Owning property in Dubai has long been seen as a clear path to building wealth. With its tax-free environment, high rental yields, and world-class infrastructure, the city has attracted both local and international investors hoping to secure their financial future through real estate.

But in recent years, a shift has quietly been taking place. Rising property prices, tighter regulations, and changing lifestyles have made many people rethink the traditional buy-to-build approach. The question now being asked, especially by younger professionals and new investors, is this: Do you really need to own property to build wealth in Dubai?

The answer, increasingly, is no.

From real estate investment trusts (REITs) to fractional ownership platforms and commercial ventures, Dubai now offers multiple ways to grow your money through property, without the responsibilities that come with being a landlord. These alternatives open up the market to those who may not have millions to invest upfront but are still looking to generate passive income or long-term gains.

In this article, we’ll explore the most promising alternatives to direct property ownership and how each one fits into Dubai’s evolving real estate and investment landscape.

Real Estate Investment Trusts (REITs)

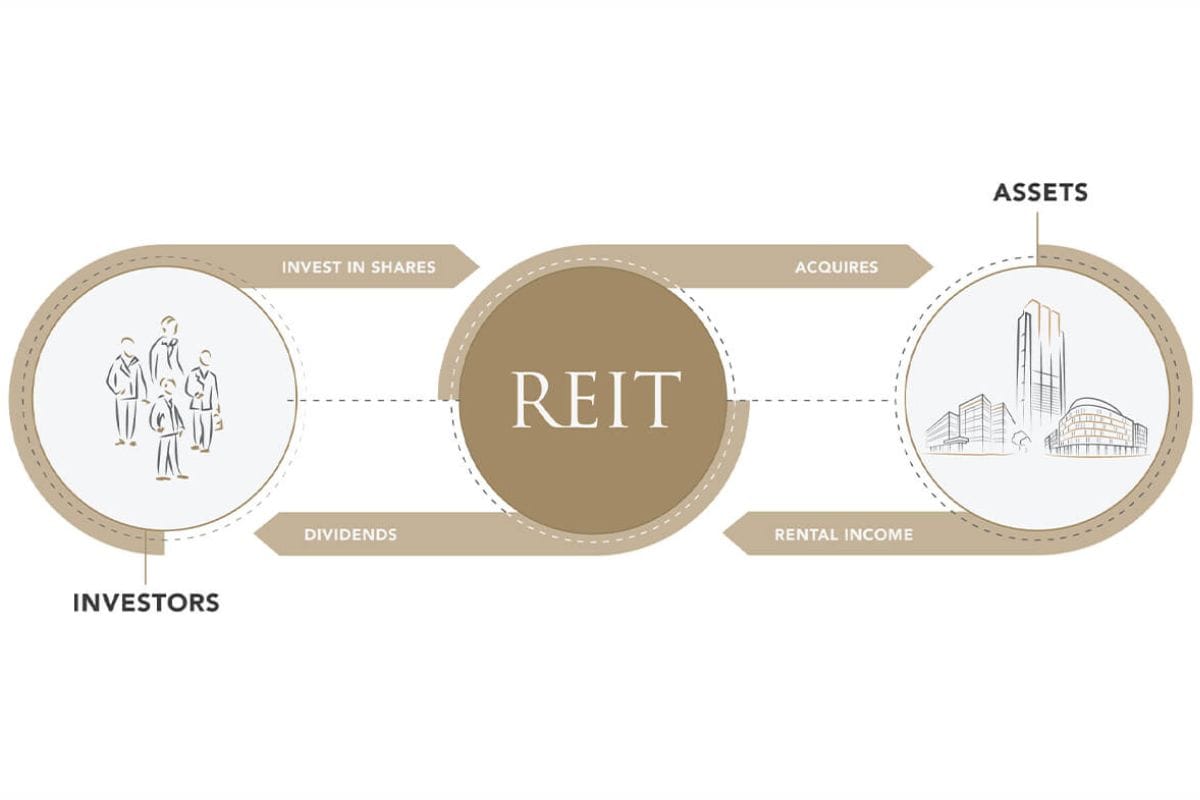

REITs offer a way to invest in real estate without having to buy, manage, or maintain any property yourself. Think of them like mutual funds, but for real estate. When you invest in a REIT, you're buying shares in a company that owns and manages a portfolio of income-generating properties, such as offices, retail spaces, schools, or warehouses.

This approach has become increasingly attractive in Dubai, especially for those who want to access the real estate market without the large upfront costs of direct ownership.

- REITs offer passive income through regular dividend payouts based on the rent collected from their property holdings.

- They are liquid investments. Shares can be bought or sold on financial markets, unlike physical property, which can take months to offload.

- Diversification is a major benefit. Instead of relying on one unit or location, your investment is spread across multiple properties and sectors.

- In the UAE, REITs like Emirates REIT and ENBD REIT are accessible to investors, each managing millions in assets across education, commercial, and hospitality sectors.

REITs are ideal for individuals who want exposure to real estate returns without the complications of ownership, like maintenance, tenant management, or fluctuating property prices.

Short-Term Rentals

Short-term rentals have gained serious traction in Dubai, especially with the rise of platforms like Airbnb and Booking.com, and a steady flow of tourists and business travelers. Instead of signing long-term leases, many property owners are opting to rent out their homes for a few nights or weeks at a time, and the returns can be significantly higher.

But what makes this an interesting alternative to traditional ownership is that you don't always need to own the property outright to profit from it.

- Short-term rentals can offer 8–12% annual returns, outperforming many long-term rental setups in the city.

- Owners or operators can register units as holiday homes through Dubai’s Department of Economy and Tourism (DET), ensuring legal compliance.

- With the right management, either personally or through a property service, vacancy periods can be minimized, especially during high-demand seasons like winter or global events.

- For those unable to purchase a full property, rental arbitrage is also becoming popular. This is where individuals lease a property long-term and sublet it short-term for profit (with landlord consent and a holiday home license).

It’s a model that works well for people with strong operational skills and an eye for hospitality, and who prefer flexibility and quicker cash flow over long-term capital appreciation

Commercial Property Investments

While residential property often gets the spotlight, commercial real estate in Dubai can be an equally, if not more, lucrative path to building wealth. Offices, retail outlets, warehouses, and even co-working spaces offer stable, long-term income opportunities for investors who want to tap into Dubai’s growing business ecosystem.

Commercial spaces tend to attract tenants with longer leases and fewer turnover-related costs, making them attractive for those seeking consistent returns with less management.

- Rental yields in the commercial segment can exceed those in residential, especially in high-demand areas like Business Bay, DIFC, or Sheikh Zayed Road.

- Commercial tenants are usually more stable, often signing multi-year contracts, reducing the risk of frequent vacancies.

- Investors can explore ready-to-use units, fit-out office spaces, or even retail shops in malls and business centers.

- With Dubai’s push toward entrepreneurship and SME growth, the demand for flexible commercial spaces is on the rise, particularly co-working hubs and boutique offices.

This route is best for investors with a higher budget and long-term outlook, who prefer stable, contract-based income with the potential for capital growth over time.

Fractional Ownership

For those who want to invest in real estate without buying an entire property, fractional ownership has opened up a more accessible route. The idea is simple: you co-own a property with other investors, each holding a share, and receive a portion of the income it generates.

In Dubai, this model is gaining popularity thanks to regulated platforms that allow people to invest with as little as AED 500.

- You get access to high-value properties, including residential apartments and commercial units, that would otherwise be out of reach for individual buyers.

- Income generated from rent is distributed to all shareholders based on their investment percentage, offering a steady stream of passive income.

- The entry point is significantly lower, which makes it a popular option for first-time investors or those looking to diversify without overcommitting.

- Platforms like SmartCrowd and Stake have made this model easier and more transparent, offering access to vetted properties with performance forecasts and legal protections.

Fractional ownership is ideal for those who want to test the real estate market, build income over time, or diversify their investments without taking on the full risks or responsibilities of ownership.

Rent-to-Own Schemes

Rent-to-own is a hybrid approach that combines renting with the option to buy. It allows tenants to move into a property as renters while gradually working toward ownership, often with a portion of their rent counting toward the final purchase price.

In Dubai, this model is gaining traction among those who want to enter the property market without committing to a mortgage right away.

- Flexibility is a key advantage. You get to live in the home before buying, giving you time to test the location and save toward the purchase.

- Some developers offer pre-agreed pricing, allowing buyers to lock in the current property value despite future market fluctuations.

- A portion of monthly rent often goes toward the down payment or reduces the final purchase cost, making it easier to build equity over time.

- Rent-to-own agreements typically span 3 to 5 years, after which the tenant can choose to buy the home or walk away.

This model works well for individuals who want to work toward property ownership but aren’t ready for a full down payment or mortgage yet.

Crowdfunding Platforms

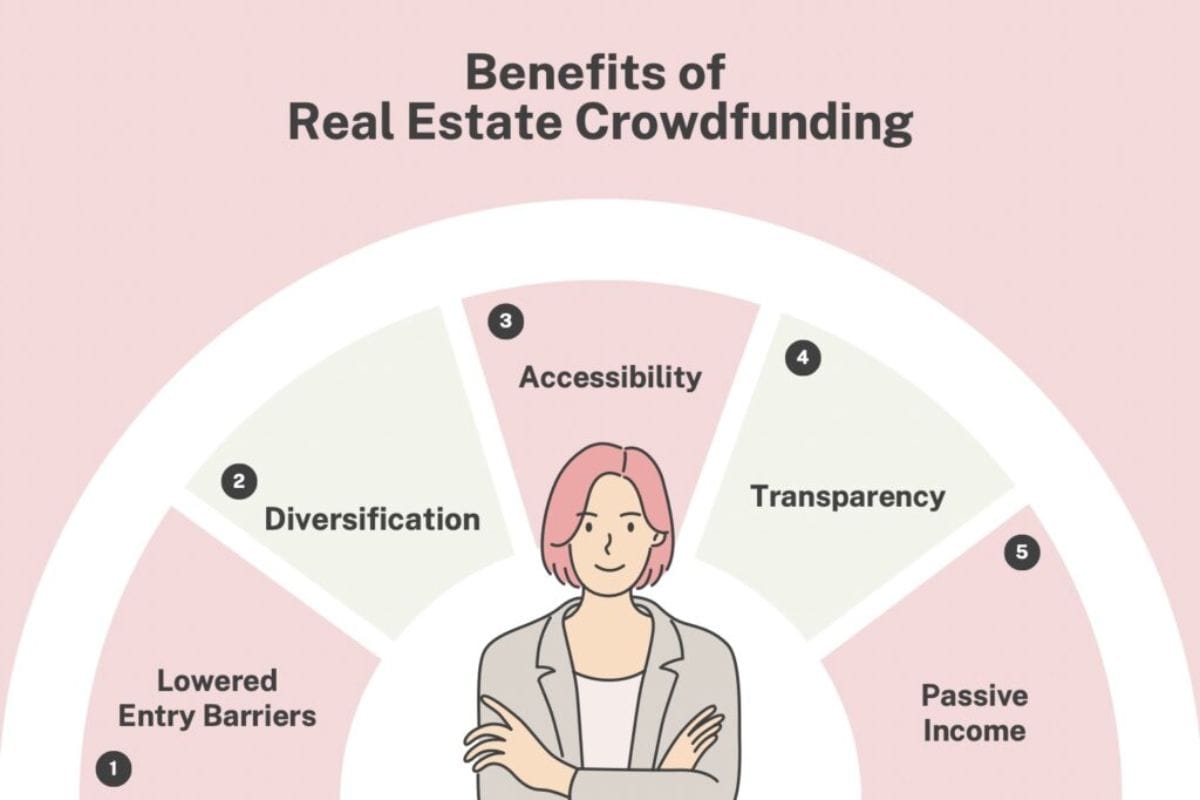

Real estate crowdfunding is changing the way people invest. Instead of buying an entire property or even a large share, investors can pool small amounts of capital with others to fund property deals, ranging from residential units to large commercial projects.

In Dubai, this approach is becoming more accessible through platforms that are regulated and transparent.

- It allows investors to start small, with minimum amounts as low as AED 500 or AED 1,000, making real estate investing possible for almost anyone.

- Returns come from rental income or capital appreciation once the property is sold, and are distributed based on the investor’s share.

- Projects are often vetted and managed by professionals, reducing the need for hands-on involvement.

- Platforms like Stake and SmartCrowd offer curated listings, market insights, and regular updates, helping investors track performance.

Crowdfunding is ideal for individuals who want to explore real estate as a passive income stream, diversify their portfolio, or invest across multiple property types with limited funds.

So, Do You Really Need to Own Property to Build Wealth?

Not necessarily. While buying property in Dubai remains a solid long-term strategy, it’s no longer the only route to building wealth through real estate. The city’s evolving investment landscape offers more flexibility than ever before, whether it’s earning passive income through REITs, tapping into short-term rentals, exploring fractional ownership, or joining a crowdfunding platform.

Each option comes with its own set of advantages, risks, and requirements. Some offer liquidity and lower barriers to entry, while others provide more stability or faster returns. The key is knowing your financial goals and choosing a model that matches your budget, comfort level, and time horizon.

Dubai is a city built on opportunity, and in today’s market, owning a property isn’t the only way to make the most of it.

Also Read: