Are you an entrepreneur with your sights set on Dubai's bustling business scene? With its thriving economy and strategic location, Dubai is a prime destination for startups and small businesses from all over the world. And if you're looking for a business structure that offers flexibility and legal protection, a Limited Liability Company (LLC) might just be the perfect fit for you!

However, the process of setting up an LLC in Dubai can be a little overwhelming. But don't worry, we've got you covered. In this guide, we'll take you through all the key benefits of LLCs and walk you through each step of the setup process. So buckle up and get ready to turn your Dubai business dreams into a reality!

Here's a complete guide to forming your own LLC in Dubai!

What is an LLC?

Of course, before getting into the details, we need to start from the beginning. So, what is an LLC?

LLC stands for Limited Liability Company, and it's one of the most popular choices for starting a business in Dubai. As the name suggests, it provides limited liability protection to its owners, which means that the personal assets of the business owners are protected in case of any legal issues or debts.

Types of LLCs

Just like any other business company, a Limited Liability Company (LLC) can have various types or structures. The two most common types of LLCs are single-member and multi-member LLCs. As their names suggest, the primary difference between the two is the number of owners or members involved in the business.

Single-member LLCs are a popular choice for sole proprietors who want to limit their personal liability while enjoying the benefits of pass-through taxation. In this structure, the owner has complete control over the business and is solely responsible for its operations and decision-making. Additionally, the owner can enjoy the benefits of limited liability, which means that their personal assets are separate from the company's assets and are protected from lawsuits and creditors.

On the other hand, multi-member LLCs are the most common structures, allowing multiple owners and members to share profits, losses, and management responsibilities. This type of LLC is ideal for businesses that have more than one owner or partner. In a multi-member LLC, each member has a say in the company's operations and decision-making, and they share the responsibility of managing the business. Moreover, each member's personal assets are protected from the company's liabilities, providing them with limited liability protection.

Benefits of Setting Up an LLC

Dubai offers numerous advantages for LLC businesses, including limited liability protection, tax advantages, business flexibility, and more! Here are some of the advantages.

- LLCs are 100% tax-free, meaning they can trade anywhere in the UAE and the GCC countries without paying taxes. However, companies registered in the UAE mainland and that are doing business in UAE local markets must pay corporate tax at a rate of 9% on earned profits over a certain number. This benefits entrepreneurs and businesses looking to start a business in the UAE by saving money on taxes and keeping more of their profits.

- Registering an LLC company in Dubai is affordable and quick, with no overhead application fees and quick license registration with the Department of Economic Development (DED).

- There is no minimum share capital needed for an LLC, and shareholders only need to show the authorized share capital of AED 100,000.

- UAE LLC companies have a wide variety of permitted business activities, with fewer to almost no restrictions on those activities. The UAE provides more than 2,000 business activities in various sectors, and obtaining DED clearance allows for the establishment of an LLC firm with various business ventures.

- UAE entrepreneurs can apply for multiple visas when forming an LLC, including an investor visa valid for two years and a long-term prestigious golden visa for foreign nationals after successfully completing one year of business, having equity, and retaining earnings of more than 2 million AED.

Steps of Setting Up an LLC

So, with all the basics covered, it's time to see what steps are needed to form your own LLC.

Identify a Business Activity

To form an LLC company in Dubai, the first step is to choose the right business activity from a wide range of options.

As a first step, you should explore the list of over 2000 business activities provided by the Department of Economic Development (DED). Dubai offers a wide range of business activities for entrepreneurs to choose from, including but not limited to, trading, manufacturing, and professional services.

Once you have identified the business activity that suits your business, it is important to conduct market research to determine its potential for growth. This research will help you identify and understand your target market, competitors, and potential challenges you may face along the way.

Choosing the right business activity is crucial because it helps set clear business goals and objectives. It also ensures that your business is aligned with market demand, which can increase your chances of success in the long run. Therefore, it is important to take your time and make an informed decision during business registration in Dubai.

Select Your Location and Workspace

When it comes to forming an LLC company in Dubai, having an office is of utmost importance, whether it's a physical one or a virtual one. Not only does it provide convenience, but it also offers flexibility, which is necessary for a growing business.

Before acquiring an office space, you need to consider several factors such as budget, space requirements, the number of employees you have, and the technological requirements of your business. It is also important to note that a lease or rent agreement is required when acquiring an office space.

Fortunately, many companies can register in the UAE without renting office space for the first year. This is an excellent opportunity for foreign nationals to test the market and save costs. However, it is important to note that this rule may vary depending on the business activity and jurisdiction.

Choosing the right location for your office depends on your business's unique needs and market conditions. It is essential to conduct thorough research and consider all the relevant factors to ensure that you choose a location that is suitable for your business's growth and success.

Register the Trade Name

When you're setting up your LLC in Dubai, you must choose a unique business name. During the process of registering your LLC, you should take the time to carefully select an appropriate trade name and reserve it with the Dubai Department of Economic Development. One important thing to keep in mind is to avoid using any offensive words or religious references in your chosen name. This will not only help you to maintain a professional image, but it will also help you to avoid any potential legal issues that could arise from using inappropriate language or references in your business name. By choosing a unique, secure, and appropriate trade name for your LLC, you can help ensure that your business is easily identifiable and that it stands out in a crowded and competitive marketplace.

Create MOA for Approval

A Memorandum of Association (MoA) is an important legal document that serves as the foundation of a company's authorization. It contains detailed information about the company's goals, objectives, shareholding structure, and other key business details. This document is a crucial requirement for the registration of a company and must be translated into the appropriate language and attested by a Notary Public like Dubai Courts or the Ministry of Justice.

The MOA should clearly outline the company's business activities, legal standing, and connection with its shareholders. It should also specify the rights and responsibilities of the shareholders, directors, and other stakeholders. This document must be provided to the relevant authorities along with the lease or rental agreement for the company's registered office. Failure to comply with these requirements may result in delays or rejection of the company's registration application.

Submit Your Documents to DED

Now you're almost done! All that's left to do now is submit all of your documents to the Dubai Department of Economic Development.

The documents needed are:

- Passport copy of investor and local sponsor

- Copy of Emirates ID

- Copy of DED registration form

- Lease agreement for office space

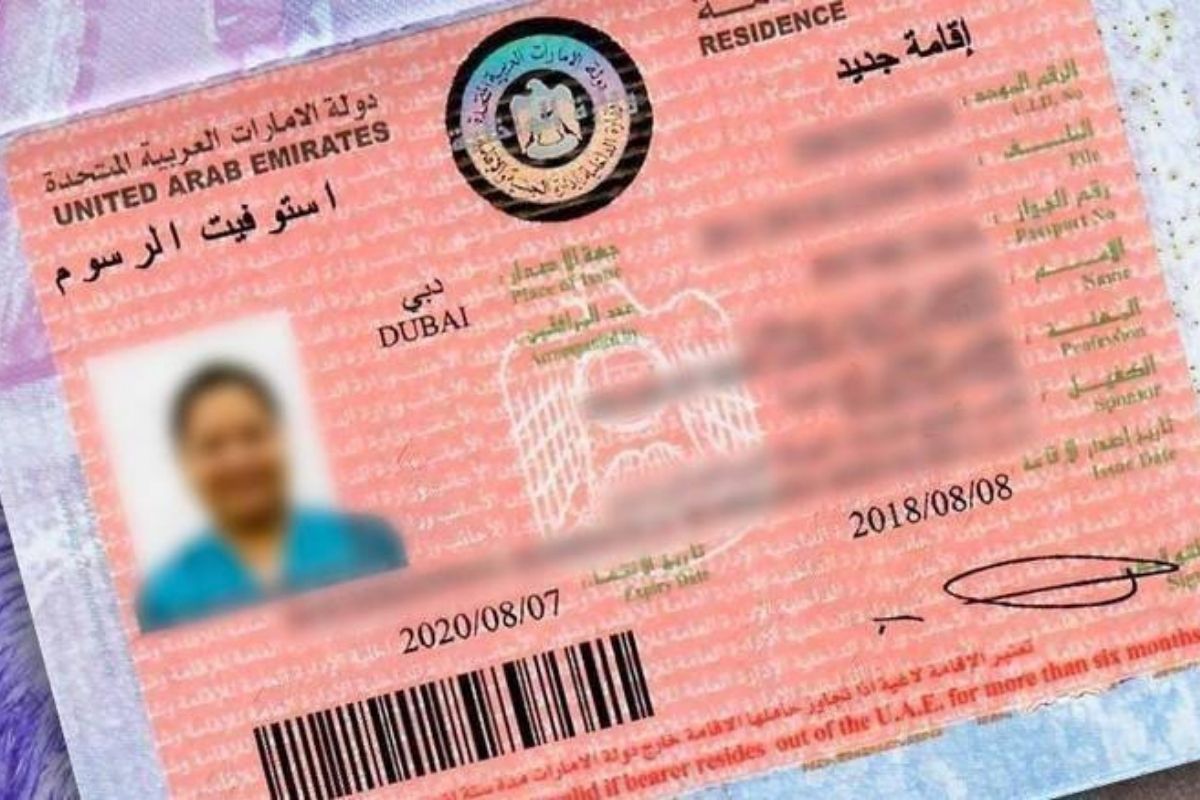

- Entry Visa

- A No Objection Certificate (NOC) if the shareholder is currently employed by a UAE company

- An attested Memorandum of Association (MOA) from a public notary

Get Your Trade License and Legal Documents

Once you have received approval from the DED and meet all the requirements, you will be issued legal documents such as a Trade License, Certificate of Incorporation, Memorandum of Association, and Share Certificates for your company. Additionally, you will also obtain other legal documents such as visas, tenancy agreements, labor cards, and more. The Memorandum of Association of your LLC will also be published in the Bulletin of the Economy and Commerce Ministry. Now, you're all set to start your business!

Costs of an LLC Company Formation

Of course, the process of forming an LLC in Dubai or anywhere else can be costly, involving expenses such as business registration, investor visas, employment visas, opening a corporate account, and government fees and taxes. Here's a run down of the expenses you may face when forming your LLC.

Registration Cost

In Dubai, the cost of LLC licenses typically starts at AED 18,500. However, registering a corporation in Dubai usually costs between AED 25,000 and AED 27,000 depending on the services and type of industry.

Investor's Visa Cost

The investor visa costs for an LLC in Dubai can range from AED 4,500 to AED 5,250.

Employment Visa Cost

The cost to issue an employee visa varies based on the type of business and employee category and can range from AED 5,000 to AED 7,000.

License Renewal Cost

In Dubai, businesses must renew their trade licenses annually to comply with regulations. A trade license renewal in Dubai can be expensive depending on a number of variables, such as the economic zone and jurisdiction. The trade license renewal cost in Dubai usually ranges from AED 8,000 to AED 15,000. It is crucial to remember that these numbers are approximations and may change depending on particular needs and the nature of the business activity.

*You would also need to keep in mind the cost of getting an office and furnishing it as well as the various application fees.

And with that, you've officially formed your LLC and you're ready to go! Now it's time to start building your brand, marketing your services, and growing your business. Remember to stay organized, stay focused, and don't be afraid to seek help or advice when needed!

Also Read: