mimojo, the UAE’s revolutionary cashback reward app, is poised for exponential growth.

The PYMNTS Intelligence and BANYAN report highlights increasing consumer interest in Card Linked Offers. In the UAE, mimojo, a cashback app, expands its merchant partnerships and adds Mastercard to its partner card schemes, reflecting the trend.

Chris Shaw, CEO, said of the report findings,

‘This report presents valuable insight into how our propriety technology is positioned for success, particularly against the backdrop of the latent need for a fresh approach to reward and loyalty in the UAE. In other mature markets, the impact of Card Linked Technology has been explored and proven. Powerful statistics such as CLO customers delivering a 90% repeat usage rate figures merchant operators in the UAE can’t afford to ignore. Here in the UAE, we are one of the first players to explore the opportunity for CLO within the rewards and loyalty market, we know that CLO is a game-changer for business growth.”

The report from PYMNTS presents data insights that demonstrate the powerful impact CLO programme can bring to influencing consumer habits:

- Once consumers have been introduced to card-linked offers, they get hooked, and more than 9 in 10 card-linked offer users plan on using them in the next 12 months.

- 57% of cardholders said they were likely to switch to a merchant that participates in card-linked offers tied to specific products

- 59% of Gen Z and 52% of bridge millennial consumers currently using card-linked offers expect to increase their use in the next year.

Shaw said,

“The report also presents poignant data we have to be mindful of when considering how we take mimojo to market. 25% of non-users note that they do not understand or are not comfortable with how card-linked offers work – this is vitally important for us to consider within our communication strategy on how we build trust and deliver assurance to consumers trialing this new technology for the first time.”

mimojo is the first-of-its-kind cashback reward app that redefines the reward and loyalty ecosystem for merchants and consumers. Co-founder Chris Shaw (CEO) and his team have leveraged over a decade of industry experience to address key challenges in the UAE’s reward redemption market.

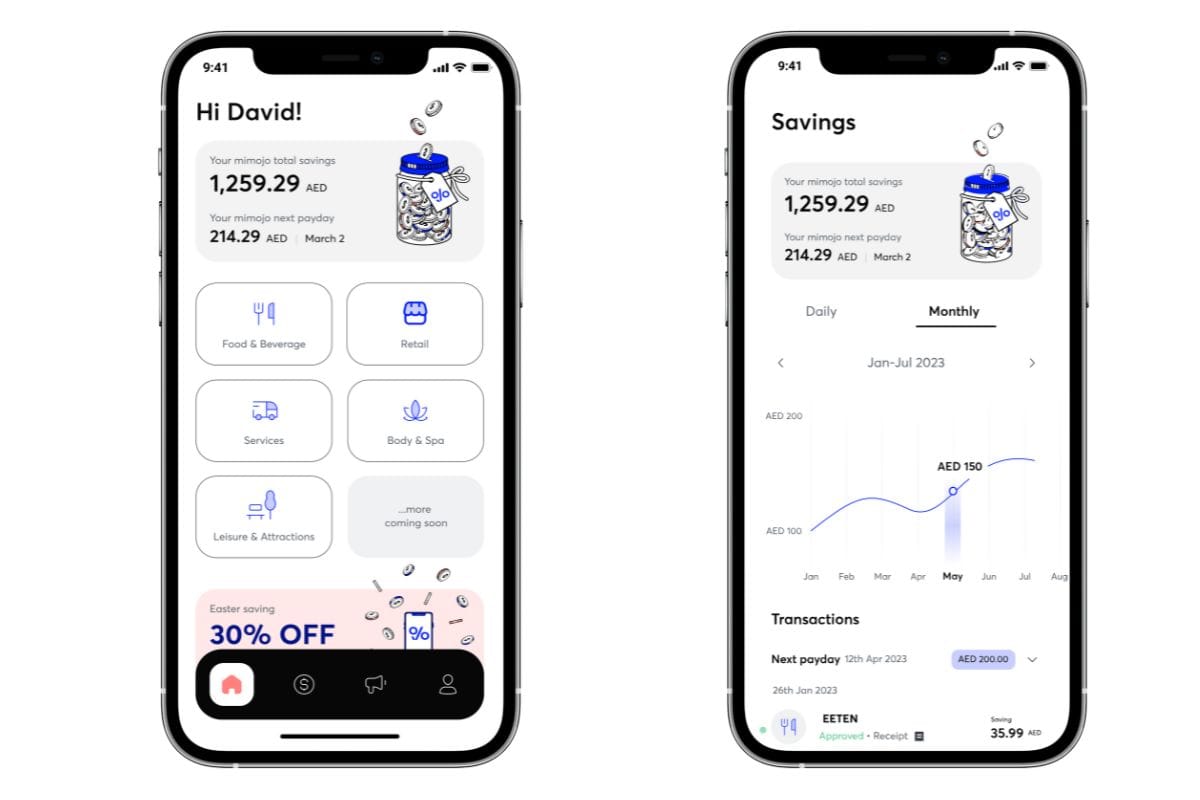

mimojo simplifies cashback rewards by linking Visa or Mastercard to its app, processing rewards with each purchase and crediting earnings monthly. Celebrating a milestone, it welcomes Al Boom Retail and Drink Dry, aiming to boost customer bases, average spending, and retention through strategic partnerships.

These new additions to mimojo join the likes of Zofeur, Coffee Planet, Gloria Jean’s, WashOn and more of the UAE’s top merchant partners across Food & Beverage, E-Commerce, Fitness & Wellness, Service and Attractions & Leisure.

How mimojo works:

- Download and sign up to mimojo

- Enrol using your Visa or Mastercard. You can add an unlimited number of cards to your account.

- Browse the app to discover your nearest / favourite venues

- Visit your preferred merchant or retailer and pay directly via your registered card(s)

- THAT’S IT – mimojo magic will pick up the transactions and add your earned cashback to your payday.

- On the 15th of every month, mimojo payday, users will receive their approved cashback disbursed directly to their card.

mimojo is available to download via the AppStore and GooglePlay. For more details, log onto their website or follow @mimojoapp on social media.