Finding the optimal price for a new product is one of the most critical yet challenging decisions a business faces. The "sweet spot" refers to the price point that maximises profitability while capturing a sufficient market share, thereby balancing customer demand with revenue generation. Success requires a strategic combination of market research, customer psychology, data analysis, and continuous refinement to achieve optimal results.

Understanding Your Pricing Foundation

Before selecting a pricing strategy, establish the fundamental factors that will inform all pricing decisions. This foundational work determines whether your price can sustain your business and compete in the market.

Calculate Your Cost Structure

Understanding your cost structure is non-negotiable. Break your costs into fixed costs (rent, salaries, equipment) and variable costs (raw materials, packaging, shipping per unit). Once you know these figures, you can calculate your breakeven point—the minimum number of units you must sell to cover costs.

For example, if your fixed costs are AED 100,000 annually and your variable cost per unit is AED 5, and you set your price at AED 20, you would need to sell 6,667 units annually to break even. This calculation reveals how sensitive your business is to price changes and helps you understand the minimum pricing floor necessary for viability.

Conduct Comprehensive Market Analysis

Research your competitive landscape thoroughly. Analyse what competitors charge for similar products, what features they emphasise, and how they structure their pricing. Understanding competitor pricing provides crucial reference points, but should not be your only determinant—your unique value proposition may justify different pricing.

Examine market trends, seasonal factors, and shifts in consumer preferences that could affect demand and willingness to pay. Use tools like Google Trends, industry reports, and social media sentiment analysis to gauge market momentum.

Core Pricing Strategies for New Products

Different strategies serve different business objectives. Select the one that aligns with your launch goals and market conditions.

Price Skimming: Maximise Early Revenue

Price skimming sets an initially high price for early adopters willing to pay a premium, then gradually lowers the price over time to reach price-sensitive segments. This strategy works best when your product has strong differentiation, limited immediate competition, or scarcity characteristics.

Use price skimming when you need to recover R&D costs quickly, when product demand is high and competition is low, or when you want to create a perception of premium quality. Apple famously used this approach with the iPhone, commanding high initial prices that gradually decreased as competitors entered the market.

The key advantage is higher short-term profits and revenue maximisation while demand is strongest. However, customers who purchase at premium prices may feel resentment if prices drop significantly soon after. To minimise this, be transparent about your pricing trajectory.

Example:

Elon Musk adopted the price-skimming strategy with Tesla when the company started selling the original roadster for $130,000.

He used the funds gathered from selling the roadster to early electric car enthusiasts to develop its second major product - the Model S, which had a price tag of $57,400. Unlike its predecessor, the Model S was targeting a wider audience of early mainstream customers with a much lower price.

Tesla’s final product serving this strategy was the Model 3 which you can get for $35,000. By producing a relatively cheap electric car, Tesla was able to target the entire car market and successfully reach market adoption for the electric car.

Penetration Pricing: Gain Market Share Fast

Penetration pricing introduces your product at a low price to attract customers quickly, gain market share, and build brand awareness, with the intention to raise prices later as demand grows. This strategy works particularly well for new brands entering crowded markets where customers need an incentive to try something unfamiliar.

Use penetration pricing when speed to market matters more than immediate profitability, when you want to prevent competitors from gaining traction, or when network effects would lock in early adopters. The primary risk is difficulty raising prices later without triggering customer churn. Be deliberate about your transition path and offer customers reasons to stay beyond affordability.

Example:

Xiaomi started producing top-tier smartphones and selling them for a fraction of its competitors’ prices. Its first major product was Mi 1, which you could buy for ~$300.

By offering a flagship model at the price of a budget phone, Xiaomi started rapidly gaining in popularity.

The penetration pricing strategy of Xiaomi was a massive success as it soon became one of the top producers of smartphones in the world with a market share of around 14% in 2021.

Value-Based Pricing: Price for Perceived Value

Value-based pricing sets prices based on how much customers believe your product is worth, not primarily on your costs. This approach maximises margins when you have clear differentiators that customers genuinely value—unique features, superior quality, time savings, or status enhancement.

Implement value-based pricing by first conducting comprehensive market research to understand what customers value most, creating detailed buyer personas with their specific pain points and willingness to pay, and then quantifying those benefits in monetary terms. For example, if your software saves customers AED 10,000 annually in operational costs, you can justify pricing that captures a portion of those savings.

The strength of value-based pricing is that it aligns pricing with actual customer benefit, often yielding stronger margins and improved customer retention. However, it requires excellent communication about your value proposition—customers must understand why your premium pricing is justified.

Understanding Customer Willingness to Pay

The foundation of all effective pricing is understanding what customers are genuinely willing to pay. This critical insight prevents leaving money on the table while avoiding prices that drive customers away.

Willingness to Pay Analysis

Willingness to Pay (WTP) represents the maximum amount customers will pay for your product. Several proven methods estimate WTP:

Conjoint Analysis presents customers with product variations at different prices and measures their preferences. By observing how customers trade off features and price, you can estimate WTP for individual features—particularly useful for new products.

The Van Westendorp Price Sensitivity Method asks customers to identify "too cheap," "cheap," "expensive," and "too expensive" price points to determine an acceptable price range.

Behavioural Data Analysis examines historical sales data to see how customers responded to different price points. Sharp drop-offs in conversion indicate price resistance.

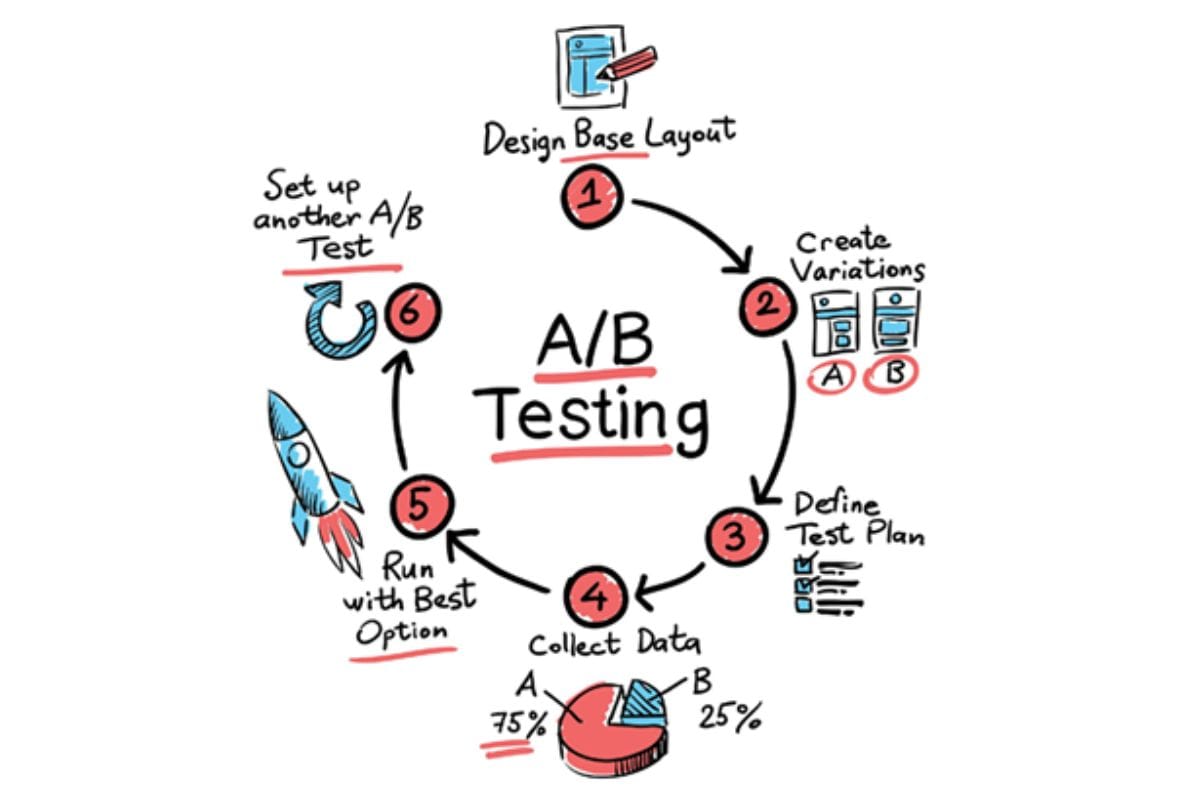

A/B Testing launches multiple pricing variations to different audience segments and measures which price point generates the best results—a real-world method that provides authentic WTP data.

Price Elasticity: Measuring Demand Sensitivity

Price elasticity measures how demand changes with price shifts. Products with elastic demand show high responsiveness to price changes—a 10% price increase leads to more than a 10% decrease in demand. For elastic products, lowering prices increases revenue.

Products with inelastic demand show minimal responsiveness to price changes. A large price increase leads to a minimal demand decrease. For inelastic products, raising prices increases revenue, making price skimming strategies particularly effective.

For new products, analyse pricing data from beta launches or early customer segments to calculate elasticity and inform your broader pricing strategy.

Psychological Pricing Tactics

Beyond fundamental pricing strategy, psychological principles influence how customers perceive price and make purchasing decisions.

Charm Pricing

Charm pricing sets prices ending in 9 (e.g., 9.99, 99.99) rather than round numbers. Customers perceive AED 9.99 as significantly cheaper than AED 10 due to the left-digit effect—our brains process numbers from left to right and focus heavily on the first digit. Research shows charm pricing can increase sales by 24% compared to rounded prices.

Price Anchoring

Price anchoring leverages the cognitive bias that people disproportionately rely on the first piece of price information they encounter. Display a higher-priced option first (the anchor), making other options appear like better deals by comparison.

The classic example is showing an original price next to a discounted price—the higher original price becomes the anchor, making the current price appear to be a bargain. This technique is particularly effective in package pricing and upselling scenarios.

Testing Your Pricing Strategy

Before committing to a pricing strategy across your entire market, conduct rigorous testing to validate your assumptions.

A/B Testing for Pricing

A/B testing different price points reveals which prices truly resonate with your customers. Divide your audience into matched groups, present different prices to each group, and track performance.

Implementation requires analysing current pricing performance and competitive landscape, defining clear test objectives and success metrics, determining which pricing elements to test, setting up proper control and variant groups, launching with a soft rollout (10-20% of traffic) before scaling, running tests to statistical significance, and analysing results by customer segment and geography.

Track these critical metrics during pricing experiments: Conversion Rate (the percentage of prospects who become paying customers), Average Revenue Per User (total revenue divided by number of users), and Customer Acquisition Cost to Lifetime Value ratio (ensuring your new pricing structure increases LTV without significantly affecting CAC).

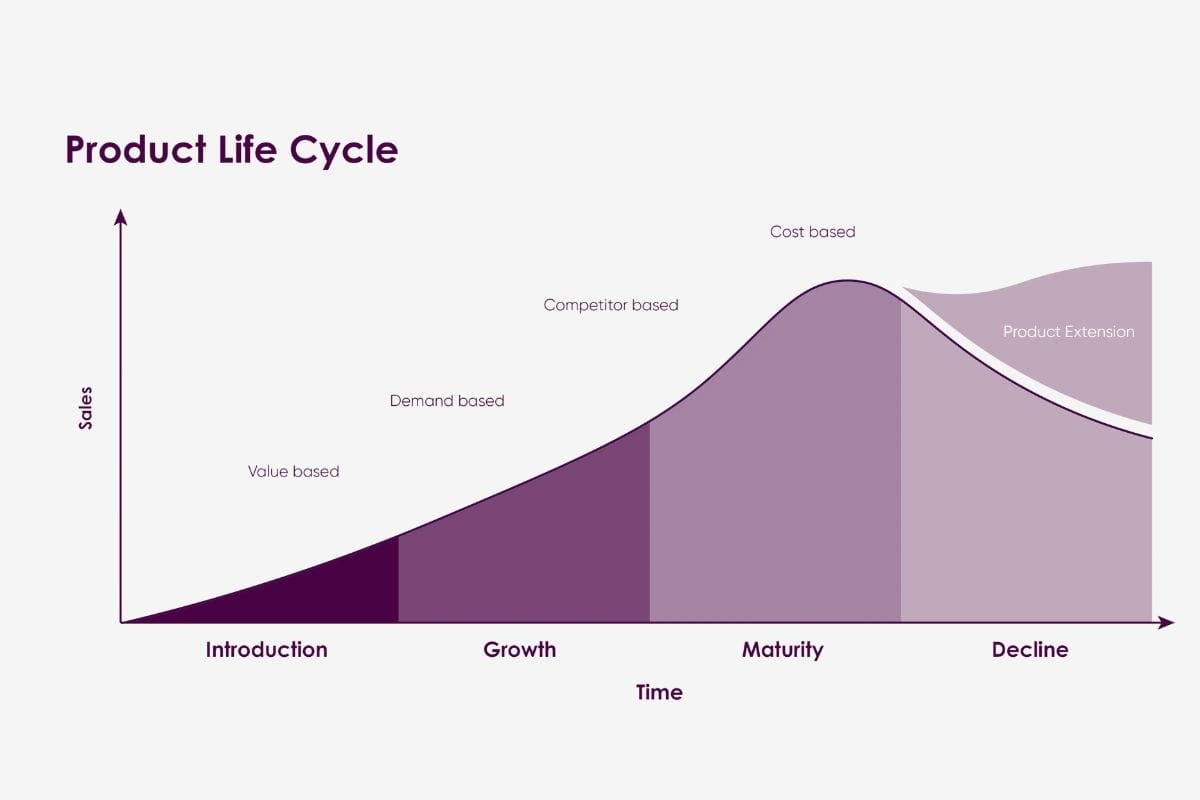

Product Lifecycle Pricing Adjustments

Your optimal price isn't static—it should evolve as your product moves through its lifecycle.

During the introduction stage, set prices reflecting product value while considering whether you're using skimming or penetration strategies. Your goal is to balance revenue recovery against market adoption needs.

In the growth stage, as competition emerges, adjust pricing to maintain competitiveness while maximising revenue. Consider dynamic pricing strategies that respond to demand changes and competitive moves.

During maturity, market saturation intensifies price competition. Shift toward margin-based pricing, value-based pricing, or differentiated pricing through service improvements, bundling, or loyalty programs. The focus becomes defending market share while maintaining profitability—small, incremental pricing adjustments often work better than dramatic changes.

Implementation Framework

The path from pricing strategy to execution follows seven phases: research and preparation (gather competitive intelligence, conduct market research, survey customers), strategy selection (choose your primary approach based on research), price modeling (develop scenarios for different demand conditions), testing (conduct A/B tests with small segments), validation and refinement (analyze results and document learnings), launch and monitor (watch actual performance against projections), and continuous optimization (regularly revisit and test your pricing strategy).

Pricing optimisation is not a one-time decision. Markets evolve, competitors respond, and customer preferences shift. Regularly revisit and test your pricing strategy to stay competitive.

Finding your pricing sweet spot requires balancing multiple competing priorities: cost recovery, competitive positioning, market penetration, and profit maximisation. By combining rigorous market research, customer psychology, data analysis, and continuous testing, you can move beyond arbitrary price selection to evidence-based pricing that maximises both customer satisfaction and business profitability.

Remember that pricing is an ongoing optimisation process, not a one-time decision—successful companies continuously test and refine their pricing strategies as market conditions evolve.

Also Read: