Family businesses are rapidly redefining their role in the global economy, moving beyond wealth preservation to shape sustainable investment, impact-driven philanthropy, and cross-border partnerships, according to discussions held at a roundtable hosted by the World Governments Summit 2026 and Dubai Chambers.

The session brought together government officials and more than 40 senior leaders from local and international family businesses to explore how family investment portfolios can be positioned for the future and how enterprises can strengthen their long-term social and community impact.

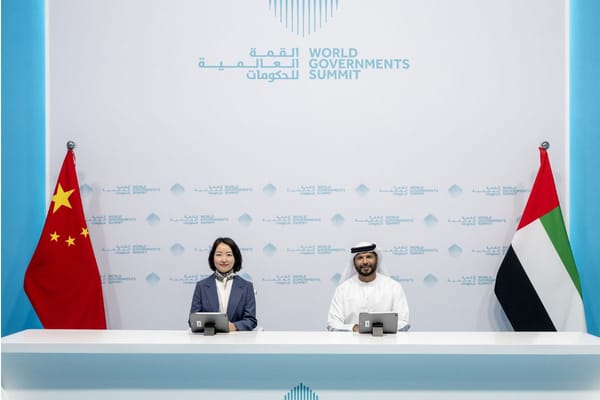

Chaired by Sultan bin Saeed Al Mansoori, Chairman of Dubai Chambers, the roundtable underscored what he described as a fundamental shift in how family businesses operate. He said these enterprises are increasingly influencing sustainable development, adopting agile governance structures, and integrating modern technologies to improve decision-making and capture emerging market opportunities.

Al Mansoori also highlighted the growing importance of involving the next generation in shaping investment and governance strategies, noting their strong understanding of digital tools and future-focused priorities.

Participants agreed that investment success is no longer measured solely by financial return. Social and environmental outcomes are now central, reflected in the rise of impact-driven philanthropy. Discussions stressed the need for clearer governance, stronger measurement frameworks for social impact, and deeper understanding of legal and tax aspects of philanthropy.

A second focus area examined governance and diversification as pillars of sustainable growth. Family businesses in Dubai were recognised as key contributors to the Dubai Economic Agenda D33, with PwC data showing the sector contributed AED491.8 billion to Dubai’s GDP in 2024.

The roundtable also highlighted a shift toward diversified portfolios, increased use of partnership-driven “club deals,” and rising participation in venture capital. During the first half of 2025, UAE family offices closed around $3 billion in VC deals, ranking behind only the United States and the United Kingdom.

Participants concluded that updated governance models and dynamic asset allocation strategies will be essential to managing global exposure and sustaining long-term growth.

News Source: Emirates News Agency