech startup, opening a retail store, or starting a service-based business, the principles of effective business planning remain the same.

This guide breaks down everything you need to know about writing a business plan that opens doors and drives success.

Why Your Business Needs a Plan

Before diving into how to write a business plan, it's worth understanding why you need one in the first place. A business plan serves multiple critical purposes beyond just securing funding.

It Forces Strategic Thinking

Writing a business plan requires you to research your industry thoroughly, identify potential risks, understand your competition, and think through every aspect of your operations. This process often reveals challenges or opportunities you hadn't considered, allowing you to address them before they become problems.

It Communicates Your Vision

Whether you're approaching banks for loans, pitching investors for equity, or recruiting key team members, your business plan articulates what your business does, why it matters, and how you'll succeed. It positions your venture professionally and demonstrates that you've done your homework.

It Provides a Management Tool

A good business plan isn't something you write once and file away. It becomes a living document that helps you make day-to-day decisions, measure progress against goals, and adjust strategies as circumstances change. In 2025's fast-moving business environment, having this reference point becomes even more valuable.

It Increases Your Success Rate

The data is clear: businesses with formal plans perform better. They're more likely to secure funding, make strategic decisions based on research rather than guesswork, and navigate challenges successfully.

Choosing the Right Format for Your Business Plan

Not all business plans look the same. The format you choose should match your business complexity, audience, and purpose.

Traditional Business Plan

This comprehensive format typically runs 15-50 pages and includes detailed sections on every aspect of your business. Traditional plans are ideal when you're approaching lenders who require extensive documentation, seeking significant capital investment, or operating in complex or regulated industries.

The depth of a traditional plan allows you to thoroughly demonstrate market understanding, operational feasibility, and financial viability. Banks and institutional investors typically expect this format, as noted by the SBA.

Lean Startup Plan

The lean format condenses your business plan into 1-2 pages, focusing on essential elements like your value proposition, customer segments, and revenue streams. This streamlined approach emphasizes visualization through charts and allows quick iteration as you test and refine your business model.

Lean plans work well for simple businesses, internal planning purposes, or when you need to pivot quickly based on market feedback. You can create a basic lean plan in as little as an hour, making it perfect for early-stage ventures still validating their concepts.

Choosing Between Them: Use traditional formats for formal funding pitches and complex ventures. Choose lean formats for internal use, simple businesses, or when you need agility. Many successful entrepreneurs start with a lean plan and expand to a traditional format when seeking formal financing.

