Dubai is built on momentum. Industries evolve quickly, new sectors emerge every year, and business models are constantly reshaped by technology, regulation, and global markets. In an environment like this, financial stability is no longer something that can be left to chance.

Building a stable financial life is about one thing: design. Relying on a single source of income places unnecessary pressure on a single pillar. A more resilient approach is the portfolio mindset. Instead of a financial life supported by one stream, this mindset focuses on constructing multiple, complementary paths for money to reach you.

Think of it like a professional athlete who trains multiple muscle groups. If one muscle is strained, the others keep the body moving. This is how we should look at our bank accounts. When income flows from several directions, stability becomes architectural, risk becomes manageable, and opportunity becomes accessible.

The Foundation of Financial Strength

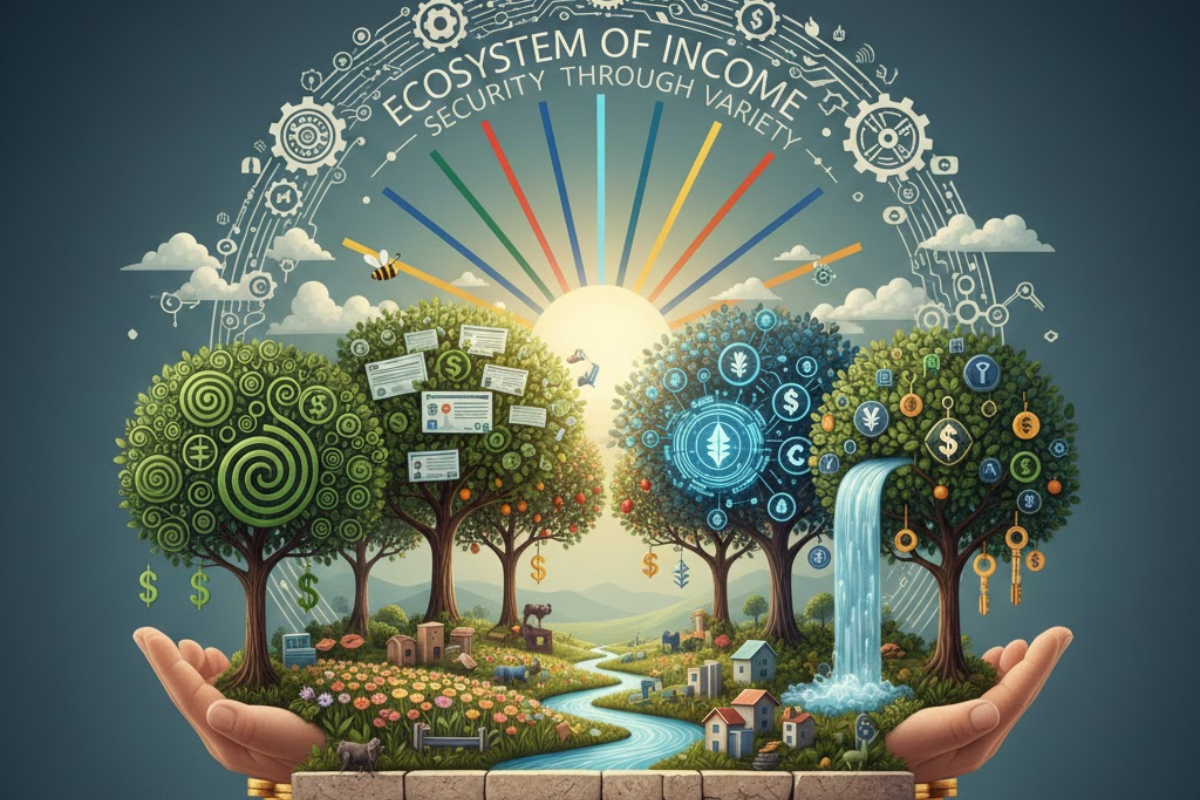

Security comes from variety. In nature, the healthiest environments are the ones with the most variety; your finances should work the same way. By creating an "ecosystem" of income, you take back control.

This isn't about working three jobs or burning yourself out. It is about a psychological transition from employment security to capability security. Employment security depends on a single entity, while capability security rests on your ability to create value across changing environments. This shift allows you to move from being a passenger in your financial life to being the architect.

