Dubai Electricity and Water Authority PJSC (ISIN: AED001801011) (Symbol: DEWA), the Emirate of Dubai’s exclusive electricity and water services provider, which is listed on the Dubai Financial Market (DFM), today held its 2nd general assembly for the year 2022.

DEWA’s shareholders have approved the payment of a one-time special dividend of AED 2.03 billion with a record date of 22 December 2022 (with a last entitlement date of 20 December 2022).

General Assembly Details

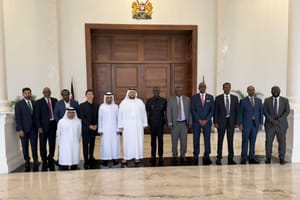

The meeting, chaired by HE Matar Humaid Al Tayer, Chairman of the Board of Directors of DEWA, was attended by HE Saeed Mohammed Al Tayer, MD&CEO of DEWA, and Members of the Board of Directors of DEWA as well as 89.43% of the shareholders. The assembly was held on Monday (12 December 2022) at the Address Boulevard Hotel Dubai as well as virtually.

Attractive Dividend Yield

For shareholders who invest in DEWA’s shares prior to the dividend record date of 22 December 2022 (with a Last Entitlement Date of 20 December 2022), the next twelve-month dividend yield is at 6.64%, at an IPO share price of AED 2.48 per share.

Quotes

“In line with the vision and directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, and the support of His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance, DEWA continues its excellence journey and smart and sustainable growth. It has achieved record results this year with net profit in the first 9 months of 2022 up by 21% compared to the same period of last year. In fact, DEWA is on track to record the best full year financial performance in its history,”

said HE Matar Humaid Al Tayer, Chairman of the Board of Directors of DEWA.

“Guided by the vision and directives of the wise leadership, we continue to make great progress in advancing our strategy which is focused on delivering sustainable growth, staying at the forefront of smart and innovative operational excellence, optimising returns for all our stakeholders while minimising our environmental footprint, ensuring consistency of returns, durability of growth, and compounding our growth value over time. This forms the basis of our core value proposition to our shareholders. Our net profit for the first 9 months of 2022 is 21% higher than the same period of last year. On a standalone basis, this 9-month net profit is nearly at par with our full year net profit of 2021. We have increased the dividend payout to shareholders for the year 2022 from AED 6.2 billion to AED 8.23 billion. At an IPO subscription share price of 2.48 AED / share, DEWA’s 2022 dividend yield is 6.64%. This dividend yield is more attractive than most companies listed on the ADX, DFM, and Tadawul, as well as other global utility companies,”

said HE Saeed Mohammed Al Tayer, MD & CEO of DEWA

“I thank our employees, customers, partners, and all stakeholders for their continued support. I would also like to thank our existing and new investors for their confidence and faith in DEWA’s business and in its management team. Together, we will continue to develop DEWA’s position as a globally leading, sustainable innovative corporation,”

added HE Saeed Al Tayer.

News Source: Dubai Media Office