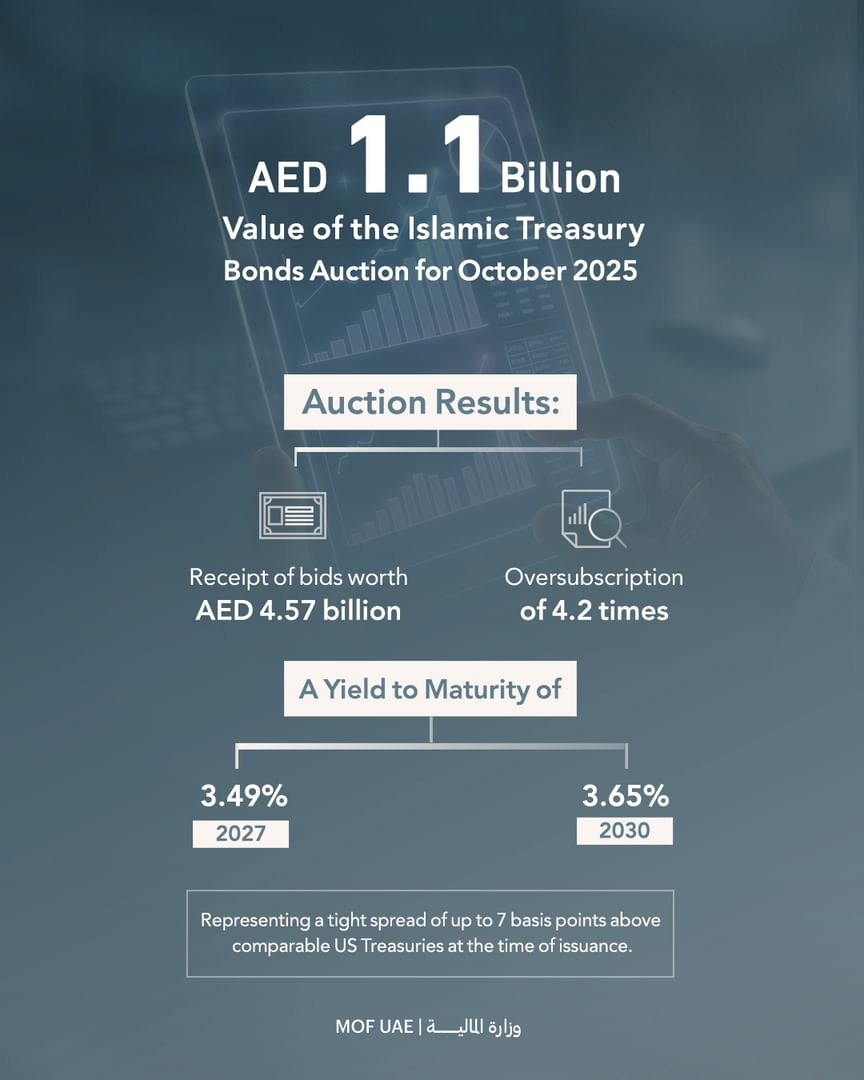

The UAE Ministry of Finance has successfully completed its October 2025 auction of dirham-denominated Islamic Treasury Sukuk (T-Sukuk), raising AED1.1 billion amid strong investor demand.

Conducted in collaboration with the Central Bank of the UAE, the auction marks another milestone in the country’s 2025 T-Sukuk issuance programme.

The auction attracted bids totaling AED4.57 billion, an oversubscription of 4.2 times, underscoring investors’ confidence in the UAE’s fiscal strength and its Islamic finance framework. All eight primary dealers participated, with allocations across two tranches — a new two-year tranche maturing in October 2027 and another maturing in May 2030.

Yields stood at 3.49% for the two-year tranche and 3.65% for the longer maturity, reflecting competitive, market-driven pricing. The yields were recorded at a tight spread of up to seven basis points above comparable U.S. Treasuries, signaling robust demand and investor trust in the UAE’s credit profile.

Listed under the UAE Treasury Islamic Sukuk Programme on Nasdaq Dubai, the T-Sukuk provides investors with enhanced secondary market access and liquidity. The programme plays a key role in developing a dirham-denominated yield curve, expanding secure investment options, and strengthening the UAE’s local debt capital market.

The Ministry of Finance emphasized that the ongoing T-Sukuk issuances support the country’s long-term economic sustainability and growth, aligning with its goal of building a more diversified and resilient financial landscape.

News Source: Emirates News Agency