In accordance with the provisions of the Federal Decree-Law No. (13) Of 2022, the Involuntary Loss of Employment (ILOE) insurance scheme has been launched to compensate employees working in the Government and Private sectors with a cash benefit for a limited period not exceeding 3 consecutive months per claim, in the event of their loss of employment due to termination.

The ILOE insurance scheme aims to provide a decent life for workers in the United Arab Emirates, in the event of unemployment until an alternative employment opportunity becomes available.

Compensation Benefits

- The Monthly compensation is 60% of the average basic salary over the most recent 6 months prior to the Involuntary Loss of Employment

- For Category A: Maximum Claim Benefits : 10,000 AED per month

- For Category B: Maximum claim Amount : 20,000 AED per month

- Maximum compensation for any one claim: 3 consecutive months

- Maximum Period of Benefits: During the Insurance Period over the entire work life of the Insured in the United Arab Emirates the aggregate Claim Payment shall not exceed 12 monthly benefits (regardless of the number of Claims submitted)

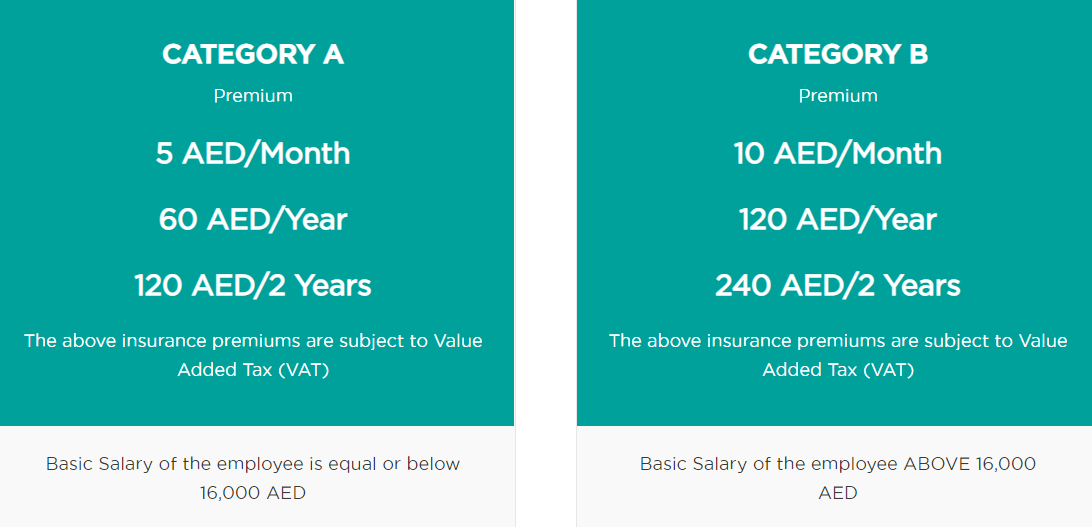

Plans

Category A Monthly Benefit

60% of the average basic salary (calculated based on the average basic salary of the last 6 months preceding unemployment), Up to 10,000 AED per month, Up to 3 consecutive months.

Category B Monthly Benefit

60% of the average basic salary (calculated based on the average basic salary of the last 6 months preceding unemployment), Up to 20,000 AED per month, Up to 3 consecutive months.

SUBSCRIPTION STARTS ON 01 January 2023

Payment Options

- Monthly

- Quarterly

- Semi Annual

- Annual/Full

Subscription Channels

- ILOE Online portal and App [www.ILOE.ae]

- Business Centers

- Exchange Centers

- Bank apps

- Telecommunications bill

- SMS

- Kiosks

Eligibility Criteria

- There must be a minimum subscription period of (12) twelve

consecutive months for the insured in the scheme Provided that there is no interruption in the subscription for three consecutive months - The Insured was committed to pay all the insurance premiums due on time

- The Insured proves that the reason for unemployment is not due to resignation

- The insured may not be dismissed for disciplinary reasons under the

Labor Relations Law and the HumancResources Law of the federal government in addition to any applicable legislation - Submit the claim within (30) thirty days from the date of loss of the work relationship or the settlement of the labor complaint referred to the judiciary

- The Insured worker should not have an existing complaint related to the absence from work.

- The insured shall not be entitled to compensation if there has been fraud or deceit involved in his claim or if the establishment where they work is fictitious

- The Loss of Employment should not be the result of non-peaceful labor strikes or stoppages, whether they result in harm or not.

- The Insured must be legally present in the United Arab of Emirates

The loss of Employment should not be the result of one of the following

reasons:

1. As a result of war, declared or undeclared, riot, insurrection, armed rebellion, revolution, military or usurping force, invasion, act of a foreign enemy, hostilities, civil war, or civil disorder

2. As a result of a discharge of pollutants, a nuclear event, a radioactive, toxic, explosive or other dangerous effects of any explosive nuclear equipment or part of such equipment

3. As a direct or indirect result of biological or chemical pollution resulting from or contributing to terrorism.

4. As a result of direct action by the government of the United Arab

Emirates that led to the expropriation or nationalization of the employer's facility or the confiscation of his money leading to his insolvency

5. As a result of the occurrence of force majeure in accordance with the

Civil Transactions Law of the United Arab Emirates No. (5) of 1985

News Source: Dubai Insurance