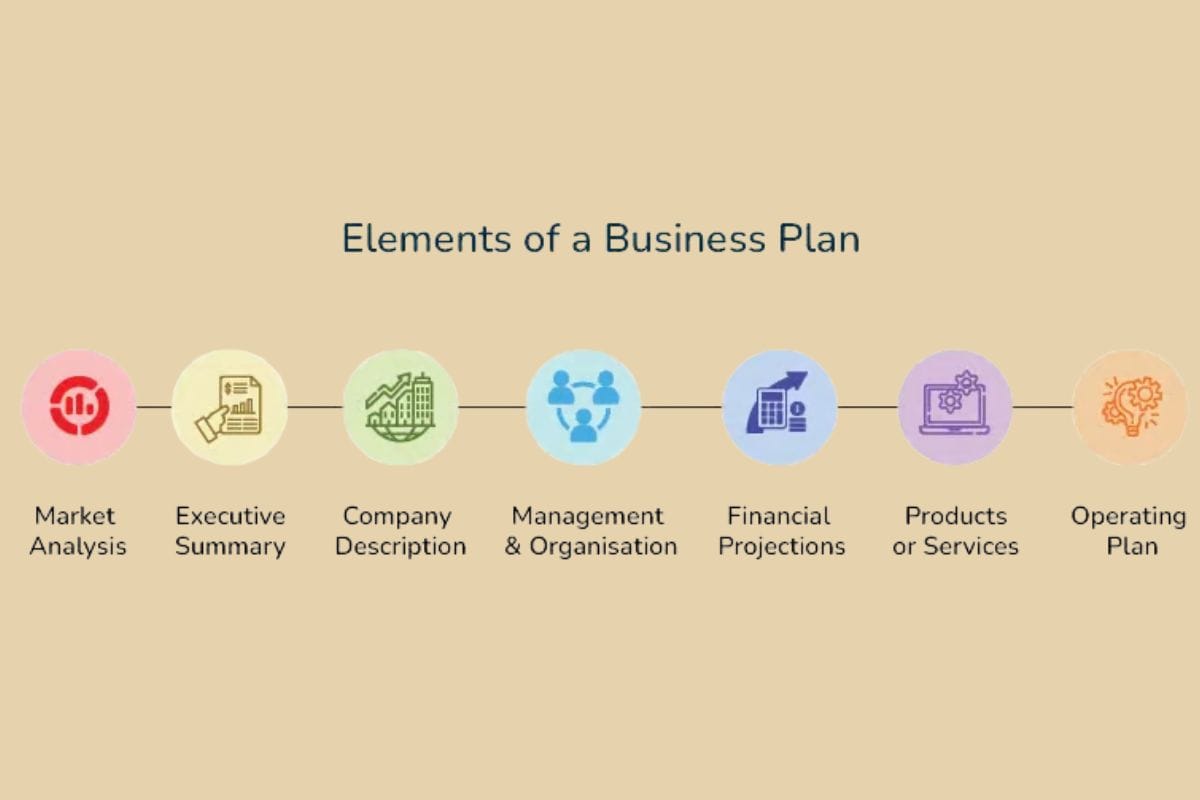

The Essential Components of Your Business Plan

Whether you choose traditional or lean formats, certain core elements must be included. Here's what every winning business plan needs:

- Executive Summary

Think of your executive summary as your elevator pitch in written form. This 3-5 paragraph overview appears first but should be written last, after you've completed all other sections. It needs to hook readers immediately and make them want to learn more.

Include your business concept, goals, unique value proposition, target market, marketing strategy, financial highlights, and key team members. Make it engaging and concise – many investors decide whether to read further based solely on this section.

- Business Description

Provide essential background about your business. Explain what products or services you offer, what problem you solve for customers, and how your business model works. Include your business structure (LLC, corporation, etc.), industry context, and any relevant history if you're already operating.

Focus on clearly articulating what makes your business different and why customers will choose you over alternatives. Source: BDC business planning guide

- Goals and Vision

Define where you want your business to go. Include your vision statement (your long-term aspirations), mission statement (your purpose), and value proposition (why customers should choose you). Set specific, measurable goals that go beyond just financial targets – consider market share, customer satisfaction, or community impact.

If you're seeking funding, clearly detail how much you need, what you'll use it for, and your exit strategy for investors.

- Management and Organization

Introduce your team. Provide brief biographies of key team members, highlighting relevant experience and complementary skills. Include an organizational chart showing reporting structure and outline hiring plans for filling skill gaps.

Investors often say they invest in people as much as ideas. A strong, experienced team significantly increases your credibility and success likelihood.

- Products and Services

Describe what you're selling in detail. Explain the benefits customers receive, how your offerings differ from competitors', and any intellectual property protection you have. If relevant, discuss research and development plans for future products or improvements.

- Market and Industry Analysis

Demonstrate that you understand your market. Include market size and growth projections, target customer segments with demographics and behaviors, competitor analysis (identify 3-5 main competitors and their strengths/weaknesses), and a SWOT analysis (your Strengths, Weaknesses, Opportunities, and Threats).

Use real data from market research, surveys, or industry reports to back up your claims. This section shows investors you're entering a viable market with realistic expectations.

- Sales and Marketing Strategy

Explain how you'll attract and retain customers. Detail your pricing strategy, promotional channels (social media, advertising, content marketing, etc.), and sales process. Include specific metrics you'll track to measure success.

Avoid underpricing your products or services – a common mistake that undermines profitability. Show that you've thought through how to reach customers cost-effectively.

- Operations Plan

Describe how your business actually functions day-to-day. Cover suppliers and vendor relationships, production processes or service delivery, facilities and equipment needs, quality control measures, and potential operational risks with mitigation strategies.

- Financial Projections

This critical section requires realistic numbers that demonstrate financial viability. Include startup costs and initial funding sources, projected income statements for 1-5 years, cash flow projections showing when money comes in and goes out, break-even analysis, and key financial assumptions.

Use conservative estimates rather than optimistic scenarios. Include sensitivity analysis showing how changes in key variables affect your projections. Unrealistic financial forecasts are one of the fastest ways to lose credibility with investors. Source: Financial projection best practices

- Funding Request (If Applicable)

If you're seeking financing, be specific about how much you need, what type of funding you're seeking (loan, equity, etc.), exactly how you'll use the funds, and what personal investment you're making.

Showing that you have your own money at stake demonstrates commitment and reduces perceived risk for lenders or investors.

- Appendix

Include supporting documents that don't fit in the main sections: resumes of key team members, permits and licenses, market research data, product photos or technical specifications, and letters of intent from potential customers or partners.

Best Practices for a Winning Plan

Following these guidelines significantly improves your business plan's effectiveness:

Be Realistic and Data-Driven

Back every claim with real data. Use market research, customer surveys, and industry reports to support your projections. Conservative financial estimates are far more credible than overly optimistic ones. Investors have seen countless projections that promise unrealistic growth – don't be another one.

Tailor to Your Audience

Banks focus on risk mitigation and your ability to repay loans. Investors look for high growth potential and strong returns. Customize your plan's emphasis and length based on who will read it. A plan for a bank might emphasize stability and collateral, while one for venture capitalists might highlight scalability and market disruption potential.

Keep It Concise Yet Comprehensive

Every word should serve a purpose. Avoid jargon and unnecessary length. Use appendices for supporting details so your main plan remains focused and readable. Most readers won't spend more than a few minutes on your plan initially, so clarity matters.

Incorporate Current Trends

In 2025, addressing trends like sustainability, AI integration, and digital transformation shows you're thinking strategically about the future. Explain how your business adapts to these trends or leverages them for competitive advantage.

Use Available Resources

Don't start from scratch. The SBA offers free templates for both traditional and lean formats. LivePlan provides over 550 industry-specific sample plans. Bank of America offers editable workbooks with prompts for each section.

AI tools can help generate initial drafts, but always refine them with human expertise to ensure accuracy and authenticity.

Review and Update Regularly

Your business plan should evolve as your business does. Review it at least annually, update it when circumstances change significantly, and use it actively in decision-making rather than letting it gather dust.

Common Mistakes to Avoid

Even experienced entrepreneurs make these errors:

Being Too Vague: Provide specific details about management, marketing strategies, and financial projections. Generic statements don't build confidence.

Ignoring Risks: Every business faces challenges. Acknowledging them honestly with clear mitigation strategies demonstrates maturity and planning rather than naivety.

Creating Overly Long Plans: Respect your readers' time. If your plan exceeds 30-40 pages, you're probably including too much detail in the main document. Move supporting information to appendices.

Failing to Differentiate: Clearly explain what makes your business unique. Avoid claims like "we'll succeed through excellent customer service" without explaining how your service will actually differ from competitors'.

Inconsistent Financials: Ensure your numbers add up and align across different sections. Errors suggest carelessness or lack of understanding.

Copying Templates Without Customization: Templates provide structure, but your plan needs to reflect your unique business, market, and strategy.

Getting Help When You Need It

Writing a business plan can feel overwhelming, especially if it's your first one. Fortunately, help is available:

Free Counseling: The SBA offers free counseling services. SCORE provides mentors with business expertise who can review your plan and offer feedback.

Templates and Examples: Use the SBA's downloadable templates or explore LivePlan's extensive library of industry-specific examples to see how successful businesses structured their plans.

Online Resources: YouTube channels like Wise Business Plans offer step-by-step tutorials. Industry associations often provide specialized guidance for specific sectors.

Professional Services: If you have the budget, professional business plan writers can help, though expect to invest several thousand dollars for comprehensive services.

A completed business plan is an achievement, but it's just the beginning. Use it to guide your decisions, measure your progress, and communicate your vision. Share it with your team so everyone understands the direction and goals. Present it confidently to lenders and investors, being prepared to discuss and defend every aspect.

Most importantly, revisit it regularly. Markets change, unexpected challenges arise, and opportunities emerge. Your business plan should evolve with your business, serving as both record of your journey and guide for your future.

Also Read: