The number of subscribers to the Unemployment Insurance Scheme has reached more than 250,000 since the start of registration on 1st January, 2023.

The Unemployment Insurance Scheme aims to secure a temporary income for the insured employee at a low premium, should he or she lose employment till such time that the employee is able to get an alternative job opportunity.

This is aimed at supporting the employee’s professional path and lifestyle in the UAE labour market without imposing any additional cost to the employers.

Khalil Khoury, Under-Secretary for Human Resources Affairs at the Ministry of Human Resources Affairs, said,

“The Unemployment Insurance Scheme comes as part of the implementation of Federal Decree Law No. 13 of 2022, which forms an essential part of a legislative and legal structure that the UAE government is keen to develop to respond to the priorities of the country’s economy.”

He called on all workers in the labour market to expedite registration to the scheme, which guarantees the continuity of a decent lifestyle for the insured employees and their families, and promotes a balance within the UAE labour market to be more competitive and attractive to national and international talents, thus enhancing the UAE’s position as an ideal destination to live and work.

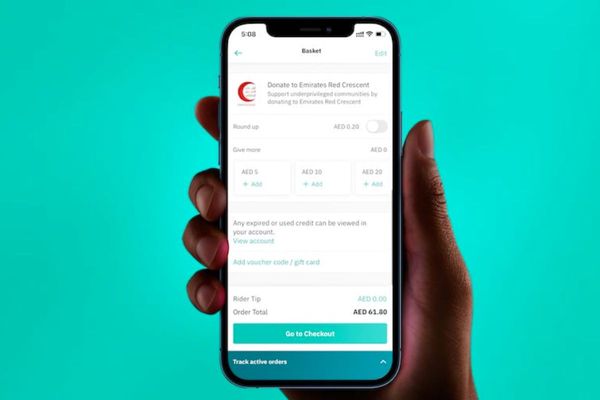

The insurance pool, represented by Dubai Insurance Company, provides eight channels for registration and subscription to the Unemployment Insurance Scheme, including a dedicated website

https://www.iloe.ae, the Smart Application of the insurance pool (iloe), self-service kiosks, businessmen service centres, exchange centres, and Smart Apps of the banks, or through Du and Etisalat bill payment centres.

Till date, about 88 percent of the subscribers preferred to subscribe to the scheme through the website, while 8 percent chose the Smart Application to subscribe to the system, whereas 4 percent chose to subscribe through the other channels.

The Unemployment Insurance Scheme includes two categories. The first are workers with a basic salary of AED 16,000 or less, which attracts an insurance premium of AED 5 per month, i.e. AED 60 annually. The maximum monthly compensation for this category is AED 10,000.

The second category covers those with a basic salary of AED 16,000 or more. The insurance premium for this category is AED 10 per month, i.e. AED 120 annually and the maximum monthly compensation is AED 20,000.

The employee can choose to pay the premium monthly, quarterly, once every six months or annually. About 86 percent of the subscribers have chosen an annual payment of the premium while 6 percent have chosen premium payment once every six months. About 4 percent of the subscribers have chosen the quarterly payment, and the balance 4 percent prefer the monthly payment option.

The insurance scheme is valid for a period of 12 consecutive months from the date of registration, provided that the termination/unemployment is not for a disciplinary cause or by resignation. The insured will lose the right to claim the compensation should he/ she leave the country or take up a new job. The compensation should be paid within two weeks from the date the claim is submitted.

The insurance programme compensates the insured employee for a maximum period of three months from the date of his or her unemployment, provided that he or she did not resign from the job or is dismissed on disciplinary grounds. The compensation is calculated at 60 percent of the basic salary in the last six months prior to unemployment.

The Unemployment Insurance Scheme covers workers in the federal government sector and the private sector. The exempted categories include investors or owners of establishments, domestic workers, temporary contract workers, juveniles under 18 years, and retirees who receive a pension and or have joined a new job.

News Source: Emirates News Agency