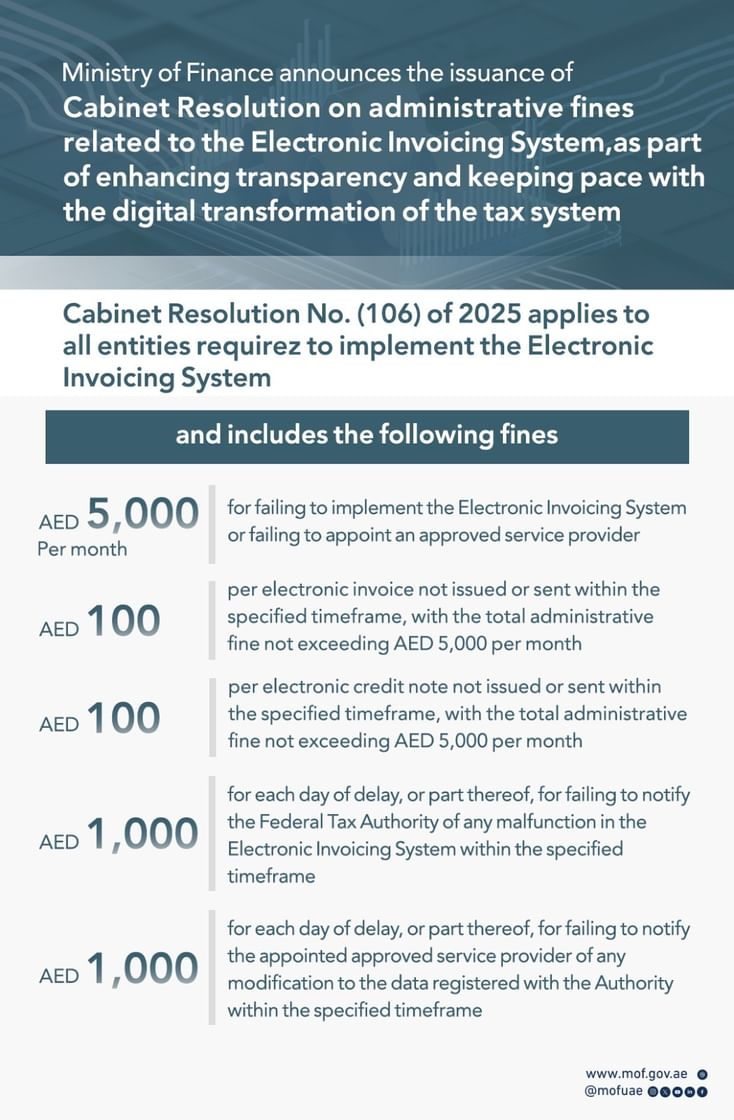

The UAE Ministry of Finance has introduced Cabinet Resolution No. 106 of 2025, setting out a structured framework of administrative fines for businesses that fail to comply with the country’s Electronic Invoicing System.

The move reinforces the UAE’s wider push toward digital transformation and enhanced tax transparency.

The resolution applies to all entities obligated to adopt the Electronic Invoicing System under Ministerial Decision No. 243 of 2025. Businesses that join the system voluntarily will not face penalties until they become mandatory participants.

Under the new rules, companies that do not implement the system or fail to appoint an approved service provider within the deadline face a monthly fine of AED5,000. Additional penalties include AED100 for each electronic invoice or credit note not issued or transmitted on time, capped at AED5,000 per month.

The resolution also introduces daily penalties of AED1,000 for failing to inform the Federal Tax Authority about system malfunctions within the required timeframe. The same daily fine applies if a business does not notify its approved service provider of changes to registered data.

According to the Ministry, the resolution marks a key milestone in the UAE’s transition to a fully integrated digital economy and aligns national tax practices with global standards.

News Source: Emirates News Agency