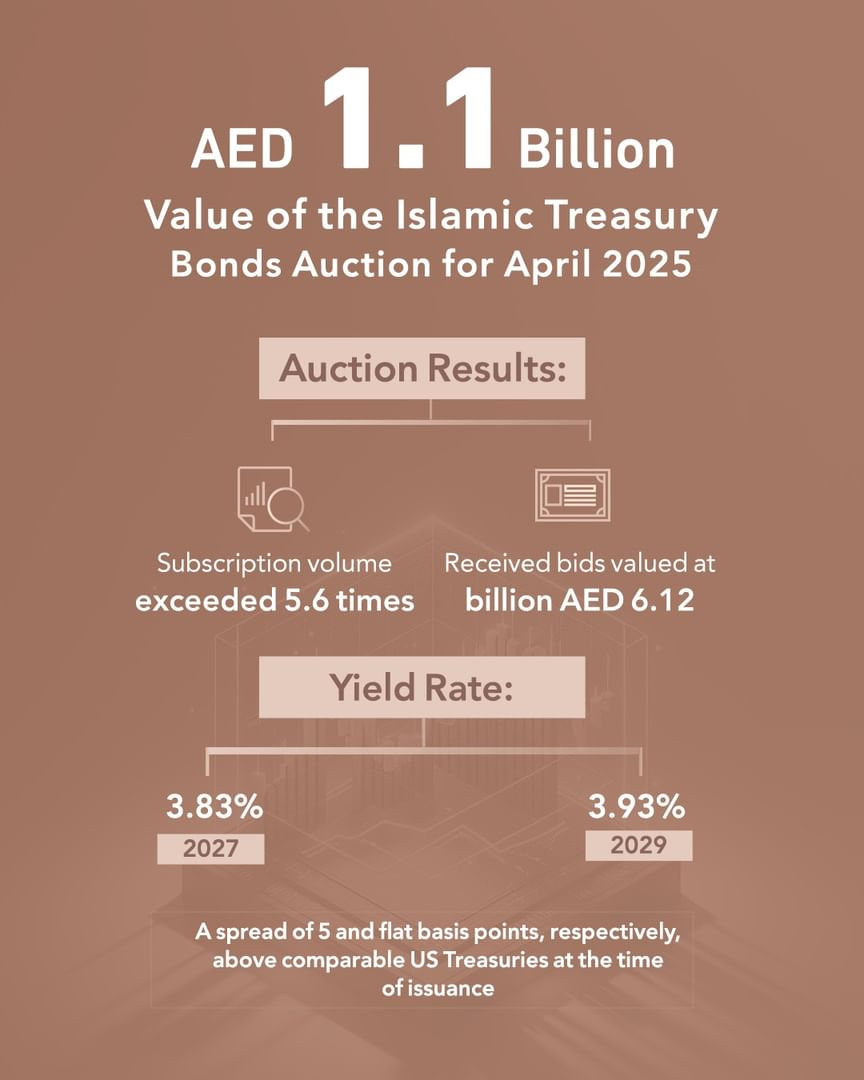

The Ministry of Finance (MoF), in collaboration with the Central Bank of the UAE (CBUAE), has successfully completed the latest auction of UAE Dirham-denominated Islamic Treasury Sukuk (T-Sukuk), raising AED 1.1 billion.

This marks another milestone in the 2025 T-Sukuk issuance program.

The auction drew strong interest from eight primary dealers, receiving total bids of AED 6.12 billion—oversubscribed by 5.6 times. This robust demand signals continued investor confidence in the UAE’s economic fundamentals and its Islamic finance framework.

The issuance was split across two tranches maturing in May 2027 and September 2029, offering competitive yields of 3.83% and 3.93%, respectively. These yields reflect tight spreads of 5 and zero basis points over comparable US Treasuries, highlighting the attractiveness and market-driven pricing of the instruments.

The T-Sukuk program is a key component of the UAE’s broader strategy to strengthen the local debt capital market. It plays a vital role in building a Dirham-denominated yield curve, while offering secure, Sharia-compliant investment options to a diverse investor base.

By deepening the local bond market and enhancing financial infrastructure, the program also supports the UAE’s long-term economic growth and fiscal sustainability goals.

News Source: Emirates News Agency