In the rapidly evolving digital landscape of the United Arab Emirates, the choice of a payment gateway is a strategic pillar for business growth. As the nation moves toward a cashless society, small and medium enterprises (SMEs) find themselves at a critical juncture where the speed of a transaction can determine the success of a customer relationship.

A robust payment gateway does more than just process credit cards; it builds trust, ensures security against sophisticated cyber threats, and integrates seamlessly into the daily operations of a modern business. For any startup or a growing boutique, the right partner is one that understands local nuances, such as the regional preference for Apple Pay and the rising demand for instant bank-to-bank transfers.

The following guide provides an informational breakdown of the top-rated payment gateways in the UAE, evaluated on their fee structures, integration capabilities, and unique features tailored for small businesses.

1. Telr: The Regional Specialist for Emerging Brands

Telr has established itself as a premier choice for UAE-based startups due to its deep roots in the Middle Eastern market. It was the first independent vendor in the region to be certified by both Visa and Mastercard, giving it a level of credibility that resonates with local banks.

- Best For: E-commerce startups and SMEs that require quick onboarding and localized support.

- Key Features: One of Telr’s standout features is its "Telr Social" tool, which allows merchants to sell directly through social media platforms by generating secure payment links. It also offers a "mini-store" setup for businesses that do not yet have a full website.

- Technical Advantage: The platform supports over 120 currencies and provides a robust anti-fraud system that is specifically tuned to regional transaction patterns.

- Pricing Structure: Telr often uses a tiered subscription model (Entry, Small, and Medium). This is beneficial for small businesses as it allows them to start with a "0% transaction fee" entry plan for a fixed monthly cost, making monthly expenses highly predictable.

2. PayTabs: The Versatile All-rounder

PayTabs is a powerhouse in the MENA region, known for its "plug-and-play" simplicity. It has built its reputation on reducing the technical barrier to entry for business owners who may not have a dedicated developer team.

- Best For: SMEs looking for a comprehensive suite of tools beyond simple payment processing, including invoicing and global reach.

- Key Features: PayTabs excels in Digital Invoicing. Businesses can create and send professional, tax-compliant invoices directly to customers via email or SMS, with an embedded "Pay Now" button.

- Integration: It offers ready-made plugins for virtually every major e-commerce platform, including Shopify, WooCommerce, Magento, and OpenCart. This allows for a "go-live" time that can often be measured in hours rather than days.

- Security: The platform is PCI DSS Level 1 compliant and utilizes a proprietary "dual-layer" fraud protection system to safeguard both the merchant and the consumer.

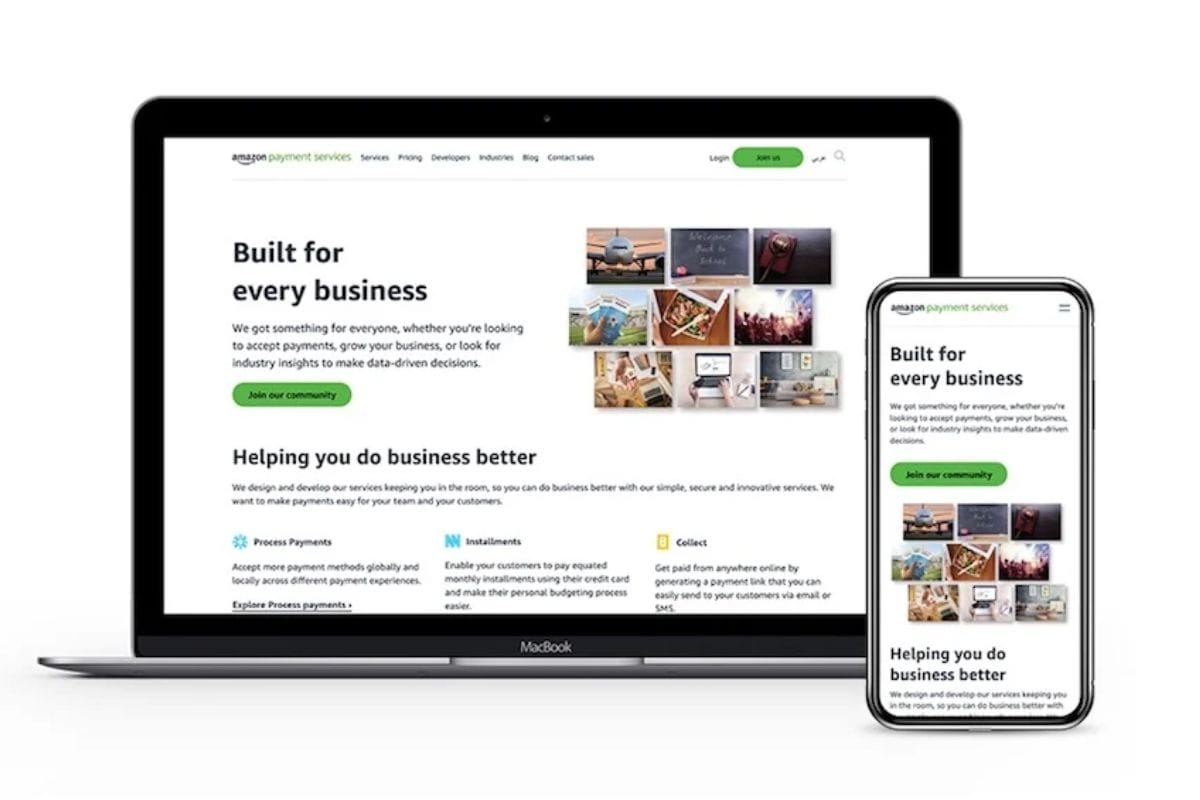

3. Amazon Payment Services (Formerly PayFort)

As part of the Amazon family, this gateway offers a level of infrastructure and reliability that is difficult to match. It is designed for businesses that anticipate high volumes and require a gateway that can handle massive traffic spikes without latency.

- Best For: Established small businesses and larger retailers looking for maximum uptime and brand-name trust.

- Key Features: The "Installments" feature allows merchants to offer their customers the ability to pay in monthly bits through local banks, which is a significant driver for high-ticket item sales in the UAE.

- Advanced Analytics: The dashboard provides deep insights into why payments might be failing, allowing businesses to optimize their checkout flow and increase "authorization rates" (the percentage of successful transactions).

- Local Compliance: Being deeply integrated with the UAE financial system, it offers seamless support for local schemes like Mada and domestic debit cards.

4. Network International (N-Genius)

Network International is the largest acquirer in the UAE and a titan of the local financial industry. Their N-Genius platform is a hybrid solution that bridges the gap between physical retail and online commerce.

- Best For: "Brick-and-mortar" businesses that also sell online and want a single provider for both their physical POS (Point of Sale) machines and their website.

- Key Features: The Omnichannel dashboard allows a business owner to see their in-store sales and website sales in one place. This simplifies accounting and inventory management significantly.

- Speed of Settlement: Because of their direct relationships with UAE banks, Network International often offers faster settlement times, ensuring that cash reaches the business’s bank account with minimal delay.

- Customization: The N-Genius gateway is highly modular, allowing businesses to add features like multi-currency conversion and advanced "3D Secure" authentication as they grow.

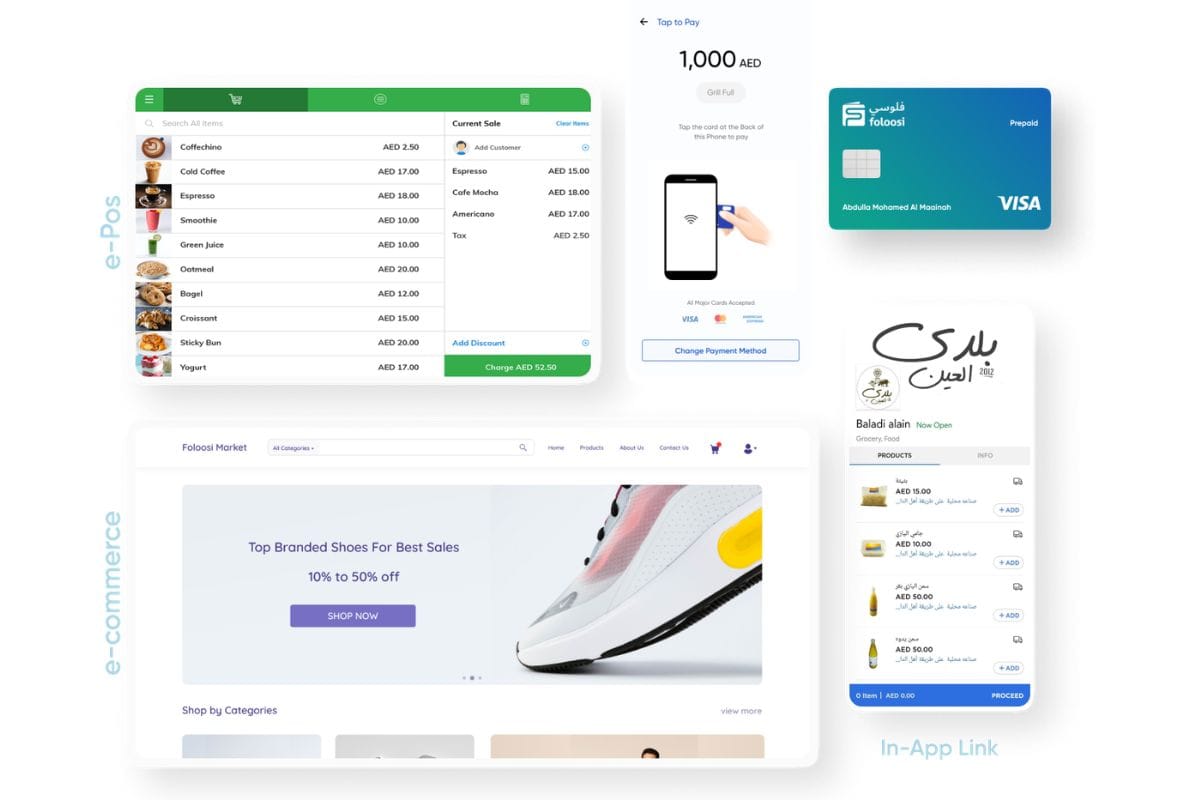

Foloosi: The Specialist in "Social & QR" Commerce

Foloosi has gained massive traction among UAE home-businesses and boutique cafes. They focus on making payments "link-based," meaning you don’t even need a website to get paid.

- Standout Feature: "Tap on Phone." Foloosi allows merchants to turn their Android smartphones into a payment terminal without any extra hardware.

- Best For: Instagram sellers, pop-up markets, and delivery-based businesses.

- Digital Tools: They offer a simplified "Store Setup" feature that helps SMEs launch a basic digital storefront in minutes.

Key Considerations for UAE SMEs

When selecting between these top-rated providers, small business owners should look beyond the headline transaction fee. Several secondary factors can have a larger impact on the bottom line:

The Settlement Cycle

In the UAE, settlement cycles can range from "T+1" (one day after the transaction) to "T+7." For a small business where cash flow is the lifeblood of operations, a 7-day delay can be a significant hurdle. Providers like Network International and PayTabs are often praised for their faster local settlements.

Onboarding and Compliance

The UAE has strict "Know Your Customer" (KYC) and Anti-Money Laundering (AML) regulations. Some global gateways have automated onboarding that can be completed in minutes, while local providers may require physical documents and a few days of manual review. Founders should choose based on how urgently they need to start accepting payments.

Multi-Currency and Cross-Border Fees

If your business targets tourists or international clients, look for a gateway that offers "Like-for-Like" settlement. This allows you to accept USD and receive USD in your account without losing 2-3% on currency conversion fees.

Integration with Local Innovations

The UAE Central Bank has recently introduced the Aani instant payment platform, allowing for bank-to-bank transfers via mobile numbers. Top-tier gateways are increasingly integrating these local rails, allowing SMEs to accept payments at a much lower cost than traditional credit card networks.

The "best" payment gateway is ultimately the one that aligns with your specific business model. If you are a local merchant selling high-end furniture and want to offer instalments, Amazon Payment Services or Telr might be more suitable.

By choosing one of these top-rated partners, UAE small businesses can ensure they are not just "collecting money," but providing a seamless, secure, and world-class experience that keeps customers coming back.

Also Read: