One of the most emotionally loaded decisions for any founder or small business owner is what to do with profit. On the one hand, there is the pressure to “be serious” and reinvest every extra dirham back into the business. On the other hand, there is your life: rent or mortgage, family needs, savings goals, and the very real burnout that comes from working hard without seeing personal financial reward.

Advisers who work with small business owners consistently emphasize that this is not a binary decision. Instead, it is about finding a sustainable balance: paying yourself enough to live without chronic stress while keeping enough capital inside the business to grow, stay resilient, and avoid unnecessary debt.

This article explores how to think about that balance, when to reinvest, when to take (or raise) a salary, and how to build a simple framework you can adjust as your business evolves.

First Things First: Is Your Business Truly Healthy?

Before deciding what to do with profits, you need to be sure they are real and repeatable. A single “good month” is not enough to justify large salary increases, nor is one bad month enough to abandon reinvestment.

Two concepts matter most here: cash flow and buffers.

- Profits vs. cash flow: A business can show a profit on paper while struggling to pay bills if cash comes in late or major expenses are poorly timed. Many accountants and advisers view consistently positive cash flow as more important than occasional profit spikes.

- Cash buffer: A common recommendation is to build at least three to six months of fixed operating expenses in cash before committing heavily to reinvestment or higher owner pay. This buffer protects you from shocks such as a major client leaving, delayed payments, or seasonal dips.

If you are still using personal credit cards or loans to cover basic living costs while the business holds cash, that is a warning sign. Several guides for small business owners note that this pattern is not sustainable and can quickly lead to personal financial strain—and ultimately resentment toward the business.

In simple terms: paying yourself nothing indefinitely is not a badge of honor; it is a risk factor—for you and for the company.

When Reinvesting Profits Is the Right Move

Reinvestment tends to be the smart choice when your business has clear, realistic opportunities to turn every dirham back into more value—either through revenue growth, improved margins, or reduced risk.

- You Have Proven Growth Opportunities

If you can point to specific areas where additional spending will almost certainly bring a strong return, reinvestment is usually compelling.

Examples include:

- Marketing campaigns with tracked, profitable results (for example, every AED 1 spent on ads reliably brings in AED 3–5 in gross profit).

- Hiring staff or contractors to remove bottlenecks so you can serve more clients or launch new products.

- Expanding a product line you already know customers want.

Some advisers explicitly frame this as a comparison: if reinvesting in your business can deliver expected returns significantly higher than what you would get by taking profits out and investing them elsewhere, it often makes sense to keep money inside the company.

- You Need To Strengthen Foundations

Reinvestment is not just about growth; it is also about making the business safer and more efficient. Resources for owner-managed businesses often highlight the importance of spending on systems, technology, and training so you can operate more smoothly and reduce errors or waste. Examples include:

- Upgrading your accounting or inventory systems.

- Investing in automation tools that reduce repetitive manual work.

- Training yourself or your team in critical skills (sales, negotiation, technical expertise).

These investments may not explode revenue immediately, but they can improve margins, reliability, and scalability over time.

- Debt Would Be Expensive or Risky

If your next stage of growth would otherwise require high-interest borrowing, using retained profits can be a safer option. Several financial planning articles point out that reinvesting profits may allow you to expand without taking on debt obligations that could strain cash flow if conditions change.

- You Are in an Early or High-Growth Stage

In the early years—especially if your business is growing quickly—it is common and often wise to keep your own pay relatively low and reinvest most profits, provided your basic needs are still covered. At this stage, every extra bit of capital can fuel momentum, and compounding growth is powerful.

That said, “low” is not the same as “zero.” Completely ignoring your own financial needs for too long is rarely recommended.

When Paying Yourself a Salary Is the Right Move

You are not just an investor; you are also an employee doing real work. Over time, failing to pay yourself fairly becomes a risk to both your well-being and the company.

- The Business Is Consistently Profitable

Once your business can reliably cover operating expenses and still generate profit over several periods—not just one lucky quarter—most advisers agree it is appropriate to begin or increase owner pay. This does not mean draining all profits, but rather acknowledging that your time and expertise deserve compensation.

- You Have Established a Cash Buffer

If you already hold three to six months of fixed expenses in cash and are not constantly firefighting cash issues, taking a regular salary becomes more comfortable. The buffer gives you confidence that a short downturn will not immediately endanger the company.

- Your Personal Finances Are Under Strain

If you are:

- Using credit cards to cover groceries or rent,

- Dipping into personal savings month after month, or

- Delaying essential personal expenses (like insurance or healthcare),

while the business is accumulating profits, it may be time to shift some focus to your own pay. Many guides for small business owners stress that this is not selfish; it is a necessary step to avoid burnout and poor decision-making driven by constant financial pressure.

- You Want Clean Separation Between Business and Personal Finances

Paying yourself a set salary (or structured owner’s draw, depending on your legal setup) helps separate your personal and business money. This:

- Simplifies budgeting on both sides.

- Improves clarity around true company performance.

- Helps with tax compliance and, eventually, business valuation.

Resources on how to pay yourself as a business owner often emphasize choosing a “reasonable” salary that reflects your role, not just pulling out profits randomly. This reduces tax and accounting complications down the line.

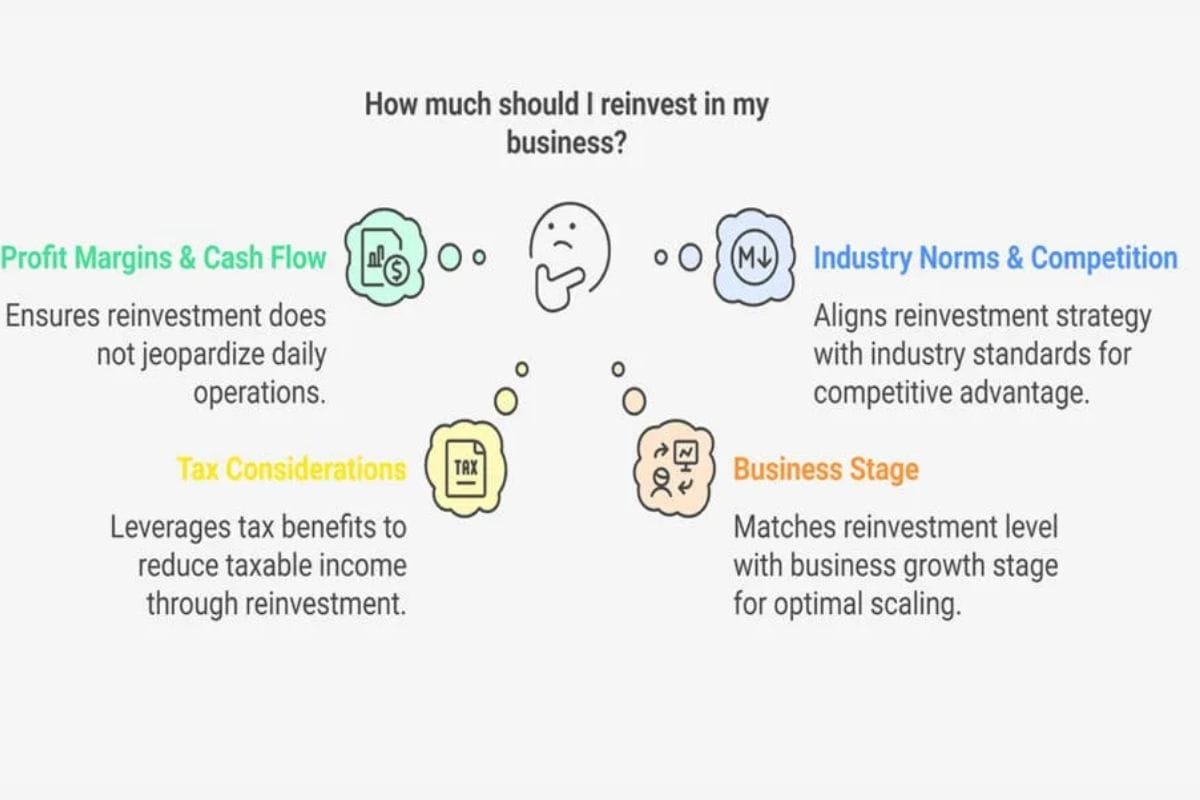

Key Factors That Should Shape Your Decision

- Stage of the Business

Broadly:

- Early-stage / high-growth: It is common to reinvest heavily in marketing, product, and hiring, while taking only a modest salary that covers basic needs.

- Mature / stable: As revenue and margins stabilize and major systems are in place, increasing salary and taking regular distributions becomes more reasonable.

The transition is gradual; you do not jump from reinvesting almost everything to extracting as much as possible overnight.

- Cash Buffer and Risk Tolerance

If your business operates in a volatile or seasonal industry, a strong cash buffer becomes even more important. Many accountants recommend business owners hold more than the minimum three months of expenses in such cases. If you are naturally risk-averse, you may prioritize a larger buffer before raising your own salary.

- Return on Reinvestment vs. External Investment

If your business can realistically turn every dirham reinvested into significantly higher future profit—say by funding a marketing funnel with known positive returns—then reinvestment often beats taking money out to invest into lower-yield assets personally.

However, if growth opportunities are limited or uncertain, it may be prudent to:

- Keep some profits inside to maintain stability.

- Take some out to diversify your personal wealth into other assets (such as index funds or property), reducing concentration risk.

- Tax and Legal Structure

How you pay yourself has tax implications and depends on whether you operate as a sole proprietor, partnership, or company. Guidance for small business owners often notes that:

- Legitimate business expenses funded by reinvested profits can reduce taxable company income.

- Salary and dividends or draws may be taxed differently, affecting your overall after-tax outcome.

Because tax rules vary widely between countries and change over time, qualified local advice is essential. General articles emphasize that you should not base major decisions purely on generic tax tips.

A Practical Framework: Moving Beyond “All or Nothing”

Instead of asking “Should I reinvest profits or pay myself?”, a more useful question is: “What proportion should go to each, given where the business is today?”

Many advisers suggest some version of a simple allocation approach rather than an extreme in either direction. Here is one way to think about it.

Step 1: Cover Essentials and Build a Buffer

First, ensure:

- All operating expenses are covered.

- You are steadily building (or maintaining) a cash buffer of at least three months of fixed costs—more if your industry is volatile.

Until this buffer is in place, consider limiting salary increases and large discretionary reinvestments.

Step 2: Set a Baseline Owner Salary

Next, decide on a baseline salary (or draw) that covers your essential personal expenses without relying on debt. In early years this may be modest, but it should be:

- Predictable (so you can budget personally).

- Sustainable for the business in average months, not only in peak periods.

This is your “minimum healthy pay,” not necessarily your long-term target.

Step 3: Decide How to Allocate Remaining Profit

Once business costs, buffer contributions, and baseline salary are covered, decide in advance how to allocate the remaining profit over a given period (for example, the next year).

A simplified example might be:

- 40% to targeted reinvestment (marketing, hiring, product, systems).

- 30% to additional owner compensation or dividends.

- 30% to extra reserves or debt repayment.

The exact percentages depend on your goals, risk tolerance, and the quality of growth opportunities. The key is making the decision deliberate rather than ad hoc.

Step 4: Review Quarterly or Annually

Your situation will change. Revenues, margins, personal circumstances, and growth opportunities never stay static.

Many finance coaches recommend reviewing your allocation at least annually, and often quarterly in fast-changing environments. In strong periods you might:

- Increase owner pay slightly.

- Fund more aggressive growth initiatives.

In uncertain periods, you might:

- Temporarily reduce distributions.

- Rebuild cash reserves.

Step 5: Stress-Test Big Decisions

Before major moves—like doubling your salary or launching a very expensive initiative—ask a simple question:

“If revenue dropped for three to six months, would this decision put the business or my household at serious risk?”

If the answer is yes, it may be wise to scale back or phase in changes more gradually.

Red Flags That the Balance Is Off

Signs You May Be Reinvesting Too Much

- You have little or no cash buffer, and a single bad quarter would be catastrophic.

- Your personal finances are deteriorating—growing consumer debt, delayed essential expenses—while the business keeps money sitting idle.

- Most of your “reinvestments” are not producing clear, measurable returns over time.

Signs You May Be Taking Too Much Out

- The business struggles to pay suppliers, taxes, or staff on time.

- You regularly delay important upgrades, hires, or marketing because “there’s no money left,” even after strong profit periods.

- You rely on overdrafts or loans to smooth day-to-day cash flow while owner pay is high.

In either scenario, the solution is not guilt, but adjustment—revisiting your allocations and making incremental changes.

The right balance between reinvesting profits and taking a salary is not fixed; it shifts as your business, finances, and market conditions change. What matters is protecting cash flow, maintaining a realistic buffer, honouring your own financial needs, and funding genuine growth opportunities when they arise.

Owners who see themselves as both employees and investors—paying themselves reasonably while reinvesting strategically—tend to build healthier, more resilient businesses over time.

Also Read: