The UAE's real estate sector exhibited impressive growth in the second quarter of 2024, with notable increases in off-plan sales in Dubai, stable villa rental margins in Abu Dhabi, and migration trends favoring Sharjah. These trends underscore the resilience and dynamism of the real estate market across the Emirates.

The International Monetary Fund (IMF) projected a 4% growth for the UAE economy in 2024, fueled by robust activities in tourism, construction, manufacturing, and financial services. A recent report by Asteco highlighted the strong economic fundamentals and government initiatives that continue to drive expansion within the real estate sector.

Abu Dhabi: residential and office market

Abu Dhabi saw the addition of approximately 2,400 residential units, particularly in areas such as Noya on Yas Island, Jubail Island, Masdar City, and Al Raha Beach.

Several residential and mixed-use projects are planned for public launch throughout 2024, expanding the city’s real estate landscape.

Key launches included:

- Elie Saab Waterfront on Reem Island: 174 units

- Bloom Living Olvera in Zayed City: 288 units

- Bada Al Jubail on Jubail Island: 109 units

Al Fahid Island also unveiled an updated master plan for about 7,000 units.

Abu Dhabi recorded 2,135 sales transactions in Q2 2024, with off-plan sales making up 57 percent.

Apartments led in both off-plan and ready sales, with a 6.8 percent quarterly increase.

Ready property transactions grew by 2.8 percent quarterly and 33.1 percent annually, while off-plan sales declined by 23.4 percent annually due to fewer project launches.

Rental Market

The rental sector in Abu Dhabi remained active, particularly in upscale apartment and villa locations. Average apartment rents increased modestly by 1 percent quarterly and 2 percent annually.

Villa rents showed a steady 5 percent increase over the past year. Prime residential areas, especially waterfront communities like Al Raha Beach, Saadiyat, Yas, and Al Reem Islands, saw high demand and occupancy rates, with some properties having waiting lists.

Mid-end properties in prime investment areas grew over 5 percent annually, while lower-end market properties remained stable due to attractive lease terms offered by landlords.

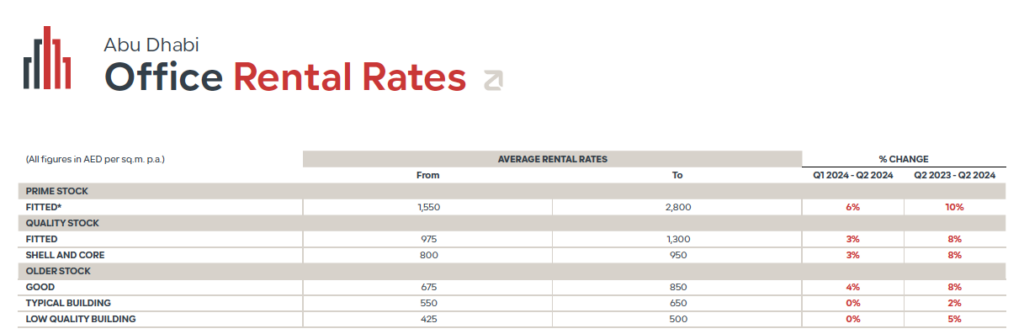

Office space

The office market witnessed a steady influx of private and corporate investments, driving demand for high-quality office spaces.

Grade A offices in prime locations saw a significant 10 percent increase in rents compared to the previous year, with quarterly growth between 3 percent and 8 percent, especially for new contracts.

Dubai: residential and office market

Dubai’s real estate market continues to attract expatriates due to its strong economy and appealing lifestyle. Approximately 6,750 residential units were completed in Q2 2024, with ongoing project launches covering a diverse range of developments.

The Asteco report noted that an additional 25,000 units are set to be delivered in the second half of 2024, with some delays anticipated until 2025.

Key launches included:

- Emaar’s Heights Country Club and Wellness: An 81 million square feet community

- Aldar’s Athlon community: Featuring 1,492 townhouses and villas

- Verdes by Haven: Offering 1,050 one-, two-, and three-bedroom units

Off-plan property sales

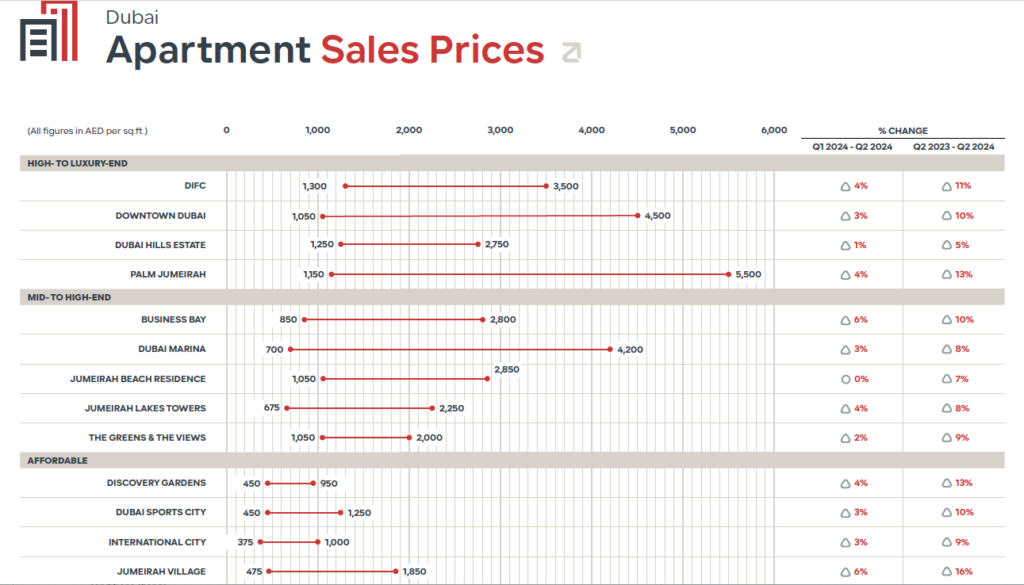

The sales market in Dubai remained strong, driven by ongoing project launches that boosted off-plan transactions.

While Q2 2024 recorded a steady 2 percent growth in average sales prices, several areas, including Jumeirah Village and Business Bay, experienced above-average sales price growth.

The report attributed this to a general increase in demand and part to a significant rise in both off-plan launches and newly completed developments.

These new projects often feature superior quality compared to earlier ones in these areas and are priced accordingly. The off-plan property market continued to maintain remarkable momentum, with both local and international investors eagerly acquiring newly launched units, attracted by the promise of strong returns on investment in a tax-friendly environment.

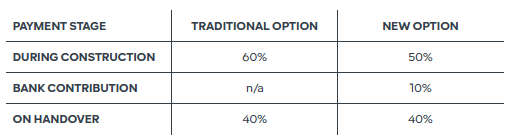

However, it is worth noting a rise in the number of developers offering sales incentives, such as lower down payments, flexible and/or extended payment plans, and promotional gifts.

Additionally, some lenders started offering enhanced financing options for off-plan properties, allowing buyers to secure up to 10 percent more funding during construction.

This additional funding is typically available for projects with at least 50 percent construction progress, ensuring a degree of risk mitigation for the lender.

This move not only stimulates the off-plan market but also broadens accessibility to potential buyers.

Rental market

Apartment and villa rental rates in Dubai increased by 3 percent and 2 percent quarterly, respectively. Annual growth moderated to single digits, with apartments rising 8 percent and villas 4 percent.

The revised RERA rental index allowed landlords to implement larger rent increases upon lease renewal.

Office space

The office rental market thrived, especially for Grade A spaces, driven by robust demand and limited supply. The upward pressure on rents is expected to continue until new supply enters the market or business conditions change.

Sharjah and Northern Emirates

Residential and office market

The Northern Emirates experienced tenant migration from Dubai to Sharjah, Ras Al Khaimah, and Ajman due to lower rental rates, improved development standards, and enhanced infrastructure. Rental growth for typical apartments outpaced high-end properties.

In Sharjah, Alef Group launched Nama 2 within Al Mamsha Raseel, featuring 174 apartments.

Al Ain market

Al Ain’s residential rental market remained positive in Q2 2024. Apartment rental rates stayed stable, while villa prices increased by 2 percent year-on-year.

Asteco’s Q2 2024 report highlights the UAE real estate market’s steady growth across different emirates.

The sector benefits from strong economic fundamentals, government initiatives, and strategic investments, ensuring its resilience and dynamism.

News Source: Gulf Business