LuLu Exchange – one of UAE’s leading financial service providers, announced today during GITEX Global event in Dubai its collaboration with the Ministry of Interior to deploy a complete digital KYC journey through new-age facial recognition on its cross-border payments app, LuLu Money.

The latest initiative marks another milestone in Lulu Exchange efforts to streamline customers’ experience, perform instant and highly secure face matching verification which will now allow customers to experience end-to-end digital remittance services, eliminating the need to physically visit a branch for initial KYC verification and onboarding.

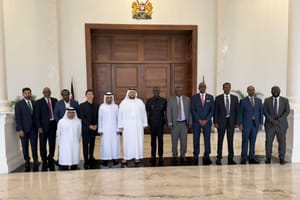

Speaking about the collaboration, Adeeb Ahamed, MD, LuLu Financial group, said,

“The collaboration with the UAE Ministry of Interior and the imminent rollout of digital KYC on LuLu Money is a quantum leap in our digital transformation journey. By offering a fully integrated digital payment process, our fintech propositions are aligned with the UAE’s Digital Economy Strategy and its efforts to transform the financial services ecosystem. The use of the digital verification face gateway service will help make financial transactions more secure and allow us to build better processes along the entire customer journey online.”

Lt. Colonel Dr. Ahmed Saeed Al Shamsi, Head of the Artificial Intelligence Systems and Services Development Team at The General Directorate of Security Support at MOI, stated,

"The Ministry is keen to provide advanced services in accordance with the directives of the UAE government and the vision of its judicious leadership. It adopts the best new digital technologies based on artificial intelligence and future foresight sciences based on forward-looking visions that recognise tomorrow’s challenges and try to find proactive solutions.”

Al Shamsi pointed out that the face ID verification and authentication service, an advanced digital authentication portal, aims to provide digital solutions that helps to achieve the digital agenda of the UAE, in line with the efforts of the Ministry of Interior to enhance the efficiency of services and the well-being of the Emirati community, and build and enhance the enablers of the digital transformation process.

“The Ministry of Interior has used state-of-the-art technologies to develop services in an innovative way, as the Ministry worked to develop the face advanced digital authentication portal by deploying it in the practical and institutional fields as well as work development. By deploying this technology, it enhanced the pioneering government work process by providing smart services that exceed customers’ expectations and cater for their needs,”

he explained.

The UAE records one of the world's largest international outward remittances volumes each year. The number of users in the digital remittance field is expected to reach 1.4 million users by 2027. This is largely due to advancing regulatory reform, world-class infrastructure, mobile and internet penetration, and active partnerships among various stakeholders.

News Source: Emirates News Agency