For the Dedicated Professional

If you have a full-time career, you already possess a massive asset: intellectual capital. Every day, you solve problems, manage systems, and build industry networks. These capabilities represent assets that can exist beyond a job description.

Building another stream of income starts with an internal audit of this value. You might provide specialized advisory services to smaller firms or package your expertise into a digital guide or toolkit. The goal is to turn the skills you already use into a separate "product" that belongs to you. This repositioning allows employment to remain your first pillar while you build assets that retain value regardless of role changes. You are no longer just renting your talent; you are owning it.

For the Business Owner

For entrepreneurs, Dubai offers an environment where sectors frequently intersect, making it ideal for portfolio-based thinking. Once a business is operational, you can leverage what has already been built to open new doors.

Many successful expansions occur through horizontal integration. This involves observing what customers need before or after your core service. A logistics company might identify gaps in inventory management; a restaurant might start a company to supply the unique sauces they’ve perfected.

Another opportunity lies in internal systems. The unique processes, training manuals, or software shortcuts you’ve developed for your team often hold external value for others. Packaging these creates new revenue streams with minimal development cost, transforming a standalone business into a financial platform.

The Three Layers of Income

To keep the structure balanced, it helps to categorize income into three distinct types:

- Active Income: Money earned "on the clock," such as your salary or project fees. This provides immediate cash flow and liquidity.

- Asset-Based Income: Revenue from owning things, such as rental properties, dividend-paying stocks, or interest. This money works for you quietly while you focus on other tasks.

- Scalable Income: The "build once, sell many" model. This includes digital products, licensed systems, or proprietary tools.

When combined, these streams create balance. Active income supports your current lifestyle, asset-based income supports continuity, and scalable income enables long-term expansion.

The Roadmap to Construction

The best way to build a house is one brick at a time. Trying to launch multiple ventures at once is a recipe for disaster; instead, follow a deliberate sequence:

- Asset Recognition: Identify the skills, networks, and underutilized resources you already have.

- The First Satellite: Focus on making your first extra dollar from a new source. Once this psychological barrier breaks, the process becomes easier.

- Optimization and Reinvestment: Use automation to protect your time so that new streams don't lead to burnout. Instead of using new income for lifestyle upgrades, reinvest it to fund the next pillar.

The New Standard of Participation

Dubai increasingly reflects a decentralized economic model where individuals operate across ventures and build independent assets. In this landscape, diversification no longer represents mere ambition; it reflects a practical alignment with how the modern economy functions.

By diversifying where your money comes from, you aren't just protecting your bank account—you are giving yourself the freedom to live life on your own terms. You make better decisions because you aren't acting out of fear. You gain the "optionality" to disengage from misaligned environments and participate in opportunities by choice.

The Ultimate Dividend: Time and Choice

The true goal of building a multi-stream architecture isn't just to see numbers grow in a bank account. The ultimate dividend of this system is time. When your financial life is supported by a single source, your time is rarely your own; it is a commodity you must sell to maintain your security. By diversifying, you are slowly buying that time back.

As your pillars grow, your "risk appetite" changes. You become bolder in your primary career because you aren't afraid of a single setback. You become more creative in your business ventures because you aren't forced to chase every low-margin opportunity just to keep the lights on. This is the definition of financial peace: the ability to make decisions based on value rather than necessity.

A Legacy of Design

We are moving into an era where the most successful individuals will be those who operate like "Personal Holding Companies." This journey requires patience. A cathedral is built stone by stone, and a resilient financial life is built stream by stream.

By starting today—by recognizing your current skills as assets and your time as capital—you are placing yourself ahead of the curve. You are no longer just an employee or a business owner; you are the architect of your own economic future. Financial security no longer depends on prediction; it depends on construction.

Stability is not the absence of change; it is the ability to adapt to it. Stop searching for the "perfect" single opportunity and start building a foundation that can handle any opportunity. Your future self will thank you for the pillars you start building today.

The Income Audit: Your First Step

- Skill Inventory: What are two problems you solve effortlessly that others struggle with?

- Resource Audit: What digital or physical asset do you currently own that is sitting idle?

- The 30-Day Action: What is one small step (a call, a post, a draft) you can take this week to test a secondary stream?

Also read: