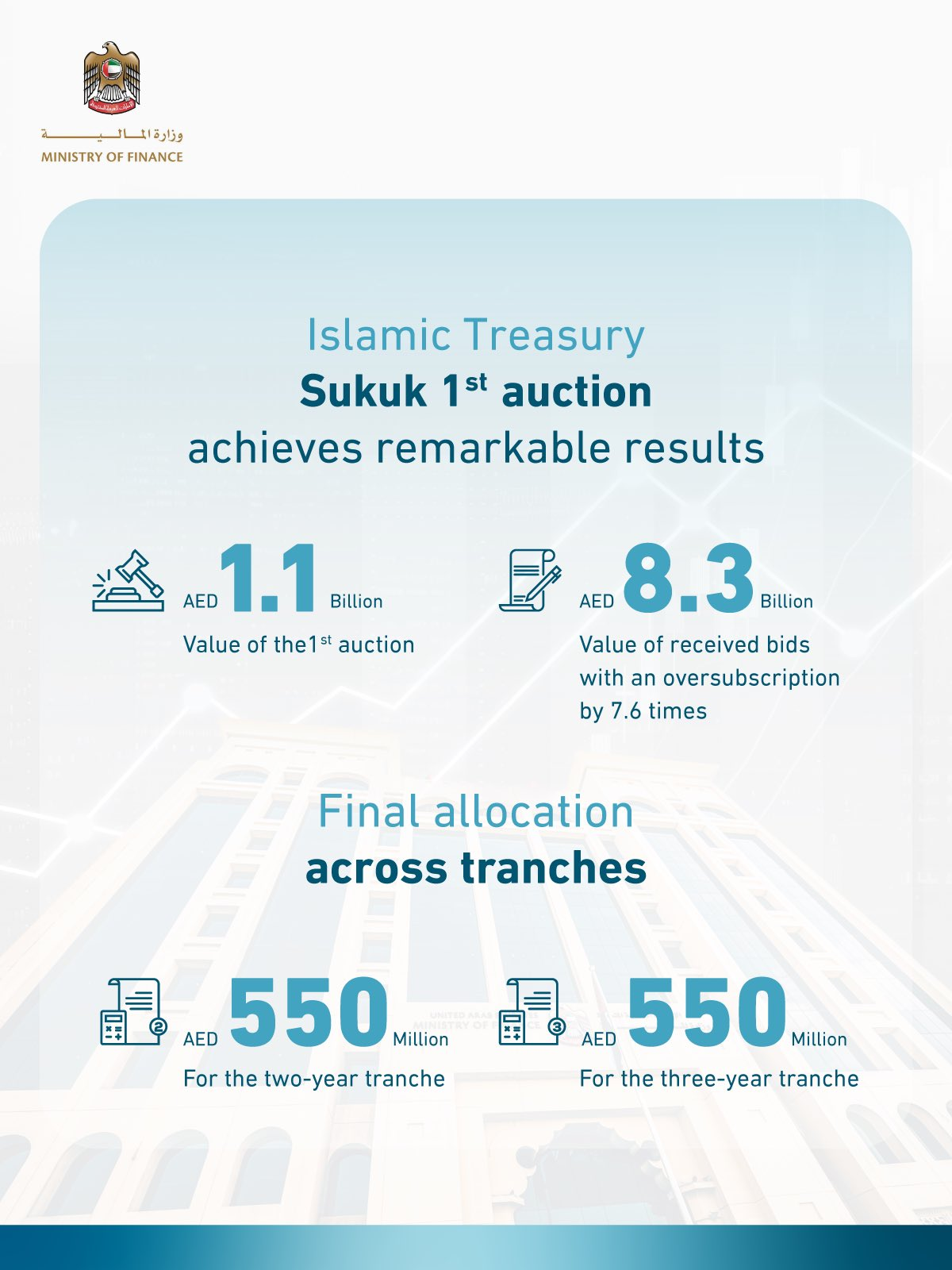

The UAE, represented by the Ministry of Finance (MoF), the issuer, in collaboration with the Central Bank of the UAE (CBUAE), the issuing and paying agent, has announced the results of the first auction of the dirham-denominated Islamic Treasury Sukuk (T-Sukuk), with a benchmark auction size of AED1.1 billion, which is part of the T-Sukuk issuance programme for 2023.

The launch of the AED1.1 billion UAE T-Sukuk programme witnessed strong demand through its eight primary bank dealers, with bids worth AED8.3 billion, and an oversubscription of 7.6 times. The strong demand was across both tranches, with a final allocation of AED550 million for the two-year tranche, and AED550 million for the three-year tranche, with a total issuance of AED1.1 billion.

Global investment destination

His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai and Deputy Prime Minister and Minister of Finance of the UAE, said the successful launch of the T-Sukuk auction reflects the UAE's prudent strategic investment policies and objectives, as the country continues to solidify its position as a global investment destination and one of the most competitive and advanced economies in the world, particularly in the Islamic economy sector.

His Highness Sheikh Maktoum bin Mohammed said:

“T-Sukuk issuances will offer high-quality Islamic assets at competitive prices due to the increase in the investor base, which reflects positively on the country’s economy and investment environment.”

Investment structure

This success reiterates the confidence of investors in the UAE’s investment structure and local economy, which is reflected in the attractive market driven prices that were equivalent to US Treasuries with similar maturities.

The first T-Sukuk auction will soon be followed by a listing on Nasdaq Dubai to promote secondary market trading along with primary dealers. The T-Sukuk programme was developed in uniform pricing (the Dutch Auction) for final bid acceptance of bids and final allocation amounts, regardless of the lower-priced bids received to ensure full transparency in accordance with global best practices for sukuk structuring. The programme will provide safe investment alternatives, further contributing to the development of the UAE’s investment environment.

The lowest bid for the two-year tenor was at 3.90%, with the weighted average bids at 3.96% and the final uniform coupon rate fixed at 3.97%. The lowest bid for the 3-year tenor was at 3.62%, with the weighted average bids at 3.66% and final uniform coupon rate fixed at 3.70%. The first auction will be followed by a series of subsequent periodic auctions, in line with the proposed 2023 issuance plan.

The Sukuk will be issued initially in 2/3/5 year tenures; followed by a 10-year tenor at a later date.

For more information on the T-Bonds, please visit the website:

https://mof.gov.ae/federal-debt-management-office/

News Source: Dubai Media Office