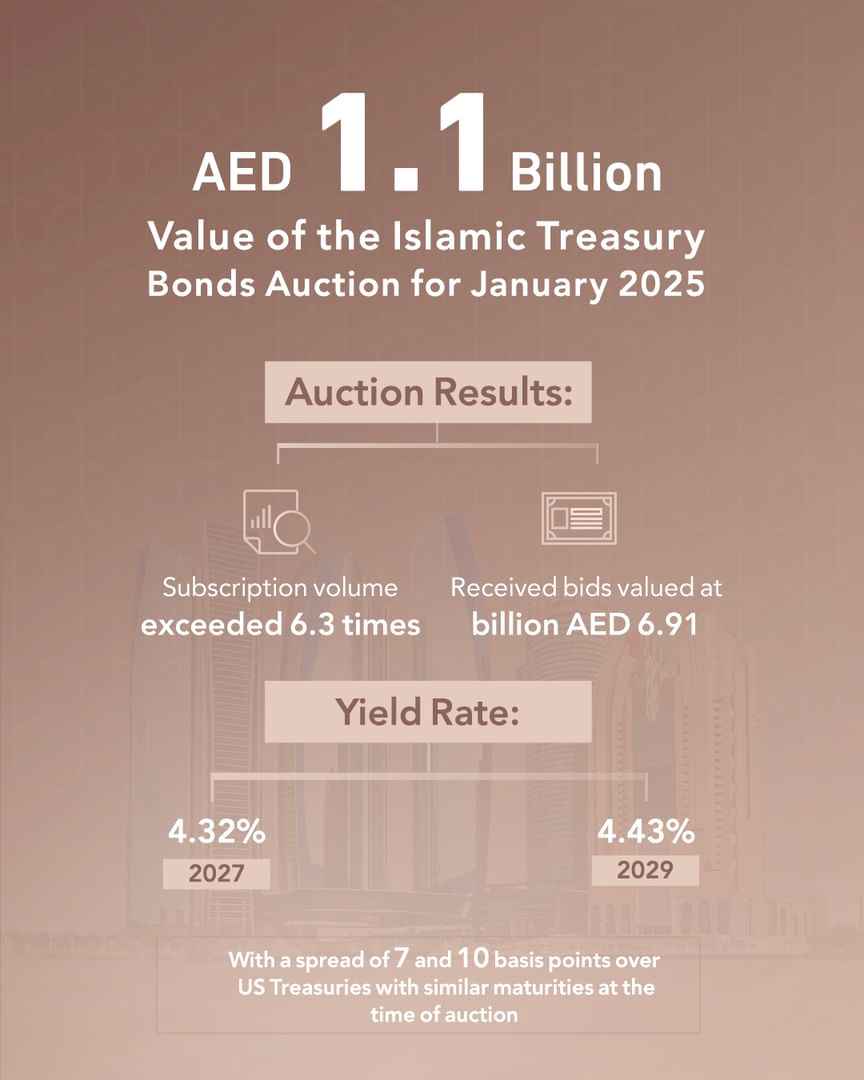

The UAE Ministry of Finance (MoF), in partnership with the Central Bank of the UAE (CBUAE) as the issuing and paying agent, has announced the successful auction of Islamic Treasury Sukuk (T-Sukuk) worth AED1.1 billion.

This issuance is part of the T-Sukuk programme for the first quarter of 2025, as outlined on the Ministry’s website.

The auction drew robust interest from the eight primary dealers, with bids totaling AED6.91 billion, representing an oversubscription rate of 6.3 times. The T-Sukuk, denominated in UAE dirhams, includes two tranches maturing in May 2027 and September 2029.

Market-driven pricing underscored the auction’s success, achieving a Yield to Maturity (YTM) of 4.32% for the May 2027 tranche and 4.43% for the September 2029 tranche. These yields reflect spreads of 7 and 10 basis points above US Treasuries of similar maturities, highlighting the competitive appeal of the issuance.

The Islamic T-Sukuk programme is a strategic initiative aimed at fostering the development of a UAE dirham-denominated yield curve, offering secure investment alternatives for investors, and bolstering the local debt capital market. Additionally, it plays a pivotal role in enhancing the investment ecosystem and supporting the UAE’s sustainable economic growth.

This milestone reflects the UAE’s commitment to advancing its Islamic finance sector and underscores investor confidence in the nation’s economic framework.

News Source: Emirates News Agency