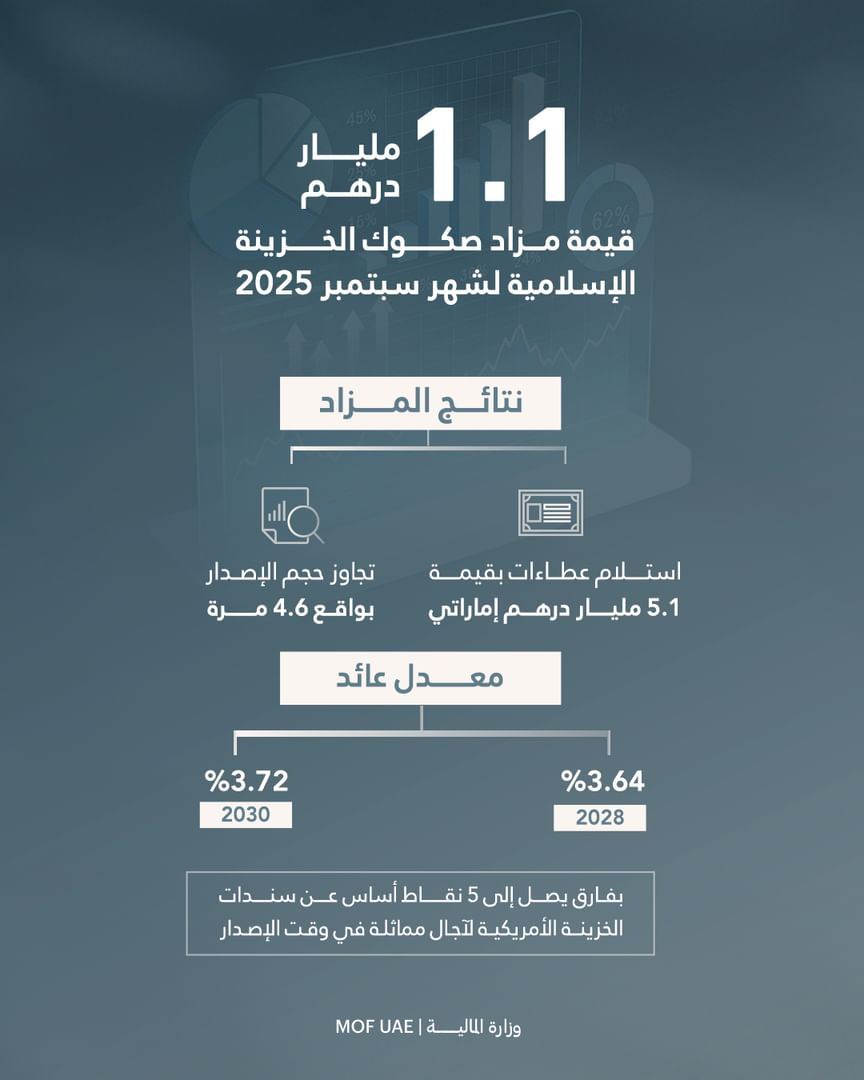

The UAE Ministry of Finance has successfully completed the September 2025 auction of Islamic Treasury Sukuk, raising AED1.1 billion in collaboration with the Central Bank of the UAE.

The auction, part of the government’s 2025 T-Sukuk issuance programme, drew strong demand from eight primary dealers. Total bids reached AED5.1 billion, representing an oversubscription of 4.6 times and underlining investor confidence in the UAE’s financial strength and Islamic finance framework.

The issuance was split across two tranches maturing in August 2028 and May 2030. The August 2028 tranche recorded a yield to maturity of 3.64 percent, while the May 2030 tranche closed at 3.72 percent. Both were priced tightly, with spreads of up to five basis points above comparable US Treasuries.

The Sukuk are listed on Nasdaq Dubai under the UAE Treasury Islamic Sukuk Programme, enhancing liquidity and providing greater access for global and regional investors in the secondary market.

Officials noted that the T-Sukuk programme strengthens the domestic dirham-denominated yield curve, offering secure and competitive investment opportunities while supporting the growth of the UAE’s local debt capital market. The initiative also plays a broader role in advancing the country’s long-term economic sustainability and financial market development.

News Source: Emirates News Agency