Dubai has come a long way from a sleepy fishing village to one of the most advanced cities with hi-tech infrastructure, and one of the biggest trade centres in the world. Dubai's location at the crossroads of Europe, Asia, and Africa gives it a significant advantage in international trade. The city is a natural gateway to the Middle East and provides easy access to fast-growing markets in India, China, Africa, and the broader Middle East region.

The city boasts the Jebel Ali Port, one of the busiest and biggest ports in the world, and a hub for global trade. Historically, Dubai was a significant trade route that contributed vastly to Dubai’s position as a trade hub for over two decades.

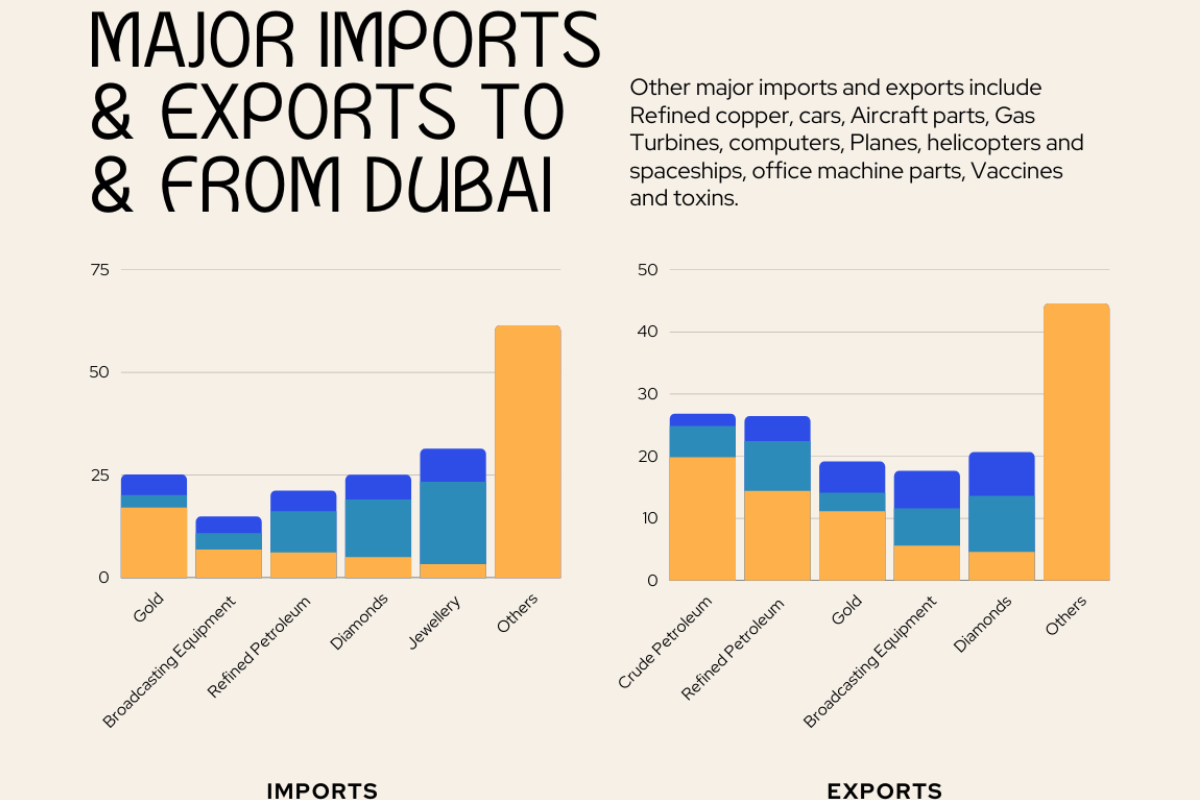

In 2019, the UAE exported $248 billion worth of goods and imported a whopping $235 billion worth. Although well-known for its export of oil and petroleum, Dubai also extensively exports diamonds, cars, aluminium, and gold. With the drastic rise in population density, an increase in consumers with high disposable incomes, and the city’s position as a global shopping centre, Dubai has significant advantages for establishing a trade business.

With several free zones distributed within the city, Dubai offers relaxed regulations, tax exemptions and customs duty benefits to businesses operating within these locations. Above all, the Dubai government invests in innovation, consistently introducing initiatives and policies that promote trade and investment.

If you’re an aspiring entrepreneur hoping to leverage endless opportunities to establish an import and export business in Dubai, this article will provide guidelines to help you kick off your venture.

Before Setting Up

Do Market Research

The primary step to launching an import and export business in Dubai is to conduct your market research. As a World Trade Organisation (WTO) member, the UAE has established trading partnerships with over 32 nations, including the United States, Japan, South Korea, the United Kingdom, China, India and Germany. Scan through the list of import and export businesses approved by the DED, and after thorough consideration, decide on an activity. It is worth consulting a company formation specialist to ensure that the chosen activity complies with the business you intend to conduct. The trading license you must obtain will depend on the chosen activity. The following chart is an overview of some of the most popular products imported and exported within Dubai.

Create a Business Plan

Before any formalities, it’s important to create a business plan by mapping out your objectives, determining your target market, developing marketing strategies to promote the business, and ascertaining financial projections and targets. A well-structured business plan will aid when seeking funding or partnerships.

Legal Structure

Learn about and decide on the company structure of your business. There are two business structures acceptable in the UAE. One must decide between a Limited Liability Company or a Sole Proprietorship. A sole proprietorship refers to a company which is set up with only one shareholder, who has unlimited liability and decision-making power. It is a better option for those who wish to establish the company on their own, given that start-up costs are comparatively low. A Limited Liability Company (LLC) is formed with multiple shareholders, who share liability within the company. However, the company must be set up with a local sponsor who holds a 51% stake in the business but would not have any decision-making power and is not entitled to a higher profit share.

Cost of Setting Up an Import-Export License in UAE

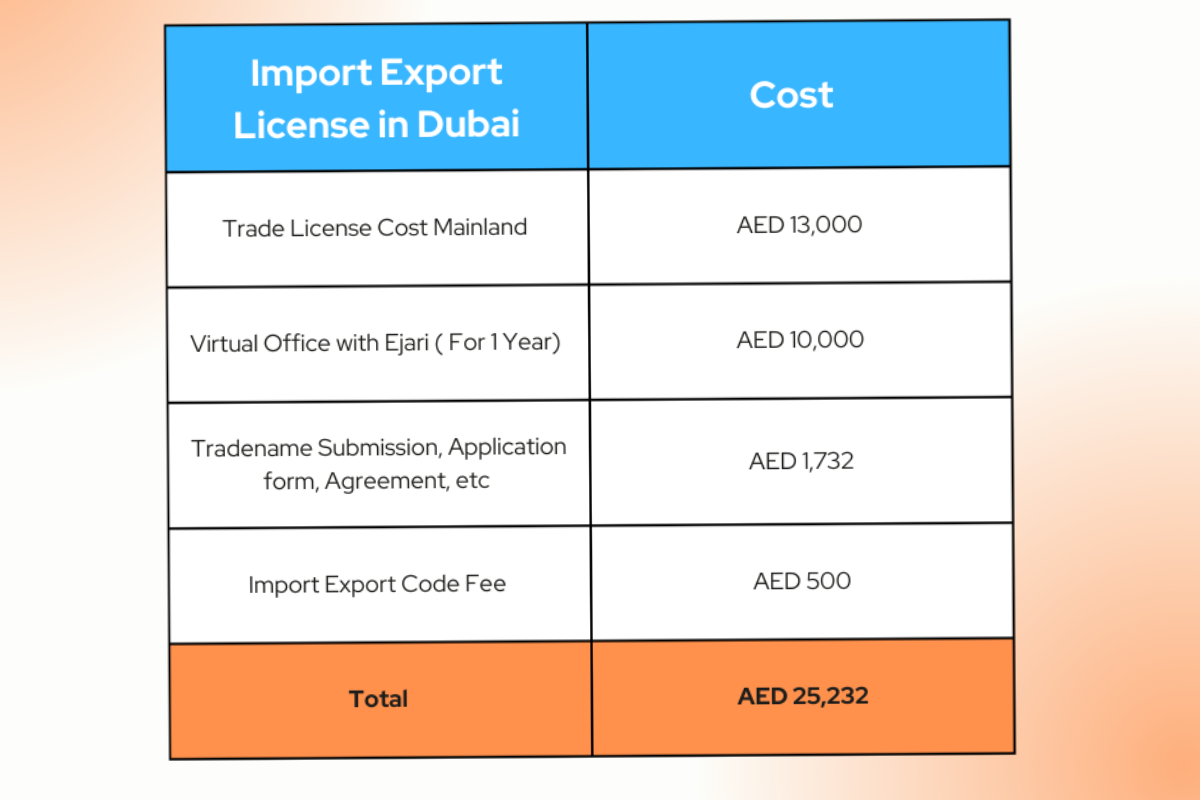

The minimum investment required to start a business in Dubai is AED 11,900, however, the cost is subjective to the nature of the business. The cost of acquiring an import-export license in Dubai is approximately AED 25,232. The total charges include obtaining a general trade license, an import-export code and also acquiring office space. It is also important to keep in mind taxation.

The following table elaborates on the breakup of costs to acquire an import-export license in Dubai.

Finalising the location

Dubai offers three main jurisdictions for business incorporation: Mainland (Onshore), Free Zone, and Offshore, each catering to different business needs. Entrepreneurs must carefully select the jurisdiction that best suits their specific business requirements from the approximately 30 free zones available, each offering unique advantages and regulations.

If entrepreneurs choose to set up their business in Mainland Dubai, they must register with the Department of Economic Development (DED) to obtain a Dubai DED License. This license enables them to operate within the mainland territory of the city. Understanding the differences between Mainland and Free Zone jurisdictions is crucial for business owners to make informed decisions about their company formation.

Opting to base your business in a free zone within Dubai will help you waive the tax charge. While mainland businesses must pay a 5% import duty, free zone businesses are offered a 0% tax rate and full ownership for expatriates and foreign investors.

There are over 20 free zones in Dubai, with some of the most prominent free zones being:

- Dubai Internet City

- Dubai Media City

- Dubai Design District

- Dubai Maritime City Free Zone

- Dubai Multi Commodities Centre (DMCC)

- Dubai Media City

- Dubai Science Park

- Dubai Outsource City

Steps to Start the Business

1. Trade License

Registering your company with the relevant authorities is the next step. You'll need to register with the Department of Economic Development (DED) to set up a mainland company. If you opt to set up your company in one of Dubai’s free zones, you will need to register with the respective free zones.

It is to be noted that a local partner is required if you choose to trade within the local UAE market.

Before commencing operations, you will need to apply for a trade license, either directly with the DED, the Dubai municipality if you choose to set up on the mainland, or the managing authority of your chosen free zone. Although the documents needed or business activity is subject to your chosen business activity, in most cases, you will require:

- Completed Application Form

- Passport copy of the prospective owners

- Two passport-sized photos

- Level Of Effort (LOE)

- Know Your Customer (KYC)

- Application Form

- Proof of Address

- Business Activity Questionnaire

- Unified number or ID number

- Basic details about owners and partners

The trade license will be issued in less than 45 minutes if all provided documents are accurate. It is also worth keeping in mind other necessities for the business such as storage space, warehouses, additional visa quotas, or multi-year licenses. Once the initial approval has been received, buy or rent out commercial space for the base of operations which will require you to submit EJARI after which you can apply to Dubai DED for license issuance with the following documents:

- Trade Name certificate

- Initial Approval Certificate

- Tenancy contract approved by Dubai Municipality and attested by RERA (Ejari)

- Memorandum of association

- Local Service Agent Agreement if a UAE national is a major shareholder

- Approvals from respective government bodies

To ease the process of getting a license, the UAE has established an online portal for DED.

2. Name and Registration

The next step is to register the name of your company. Here are some of the rules to keep in mind while naming a company:

- The name must reflect the activity of the business

- It must not include offensive or blasphemous terms

- The name must not contain any acronyms of the owner’s name, for example, Mohammad Omar Exports would be permissible, but MO Exports would not.

- The name cannot include UAE, Emirates, City names, Districts, and Airport Codes

Once registered, you will receive a trade name certificate which must be submitted for the DED license.

3. Obtain Customs Code

Similar to many countries worldwide, any import-export venture in Dubai, UAE, must ensure proper goods clearance. This necessitates registration with Dubai Customs and obtaining a customs code. To obtain the customs code you will need the following documents:

- Certificate of Origin

- Permit if you will be importing restricted goods

- Delivery Order

- Declaration form for importing goods

- Invoices for goods

- Trade license

- Packing list

- DFSA declaration

In the case of exporting, the exporter will need similar documents including;

- Export Invoice

- Packing List

- Original Waybill

- Original Commercial Invoice

- Packing List

- Form of exemption from customs duties if applicable

- Original or copy of Certificate of Origin

To make the process of obtaining the customs code easier, the UAE has set up an online portal, Mirsal 2, for applicants.

It is worth keeping in mind a list of items that are prohibited, banned and restricted for trade within Dubai.

Prohibited or banned items:

- Narcotic drugs

- Gambling tools, machinery, and devices

- Live Swine

- Radiation and nuclear fallout contaminated substances

- Nylon fishing nets

- Paan and betel leaves

- Counterfeit and pirated goods that infringe copyrights

- Blasphemous goods that go against Islamic beliefs like pornography

- Antiquities

- E-cigarettes and electronic hookah

Restricted Items:

- Drinking water

- Alcohol

- Pharmaceuticals and surgical instruments

- Print materials, publications and media products

- Nuclear energy-related materials

- E-cigarettes and electronic hookah

- Transmitters and radio equipment

- Perishables, personal care and cosmetics

- New Tires

- Rough Diamonds

- Arms, Ammunition, explosives and fireworks

- Live pets/domestic animals, pants, fertilizers and insecticides

4. Bank Account

After doing the necessary registrations and receiving approvals, you will now need to open a corporate bank account for the business to manage your business transactions. The basic documents you will need to provide will include:

- A completed application form

- A signed sanction by the shareholders

- Copy of your passport and Emirates ID

- Proof of residency visa

- Proof of residence address

- Certified company documents

- Business plan

- Bank statements dating back 3-6 months

After Setting Up

1. Warehousing and Logistics

Based on the nature of your business, you might require warehouse space to store goods or an office to manage your operations. Dubai offers a wide range of options, and selecting the right location can significantly impact your business efficiency.

2. Networking and Partnerships

Building a strong network of contacts within your industry and related sectors can open up new opportunities and potential partnerships. Attend industry events, join trade associations, and connect with other businesses to expand your network.

3. Quality Standards and Certification

Depending on the nature of your products, they might need to comply with specific quality standards and certifications. This is especially relevant for items related to health, safety, and environmental regulations. Ensure your products meet all the requirements to avoid any legal complications.

4. Promotion and Marketing

Develop a comprehensive marketing strategy to create awareness about your products and services. Utilize digital marketing, participate in trade shows, and build connections with potential customers and partners both locally and internationally.

5. Compliance and Documentation

Import and export businesses involve a lot of paperwork. Ensuring that all the required documentation is accurate and up-to-date is crucial to avoid delays and customs-related issues.

Starting an import and export business in Dubai can be a rewarding venture, but it requires careful planning, adherence to regulations, and building strong relationships with stakeholders. It's highly recommended to consult with a local business advisor or legal expert to guide you through the process and ensure compliance with all the requirements.

Read Also: