Chinese online fast-fashion retailers are rapidly gaining ground in the US fashion sector, as per recent industry data.

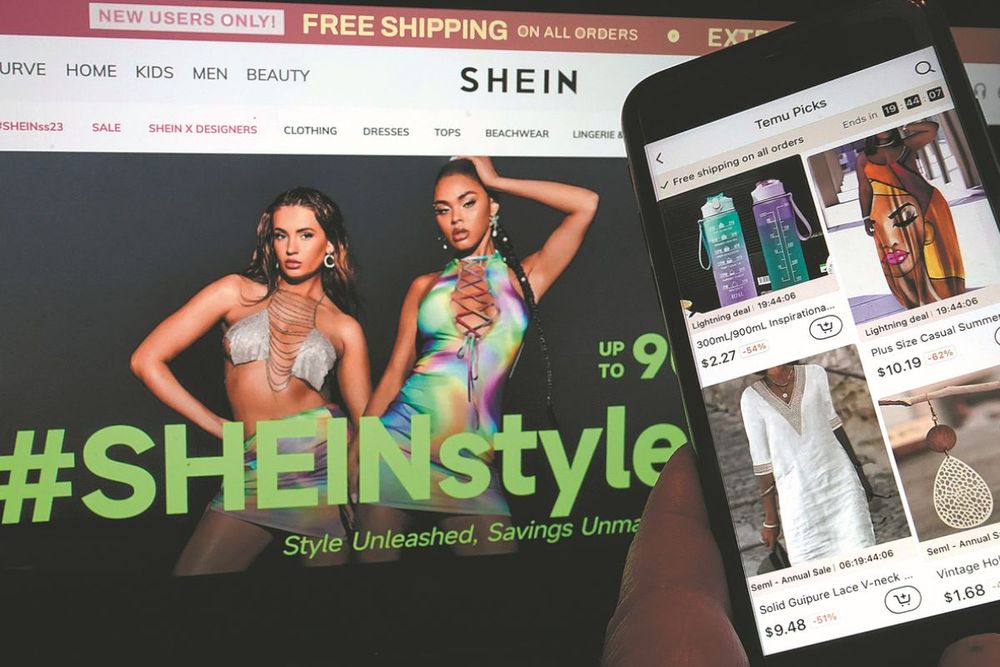

These e-commerce platforms have evolved into thriving hubs for both buyers and sellers, driving the expansion of international commerce for Chinese enterprises. Among these platforms, Shein and Temu are attracting much of attention from US consumers.

These e-commerce platforms are capitalizing on their competitive pricing, complimentary shipping, regular promotional offers, and flexible return policies. In the previous year, Shein, a digital fashion platform, achieved a remarkable milestone by garnering 200 million downloads, surpassing even Amazon to become the most frequently downloaded application across both Apple and Google stores.

The platform has reported a substantial annual revenue of $30 billion along with 13.7 million users on an annual basis. In comparison to well-known fashion brands such as H&M, Zara, or Uniqlo, similar-styled products available on Shein are priced more affordably, often falling within the $20 to $30 range per item. Users of the app are also granted daily discount vouchers, ensuring their access to better pricing options.

As per the US Bureau of Labor Statistics' Consumer Price Index, apparel prices rose 3.1 percent in the past year. The increase in clothing and footwear costs is putting a strain on the budgets of many US consumers and they are looking for cheaper alternatives, according to analysts.

Shein and Temu strategically entered the US market during a period of relatively high inflation. Last year, the inflation rate for apparel reached 5.03 percent and dropped to 3.17 percent this year.

Apart from being price-driven, the styles and trends of products have also captured millions of customers. Both Shein and Temu have outpaced traditional US brands with their faster rollout speed. Data collected by Rest of World revealed that between July and December 2021, they added between 2,000 and 10,000 SKUs (stock-keeping units, or individual styles) to their apps each day.

Drawing on a user experience approach similar to its parent company Pinduoduo, which is a top competitive retailer in China, Temu has rapidly attracted US customers.

Unlike Shein, which mainly sells branded apparel, Temu operates more like a marketplace, also selling home appliances, furniture, and other accessories. According to Bloomberg Second Measure, spending on Temu was 20 percent higher than the more established fast-fashion retailer Shein in the US in May.

Shein and Temu have been entangled with lawsuits back and forth for months, while other small Asian e-commerce platforms like TikTok Shop, AliExpress, and Wish are also entering the US market.

Shein and Temu also attract Asian customers in the US.

"It makes me feel at home, like shopping with Taobao,"

said Cici Wang, an international student at New York University, referring to the popular Chinese e-commerce platform.

"The products are cheaper and cuter than those on Amazon."

News Source: China Daily