As Dubai continues its rapid digital expansion—embracing smart city infrastructure, AI-driven services, and cloud-based operations—the risk of cyberattacks is growing just as fast. But are businesses keeping pace with the threats?

According to the UAE Cybersecurity Council, the country has seen a sharp increase in the frequency and complexity of cyber incidents targeting both public and private sectors. A 2023 Interpol report highlighted the Middle East as a rising hotspot for ransomware and phishing campaigns, with the UAE named among the most targeted GCC nations.

Why is Dubai particularly vulnerable? As a regional headquarters for global corporations and a thriving hub for fintech, healthcare, and logistics, the city holds high-value data that attracts both organized cybercriminals and opportunistic threat actors.

What would happen if a critical system went down? Or if sensitive customer data was exposed? For many businesses, the financial and reputational damage could be irreversible.

In this article, we’ll explore the role cyber insurance plays in protecting Dubai-based businesses from these rising digital threats. From what it covers to how much it costs, and which providers are leading the market, everything you read here is based on official sources and verified information.

What Is Cyber Insurance?

Cyber insurance is a specialized form of business coverage designed to protect companies from financial losses caused by cyber incidents, such as hacking, ransomware attacks, data breaches, or system failures. It helps organizations recover from disruptions, manage liabilities, and maintain operational continuity during and after a digital threat.

Most policies are divided into two main types of protection: first-party and third-party coverage.

First-Party Coverage: Protecting Your Own Business

When your systems go down or sensitive data is compromised, first-party coverage helps cover the direct losses your business faces. This typically includes:

- Business interruption costs caused by system downtime.

- Data recovery and restoration, including forensic investigation to identify and resolve the breach.

- Legal and regulatory notification expenses, such as notifying affected customers and managing compliance requirements.

First-party coverage may also include compensation for revenue losses and administrative fines if the breach occurred due to internal failures in data protection.

Third-Party Coverage: Managing External Liabilities

If a breach affects your clients, partners, or any third party, this coverage handles claims made against your business. It often includes:

- Liability for financial losses that others may suffer as a result of the incident.

- Legal defense costs in case of lawsuits or investigations.

- Regulatory fines or penalties related to data protection violations.

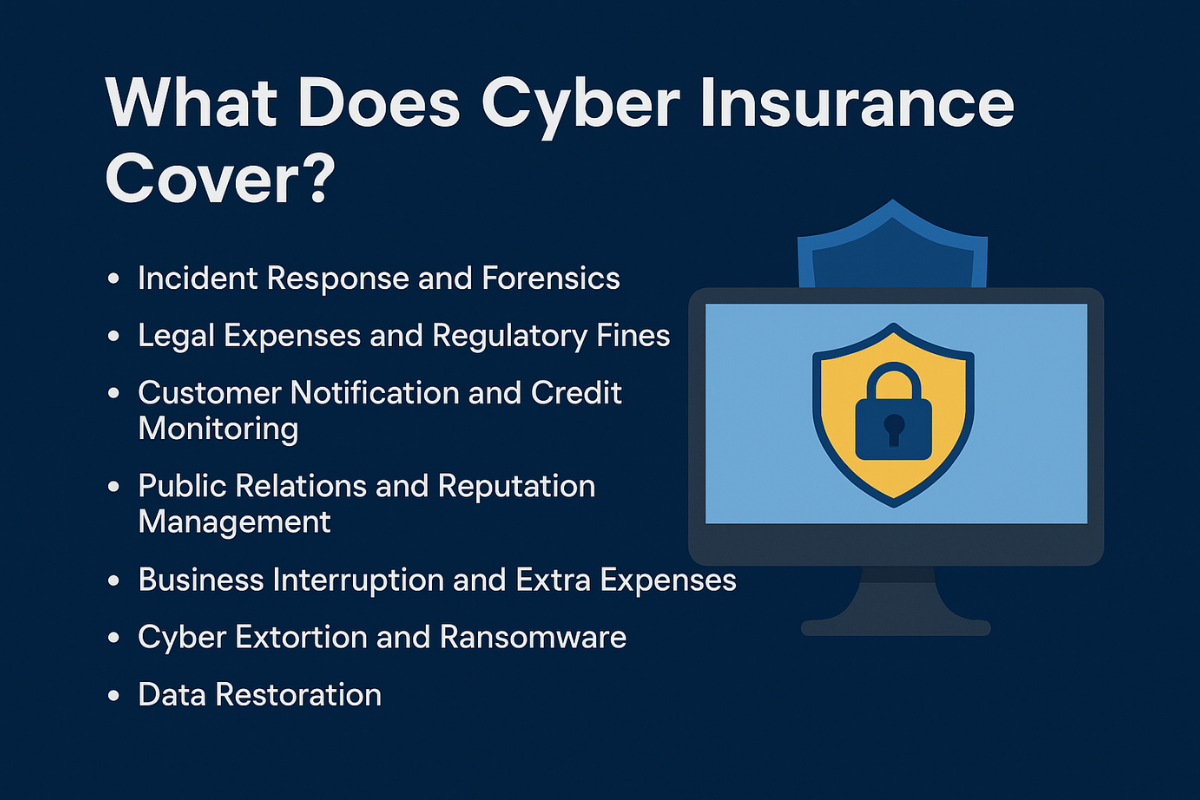

What Does Cyber Insurance Cover?

Cyber insurance typically includes the following key areas of coverage that help businesses respond to and recover from digital threats:

1. Incident Response and Forensics

Cyber insurance usually provides access to a dedicated team of cybersecurity experts who respond immediately after a breach. This includes digital forensics to understand how the attack happened, containing the threat, and guiding your team through the first critical hours.

2. Legal Expenses and Regulatory Fines

If a cyber incident triggers legal issues or regulatory investigations, the policy covers legal advice, defense costs, and penalties. This is particularly important for businesses in the UAE, where data protection regulations are increasingly strict and enforcement is becoming more proactive.

3. Customer Notification and Credit Monitoring

If customer data is compromised, insurers will cover the cost of notifying affected individuals. Many policies also include credit monitoring or identity protection services to help rebuild customer trust and meet compliance requirements.

4. Public Relations and Reputation Management

To help manage public perception after an attack, cyber insurance often includes access to PR consultants who handle media communication and reputation recovery. This support can be crucial when trying to reassure customers, partners, and investors.

5. Business Interruption and Extra Expenses

If your operations are disrupted due to a cyber event, the policy can compensate for lost income and additional expenses incurred during recovery. This might include emergency IT support, renting temporary infrastructure, or even relocating operations briefly.

6. Cyber Extortion and Ransomware

Coverage typically includes ransom payments, expert negotiation support, and the technical services needed to restore systems after an attack. With ransomware becoming more common in the region, this has become a key part of most cyber insurance policies.

7. Data Restoration

In case of data loss, deletion, or corruption, cyber insurance helps cover the cost of restoring systems, software, and databases. This ensures that your business can get back to normal operations as quickly and smoothly as possible.

Why It’s Important for Dubai Businesses

Cyber threats in the UAE have increased significantly in recent years. Businesses in Dubai are particularly exposed due to their reliance on digital platforms, cloud systems, and financial technologies. As phishing, ransomware, and malware attacks grow more sophisticated, having cyber insurance in place becomes a critical safety net. It ensures that a single breach does not disrupt business continuity or lead to long-term damage.

One of the biggest reasons businesses invest in cyber insurance is for financial protection. A serious cyberattack can lead to major expenses, including legal fees, data recovery, operational downtime, and even ransom payments. Without insurance, these costs fall entirely on the business. With insurance, however, you gain a financial buffer that can help absorb the impact and prevent sudden financial loss or insolvency.

Regulatory compliance is another growing priority. The UAE has been strengthening its data protection laws, requiring businesses to report breaches, notify affected customers, and demonstrate preparedness. A good cyber insurance policy helps businesses meet these obligations by covering legal advice, documentation support, and regulatory penalties, especially under the UAE’s Personal Data Protection Law (PDPL).

Perhaps one of the most valuable aspects of cyber insurance is access to expert support. Most policies include 24/7 emergency response teams that guide businesses through the chaos of a breach. These teams often include incident responders, digital forensic analysts, legal consultants, and public relations experts who can step in immediately, minimize damage, and help the business recover efficiently.

In short, cyber insurance is not just about compensation. It is about being equipped to respond, comply, and recover with confidence.

Leading Cyber Insurers in Dubai / UAE

QBE

QBE offers a comprehensive policy called QCyberProtect, which includes cyber liability, media liability, data breach legal costs, business interruption coverage, and data restoration. The policy is available globally and is widely used by businesses in the UAE.

They provide 24/7 crisis support through an expert panel that includes specialists in forensics, legal affairs, and public relations. Additional tools like a secure “saferoom” help businesses activate response plans quickly when incidents occur.

QBE also offers ongoing risk management support through its Cyber Risk Management Portal and provides discounts on preventative services, showing a commitment to both proactive and reactive protection.

Why QBE is a top choice: Globally consistent coverage with specialized tools, strong support systems, and round-the-clock incident response.

AIG (CyberEdge)

AIG’s CyberEdge policy includes protection for data loss, regulatory fines, cyber extortion, third-party liabilities, and business interruption.

The policy also grants access to a comprehensive cyber resiliency program that offers services such as risk assessments, vulnerability scans, phishing simulations, Darknet monitoring, and ransomware preparedness, customized based on the level of coverage.

AIG operates on a “Claims First” model, providing immediate IT forensics and legal support, along with continuous advisory throughout the policy duration.

Why AIG stands out: Strong focus on prevention, deep technical resources, and global expertise from claim initiation to resolution.

Howden

Howden focuses heavily on incident response. Their policies include expert-led containment and system restoration services, making them particularly appealing for businesses looking for hands-on support during and after an attack.

Why Howden excels: A practical, specialist-driven approach to cyber recovery—ideal for businesses in the UAE seeking reliable and fast incident resolution.

Arthur J. Gallagher (AJG)

AJG offers tailored cyber insurance solutions that include 24/7 access to breach response teams. These teams are equipped to handle digital forensics, legal guidance, and public relations support.

Their policies are designed to be highly customizable, adapting to the specific needs and operational risks of each business while ensuring immediate access to expert help when needed.

Why AJG matters: Flexible, client-focused coverage with around-the-clock support, ideal for businesses needing personalized protection and fast intervention.

UAE Cyber Insurance Cost Breakdown

| Business Type | Coverage Scope | Estimated Annual Premium (AED) |

|---|---|---|

| Small Business (SME) | Basic coverage for data breach, basic liability | 1,800 – 3,700 |

| Mid-sized Business | Broader coverage including extortion, PR, BI | 7,400 – 18,500 |

| Large Enterprise / High Risk Sector | Full coverage including compliance, restoration, large liability | 37,000+ |

BI = Business Interruption

What Affects the Cost of Cyber Insurance in the UAE?

Premiums vary significantly based on the following factors:

- Business Size & Revenue: Larger organizations face more complex risks and pay higher premiums.

- Industry Sector: Companies in finance, healthcare, and e-commerce typically pay more due to regulatory and data sensitivity.

- Cybersecurity Measures: Businesses with strong protections—like firewalls, encryption, MFA, and employee training—are considered lower risk and may receive discounted premiums.

- Claims History: A business with no history of incidents or breaches is likely to receive more favorable rates.

- Coverage Limits & Deductibles: Higher coverage amounts and lower deductibles increase premiums; balancing these appropriately helps control costs.

Tips to Reduce Premiums Without Compromising Protection

- Invest in Cyber Hygiene: Implement basic controls like endpoint protection, backup systems, and staff awareness programs. Many insurers offer lower rates for businesses with strong internal protocols.

- Bundle with Other Insurance: Some UAE insurers allow cyber to be added to broader business insurance policies (e.g., SME packages), which can reduce costs.

- Choose the Right Deductible: Opting for a slightly higher deductible can reduce premium costs while still maintaining core protection.

- Work with Specialized Brokers: Brokers like PolicyBazaar UAE and InsuranceMarket.ae can help assess your risk profile and connect you to insurers offering the best coverage-to-cost ratio.

Emerging Risks and Policy Adaptation

AI and Deepfake Risks

AI-generated deepfakes—such as fabricated videos or voice recordings—are a growing threat, capable of tricking staff into approving fraudulent transactions or damaging reputations. Recent reports from Reuters highlight how insurers are introducing affirmative AI endorsements that specifically cover incidents involving deepfakes under cyber policies. These endorsements aim to clarify and extend coverage where traditional policies may fall short.

War and State-Sponsored Attack Exclusions

Many cyber insurance policies now include a “war exclusion clause”, which excludes coverage for "hostile or warlike actions" by state-backed actors. While these clauses have historically been narrow, insurers are extending them to include state-sponsored cyberattacks, even in peacetime. The evolving wording places extra emphasis on:

- Whether the attacker is a sovereign state

- Whether the attack qualifies as a warlike act

Recent legal developments, such as the U.S. Merck case, have ruled that a war exclusion should not broadly apply to cyber incidents, especially if they lack direct military action. Nonetheless, it is now standard for policies to contain explicit exclusions related to state-sponsored cyber operations.

Why This Matters for Dubai Businesses

- Deepfake protection: Without AI-specific endorsements, traditional cyber policies may not cover losses resulting from AI-based fraud, leaving organizations exposed to new forms of attack.

- State-supported cyber threats: As cyber warfare evolves, it's possible that major disruptions could result from nation-state actors. Businesses should scrutinize war exclusion language to ensure clarity about which attacks are covered.

What UAE Companies Should Do

- Request AI endorsements in your policy to ensure incidents involving deepfakes or AI manipulation are explicitly covered.

- Carefully review war exclusion clauses: Seek clear definitions regarding state-sponsored cyberattacks and explore add-ons or special endorsements that limit these exclusions.

- Consult with local brokers and insurers, as UAE policy language is adapting quickly to include or exclude these emerging risks. Ensuring alignment with your risk profile is now essential for complete protection.

Getting the Right Coverage: Key Considerations

When choosing a cyber insurance policy in the UAE, it’s critical to understand what is covered—and just as importantly, what isn’t. Below are the essential elements that every Dubai-based business should evaluate before finalizing coverage:

1. First-party and Third-party Coverage

A strong cyber insurance policy should protect both internal and external losses. First-party coverage addresses direct impacts on your business, such as data restoration, operational downtime, and recovery costs. Third-party coverage, on the other hand, protects you from liabilities related to customer claims, legal actions, and regulatory penalties. Both are essential to ensure your business is comprehensively protected from cyber risks.

2. Incident Response Services

Time is critical during a cyber incident. Make sure your policy includes immediate access to expert-led response teams that handle forensic investigations, system containment, legal advice, and communication strategy. A fast and coordinated response can significantly reduce the impact of a breach.

3. Ransomware and Extortion Coverage

With ransomware becoming one of the most common cyber threats, it’s important that your policy explicitly covers ransom demands, negotiation support, and associated recovery costs. This is especially relevant given the rise in sophisticated double-extortion tactics where data is both encrypted and threatened with public release.

4. Regulatory Fine Coverage under UAE Data Laws

UAE regulations, such as the Personal Data Protection Law (PDPL) impose strict obligations on breach reporting and consumer protection. Your insurance policy should include coverage for legal consultation, documentation support, and any regulatory fines that may be imposed in case of non-compliance.

5. Exclusions and War Clauses

Some policies include clauses that exclude cyberattacks deemed to be state-sponsored or linked to geopolitical conflict. These "war exclusions" can limit your protection in cases of large-scale or coordinated cyber events. It is important to read these clauses carefully and explore endorsement options if your business is at risk of being targeted in such scenarios.

Tip: Always review the fine print with your insurer or broker and tailor your policy to match the scale, structure, and exposure of your business. Gaps in coverage often come from unclear exclusions or assumptions about what's automatically included.

In today’s digital-first environment, cyber risks are no longer a distant threat. They are a daily reality for businesses in Dubai. Having the right cyber insurance policy in place helps protect against financial losses, supports regulatory compliance, and gives businesses access to expert guidance when it matters most. As threats evolve, so should your coverage. Reviewing your options carefully, understanding what’s included, and choosing a provider with strong local support can make all the difference in managing risk and maintaining business continuity.

Also read: