Dubai is widely recognized as a global leader for entrepreneurship, offering a world-class infrastructure, a strategic geographic location, and a tax-friendly environment that consistently attracts the world's brightest minds. In 2026, the city’s business ecosystem has reached a new level of maturity, offering founders even more streamlined digital processes and robust regulatory support.

However, the key to a successful launch in this vibrant market is comprehensive financial planning. Building a "simple and realistic" budget means looking beyond the initial setup fees and understanding the full operational roadmap for your first 12 months.

This guide provides a professional, step-by-step breakdown of how to budget for your first year, ensuring your business is built on a solid foundation of stability and growth.

1. The Strategic Foundation: Choosing Your Jurisdiction

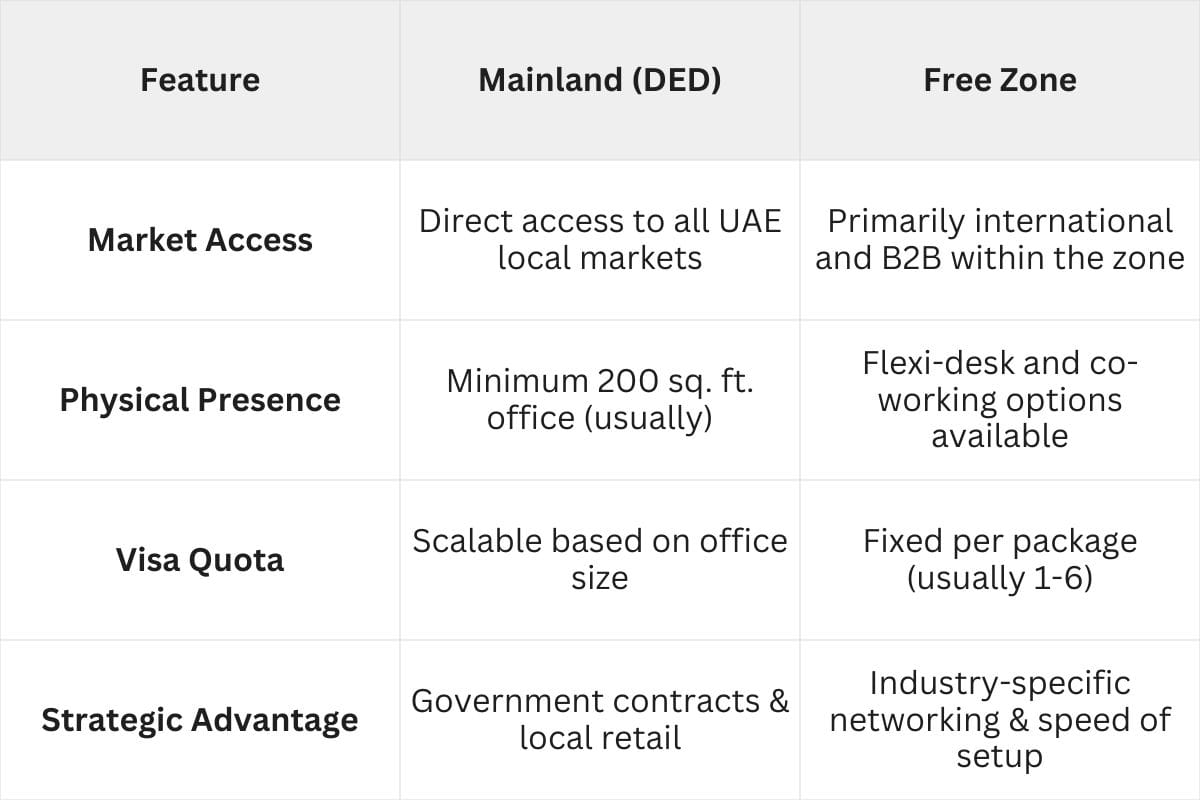

Your first budgetary decision is choosing the jurisdiction that aligns with your long-term vision. Dubai offers two primary pathways, each designed to support different types of business models.

Free Zone Jurisdictions: Innovation and Efficiency

Free zones like DMCC, IFZA, or Dubai Silicon Oasis are designed as specialized hubs for specific industries (tech, media, commodities). They offer 100% foreign ownership and are ideal for businesses focused on international trade or digital services.

- Budgetary Focus: Free zones typically offer "all-in-one" startup packages.

- Average Cost (2026): Basic packages start from AED 12,500 to AED 25,000, often including a license and one visa quota.

Mainland (Onshore): Unlimited Market Reach

Regulated by the Department of Economy and Tourism (DET), a Mainland license allows you to trade directly with any business or consumer within the UAE and bid on government contracts.

- Budgetary Focus: Higher upfront investment in exchange for total market access.

- Average Cost (2026): Licensing fees typically range from AED 15,000 to AED 35,000, depending on your activity.

2. Investing in Human Capital: Residency and Visas

One of the great advantages of starting a business in Dubai is the ease with which you can secure residency. Your budget should reflect this as an investment in your personal and professional stability within the city.

Residency Visa Costs

In 2026, most investor and employment visas are valid for two years. The government has streamlined this process through digital portals, making it more efficient than ever.

- Standard Processing: Budget AED 4,500 – AED 7,000 per visa.

- Components: This includes the entry permit, change of status, medical fitness test, and the issuance of your Emirates ID.

Mandatory Health Insurance

Dubai prioritizes the well-being of its residents. Health insurance is a mandatory requirement for all visa holders.

- Basic Plan (EBP): Approximately AED 750 – AED 1,200 per year.

- Comprehensive Coverage: For founders seeking higher-tier medical access, budget AED 2,500 – AED 5,000.

3. Infrastructure and Workspace: Your Business Home

Dubai offers some of the world's most modern workspaces. Whether you need a prestigious address in Business Bay or a creative co-working space in Alserkal Avenue, your choice of office will be your biggest "operating" expense.

Flexible Office Solutions

Many new founders utilize Flexi-Desks or Business Centers. This allows you to maintain a physical presence—a legal requirement—while keeping costs low.

- Flexi-Desk (Free Zone): AED 8,000 – AED 15,000 per year.

- Physical Office (Mainland): AED 130 – AED 350 per sq. ft.

The Municipality Fee & Utilities

When budgeting for an office, remember to include the Dubai Municipality Fee, which is 5% of your annual rent. This is a standard contribution that supports the city's world-class public services and infrastructure.

- Utilities (DEWA): For a small office, budget AED 300 – AED 600 per month.

- Telecommunications: Business internet packages (essential for a local .ae presence) range from AED 450 to AED 900 per month.

4. The Professional Layer: Compliance and Tax

In 2026, Dubai has fully transitioned into a mature, internationally aligned tax environment. The government has introduced several initiatives to ensure this transition is supportive of small businesses.

Corporate Tax and Small Business Relief

The UAE has a standard corporate tax rate of 9% on profits above AED 375,000. However, the government actively supports startups through the Small Business Relief (SBR) program.

- The Benefit: If your annual revenue is below AED 3,000,000, you can elect for SBR, which effectively brings your tax liability to zero until the end of December 2026.

- Budgeting Tip: Even with 0% tax, you must register for Corporate Tax. Budget for a cloud-based accounting software (like Zoho or Xero) at AED 200/month to ensure your records are compliant from Day 1.

Digital Banking

Dubai is a leader in FinTech. For new founders, digital-first banks like Wio Business provide an excellent, low-cost entry point.

- Monthly Fees: Usually AED 99.

- Traditional Banks: May require a minimum balance of AED 25,000 – AED 50,000. Budgeting for this "locked" capital is essential for a realistic cash flow forecast.

5. Market Growth: Connecting with your Audience

Dubai is a hyper-connected, global city. To succeed here, your budget must account for active participation in the local business community.

- Networking & Memberships: Joining the Dubai Chamber or industry-specific groups (like Dubai FinTech Hive) is invaluable. Budget AED 3,000 – AED 5,000 for annual memberships.

- Digital Marketing: Ad spend in the UAE is competitive but highly rewarding. A realistic starter budget for social media and Google Ads is AED 2,500 – AED 5,000 per month to build initial brand awareness.

6. The Comprehensive Year 1 Budget Roadmap (Professional Estimate)

The following table represents a realistic first-year budget for a Consultancy Startup in a Dubai Free Zone with one founder and no initial employees.

7. Professional Best Practices for Budget Success

To ensure your first year is as smooth as possible, follow these professional standards practiced by Dubai's top entrepreneurs:

- Early Compliance Registration: Register for Corporate Tax as soon as your license is issued. This demonstrates professional transparency and avoids any administrative late-filing fees.

- Attestation Readiness: If you are using foreign degrees or marriage certificates for your visa or company structure, have them attested by the Ministry of Foreign Affairs (MOFA) early. Budget AED 2,000 for these administrative formalities.

- The "Success Buffer": In any dynamic market, opportunities appear quickly. A 10-15% reserve fund is not for "hidden costs" but for strategic agility—allowing you to scale a marketing campaign or hire a freelancer exactly when you need to.

Building a budget for your first year in Dubai is an exercise in vision and responsibility. By planning for the full scope of your setup, residency, and compliance needs, you are showing respect for the high standards of the Dubai market.

The costs associated with starting here are an investment in one of the most stable, safe, and technologically advanced cities on earth. With proper planning and a realistic budget, you can spend less time worrying about finances and more time contributing to the incredible growth story that is Dubai in 2026.

Also Read: